Intelligence Hub

UK Autumn Budget 2024 Summary Note – 31st October 2024

Executive Summary

This briefing note summarises the key policy announcements from the Autumn Budget and their impact on businesses and households in Glasgow City Region (GCR).

The Chancellor has announced unprecedented tax rises worth £40 billion, major increases in public spending for the NHS and other public services as well as significant increases in borrowing to fund investment. One of the most significant announcements was the increase in National Insurance Contributions (NIC) for employers as well as a reduction in the threshold at which they start paying it. Economists argue that this will have a negative impact on wage growth and on the labour supply. The Office for Budgetary Responsibility (OBR) forecasts a reduction in unemployment in the short-term, as a result of the spending boost, but an increase in the long-term; and an overall reduction in the economic participation rate.

Small businesses, which constitute the majority of the business base in GCR, have welcomed the policy as the employee allowance protects them from the tax. However, businesses are impacted via other regulatory changes such as a six percent increase in the national minimum wage. Economic commentators argue that support is still required to enable employers to invest in their workforce and adaptive technologies.

Living standards show a mixed outlook. Although the spending decisions have been highly distributive i.e. disproportionately benefitting households on the lowest incomes, the gains have largely been offset by the increases in NICs and other taxes. According to the OBR, the cumulative impact of the policies is expected to lead to weaker living standards by 2029. However, there are other policies underway that could potentially reverse these trends. Improvements in public services could enhance quality of life. And, addressing the persistent issue of economic inactivity due to ill-health could boost economic participation, contributing to stronger overall living standards in the future.

The Budget brings several funding commitments and investments to Scotland, with the potential to drive positive developments for GCR. Confirmation of £160 million in funding for the Investment Zone programme and initiatives like the Innovation Accelerator extension. The Whitelee hydrogen project and Brand Scotland offer valuable opportunities for the Region. The full impact of these funding commitments for Scottish local government will become clearer once the Scottish Government releases further details in the Scottish Budget, scheduled for 4th December.

On the downside, there has been a reduction in SPF funding. This has been extended for a year, and the budget for the Region is expected to be cut by 40%.

Finally, the UK Government also confirmed that integrated settlements will be implemented for Greater Manchester and West Midlands Combined Authorities at the start of the 2025-26 financial year, and for four further Mayoral Combined Authorities (MCAs) from 2026-27 – the North East, South Yorkshire, West Yorkshire and Liverpool City Region. Such arrangements may mean the Region is left behind.

Economic Outlook and Impacts

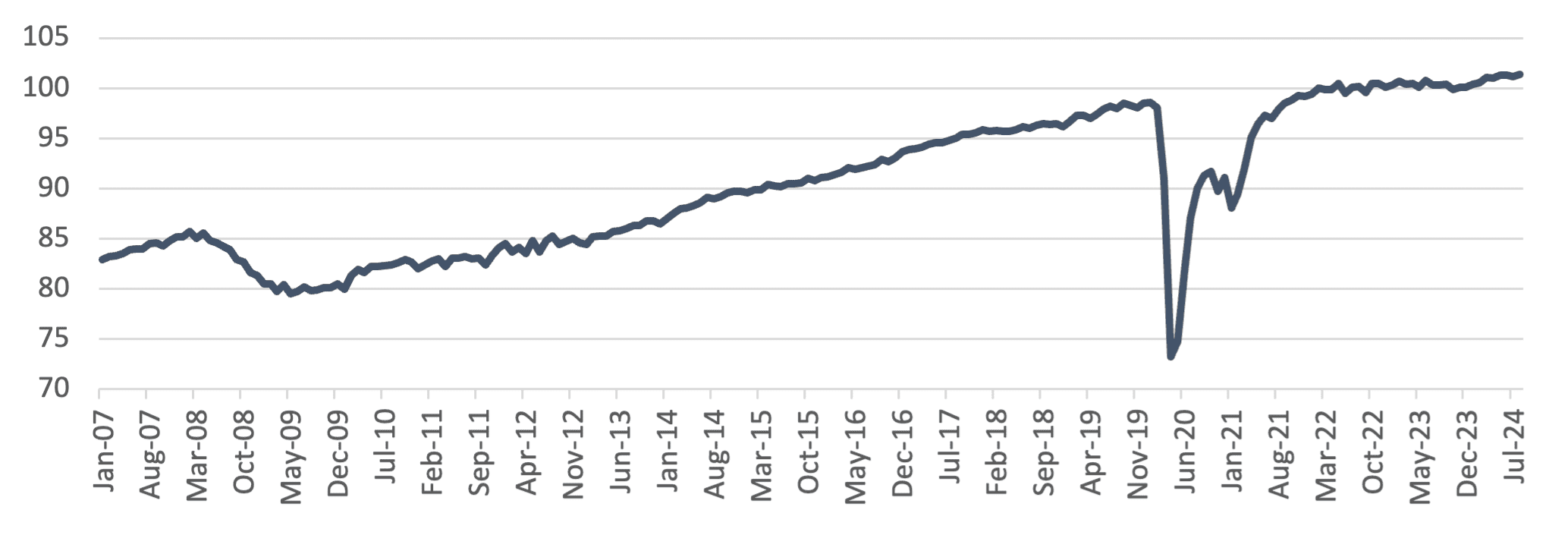

The Autumn Budget is set against a challenging economic backdrop. The past decade has been marked by persistently low productivity growth and an employment rate below pre-pandemic levels, unique among G7 economies[1]. These factors have contributed to stagnant living standards, with per capita GDP still trailing pre-COVID levels[2], and as shown below, a poor post-pandemic performance in GDP growth.

Figure 1: UK GDP Indexed to 2022

Source: ONS

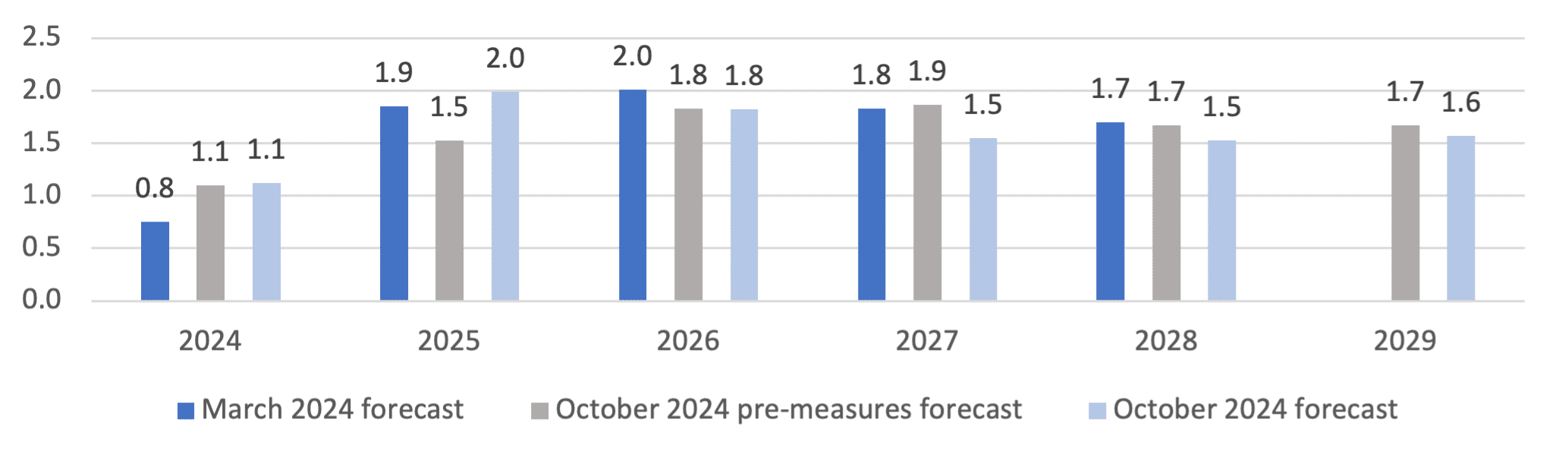

But after facing recession in the second half of 2023, the UK economy has performed better than expected. According to the OBR’s pre-Budget analysis, the UK economy is projected to reach 1.1% of growth in 2024 and 1.5% by 2025, pre-measures. Inflation, after reaching a peak of 11.1% in October 2022, and has reduced to 1.7% in September 2024.

In its October 2024 forecast, the OBR project that the enhanced public spend from the Budget will deliver a temporary ‘sugar boost’ to this trend and uplift real GDP in the short term of 0.6% at its peak in 2025/26.

Figure 2: OBR’s Forecasted Real GDP Growth

Source: OBR’s October 2024 Economic and Fiscal Outlook

But, to fund this increased public investment, the Chancellor has raised tax on an unprecedented scale[3]. Around £25 billion of this comes from increases in National Insurance contributions for employers, with an estimated 940,000 employers losing out in net terms[4].

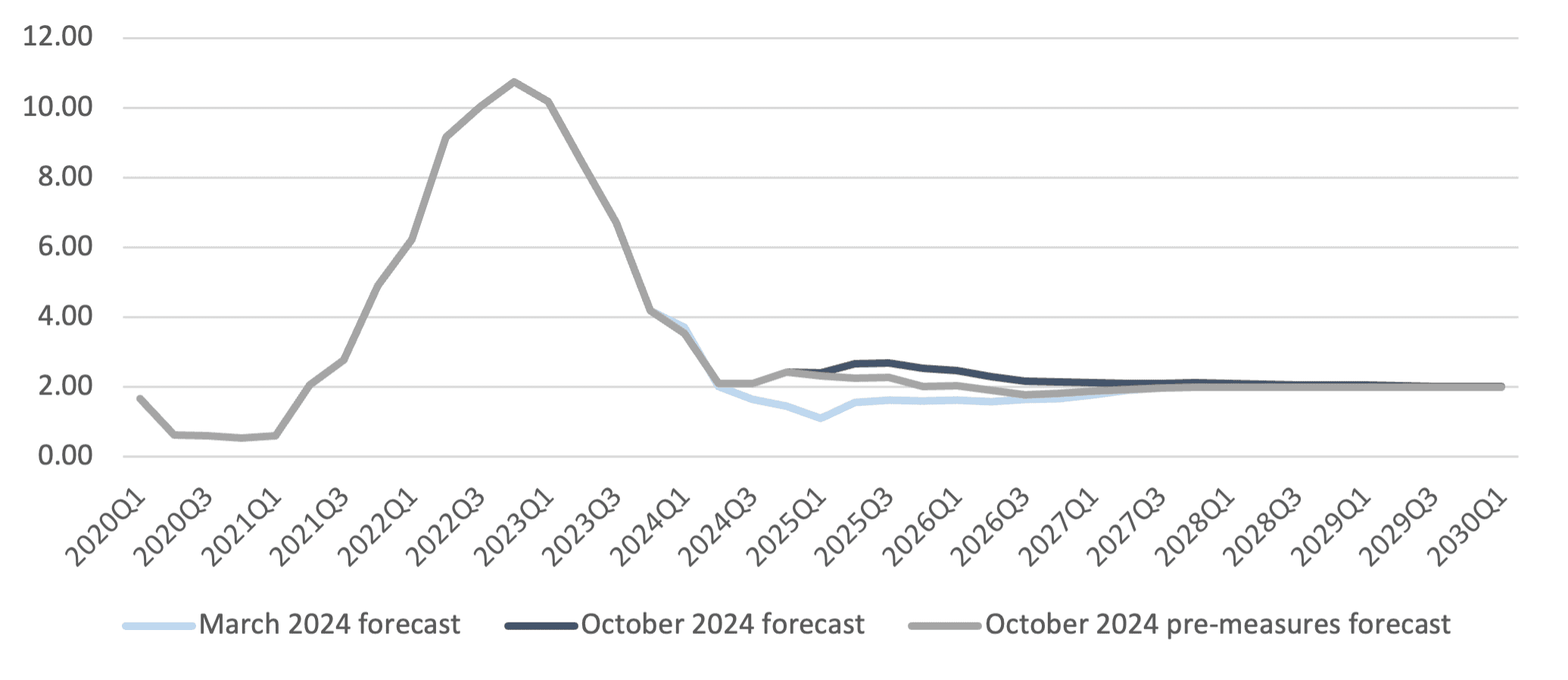

The OBR have downgraded their inflation forecast, meaning that this combination of spend and tax will likely increase inflation by around 0.4% in 2025/26, with similar impacts up until 2029/30.

Figure 3: OBR’s Forecasted CPI (Consumer Price Index/Inflation)

Source: OBR’s October 2024 Economic and Fiscal Outlook

However, there are two main uncertainties to these trends. One is global energy prices, which remain a systemic risk for the UK economy. Numerous ongoing, and potentially expanding conflicts in the Middle East and Ukraine are disrupting supply chains impacting consumer prices. The other is rising welfare costs, particularly from incapacity and disability benefits multiplied by the UK’s ageing population, which has increased substantially since the pandemic. The forecast welfare spending is set to increase to 3% of GDP by 2029/30.

Both factors have the potential to further drive-up inflation, increase borrowing and dampen the UK’s growth outlook, throwing forecasts off. The UK Government’s enhanced spend may then provide a short-term uplift, but it is not without trade-offs, uncertainties and reliance on the private sector matching investment.

[1] Autumn Budget 2024 Background Briefing

[2] Resolution Foundation, Ending Stagnation

[3] Resolution Foundation, More, More, More

[4] The IFS believe that this will likely be lower, around £16 billion, as contributions are proportional to wages which are forecast to fall in real terms, reducing the headroom given by the Budget.

Labour Market

Evidence suggests that vacancies within the labour market have continued to fall, whilst wage growth has also eased. This broad trend of a loosening labour market has resulted in a recent increase of unemployment since the record-low unemployment estimates recorded during the second half of 2022.

The measures announced in the Autumn Budget are anticipated to boost UK output to 2026. Unemployment projections from the OBR have been revised from March 2024 to reflect the increased economic activity to 2026 – which now project a 0.3%-point decrease in unemployment in 2025 and 2026.

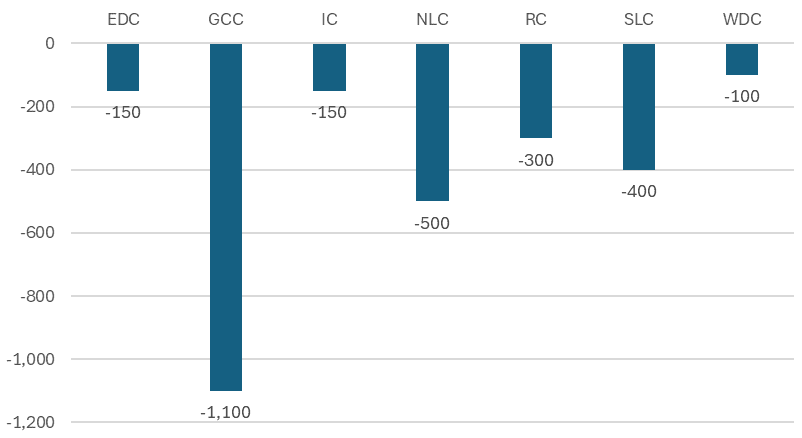

Using the OBR projections and the latest Labour Market estimates from the Annual Population Survey (APS) – it is projected that the equivalent of 2,700 individuals would no longer be claiming unemployment benefits in Glasgow City Region by 2026.

Figure 4: OBR’s Forecasted Unemployment Change on Glasgow City Region*

Source: OBR & APS

*East Renfrewshire Council estimates not statistically robust

It should be noted that the impact of the increase to employers’ NICs has been incorporated within these projections. The OBR anticipate that employers will account for this increase through decreasing wages and profits.

The Chancellor also announced that the earnings threshold for Carer’s Allowance will be increased from £151 to £195 a week. This increase is the equivalent of 16 hours at the National Living Wage, resulting in one of the biggest increases in the earnings limit since the benefit was introduced in 1976[5]. It is anticipated that up to 60,000 unpaid carers will now have access to Carer’s Allowance.

An increased earnings threshold will also allow those currently receiving Carer’s Allowance greater access to employment, or the opportunity to work more hours. This increase could benefit the approximate 227,000 unpaid carers within Glasgow City Region – providing labour market opportunities for those previously categorised as economically inactive. Carer’s UK estimate that 70% of unpaid carer are female, so the improved Carer’s Allowance could also contribute towards the Gender Employment Gap – which is currently estimated at 5.8% points in Glasgow City Region.

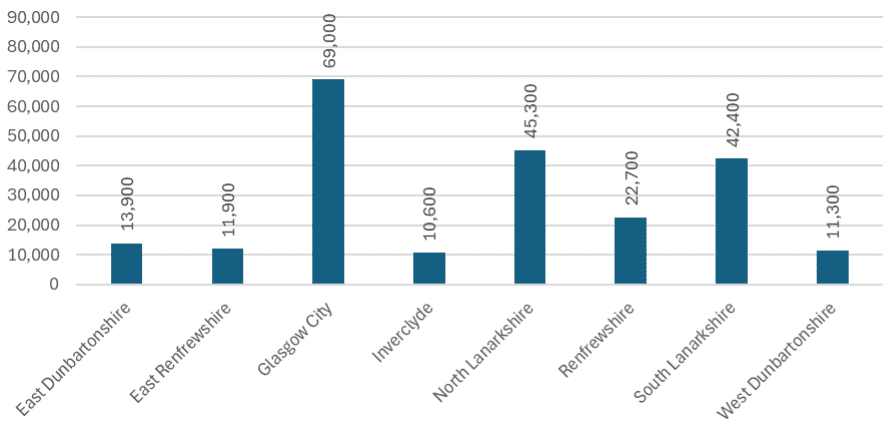

Figure 5: Volume of Unpaid Carers in Glasgow City Region (2022)

Source: Scottish Census 2022, APS 2023

Carer’s Scotland has written to the Cabinet Secretary for Social Justice to seek assurances that the Scottish Government will also introduce an equivalent increase within Social Security Scotland’s Carer Support Payment[6].

[5] https://www.carersuk.org/news/carers-scotland-write-to-cabinet-secretary-regarding-today-s-announcement-by-the-chancellor-on-increases-in-the-earnings-threshold-of-carer-s-allowance/

[6] https://www.carersuk.org/press-releases/carers-uk-welcomes-carers-allowance-earnings-threshold-increase-in-autumn-budget/

Business Base Impacts

From April 2025 the government is increasing the rate of employer NICs to 15% and decreasing the per-employee threshold at which employers are liable to pay National Insurance to £5,000.

Employee Allowance has also been revised in an effort to protect small businesses – increasing to £10,500 next year. The Government has also removed the £100,000 NIC threshold, meaning that all eligible employers will now benefit from the £10,500 discount. It is anticipated that next year over half of employers with NICs liabilities will experience a benefit or no change overall.

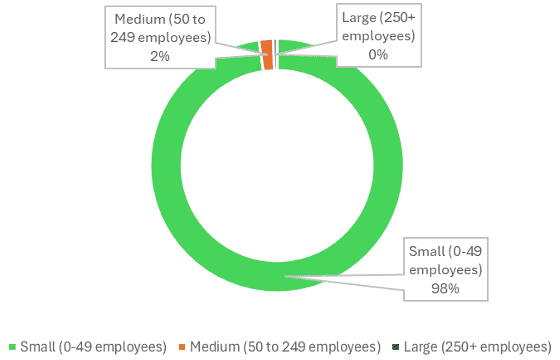

The Federation of Small Businesses (FSB) has welcomed the proposals outlined within the Budget – indicating that the increase in Employee Allowance will protect the smallest employers from increased jobs tax[7]. Approximately 48,500 of Glasgow City Region’s 50,000 enterprises are classed as a small enterprise – comprising of less than 50 employees.

Figure 6: Glasgow City Region Business Base by size (2024)

Source: UK Business Counts

However, Prosper argues that whilst employee costs for the smallest employers have been mitigated, support is still required to enable employers to invest in their workforce and adaptive technologies in order to boost productivity[8].

The Resolution Foundation (RF) has also noted that the proposed NIC changes will result in a disproportionate impact for workers due to the proposed three pence rate cut for those that are self-employed[9]. RF calculated that the total tax due for employees is higher than self-employed workers for an equivalent value of work. RF argued that this poses a risk of employers taking on self-employed contractors, rather than employees, resulting in lower revenue for the Treasury and less employment protections for those hired as self-employed contractors.

It was also announced that the UK Government intends to provide greater support for businesses operating in the high street retail, hospitality and leisure (RHL) industries from 2026-2027. The support will include a permanently lower business rate multiplier for RHL properties and a 40% relief for RHL businesses through the Small Business Rates Relief.

Non-domestic rates relief is a devolved power for Scotland[10], and the Scottish Government has not implemented the same level of rates relief seen in England since July 2022[11]. Andrew McRae, Scottish Policy Chair of the FSB, responded to the Budget announcement by confirming FSB’s intention to pressure Scottish Ministers to pass similar measures to those in England.

The introduction of a similar relief on the RHL industries in Scotland would provide a significant benefit within Glasgow City Region. These RHL industries combined account for nearly £7 billion of the Region’s total economic output – with approximately 14,000 enterprises providing 193,000 jobs.

Figure 7: Retail, Hospitality, and Leisure Business Base within Glasgow City Region

| Industry | Jobs (2022) | Enterprises (2024) | GVA (2022, £m) |

|---|---|---|---|

| Wholesale and retail trade | 109,000 | 8,170 | £4,700 |

| Accommodation and food service activities | 60,000 | 4,400 | £1,620 |

| Arts, entertainment and recreation | 24,000 | 1,410 | £646 |

| Retail, Hospitality, and Leisure Total | 193,000 | 13,980 | £6,966 |

Source: UK Business Counts, Office for National Statistics

[7] https://www.fsb.org.uk/resources-page/employment-allowance-rise-welcome-from-chancellor-in-tax-raising-budget.html

[8] https://prosper.scot/uk-budget/

[9] https://www.resolutionfoundation.org/press-releases/chancellor-provides-326-billion-boost/

[10] https://www.dentons.com/en/insights/articles/2024/october/30/uk-autumn-budget-2024-the-scottish-perspective

[11] https://www.fsb.org.uk/resources-page/fsb-scotland-employment-allowance-rise-welcome-in-tax-raising-budget.html

Household Impacts/Living Standards

Economic commentators such as the OBR, the Institute for Fiscal Studies and the RF agree that the Autumn Budget is likely to have mixed impacts on households’ living standards. This is due to contrasting effects of the policy announcements on wage growth and performance of public services.

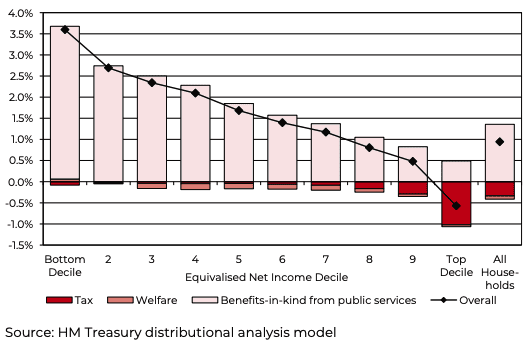

Distributional analysis of the policy impacts by the Treasury (chart below) shows that, on average, households in the lowest income deciles will benefit the most from policy announcements around tax and welfare spending in 2025-26.[12]This means that, in the forecast period, the poorest households will receive more in public spending than they pay in taxes. It is worth noting though that the analysis excludes the impact of business taxes and changes to regulation.

Figure 8: Impact on decision at Autumn Budget 2024 and Spending Review 2025, Phase 1 on households in 2025-26, as a % of net income, by income decile.

Source: HM Treasury

Another major announcement was the increase in the national minimum wage of 6% to £12.21 (from £11.44) in 2025, in line with the recommendations from the Low Pay Commission.[13] This is going to positively benefit an estimated 236,000 employees who work in low pay sectors in GCR.

Despite higher wages, the outlook for living standard looks weak. The OBR forecasts that real disposable household income[14], a key measure of living standards, will fall by 2029.[15] This reflects the impact of increases in NICs as well as tax increases. On the positive side, the OBR and the RF[16] also note that increased UK Government spending on public services could bolster living standards. However, it remains uncertain whether improvements in public services will offset the negative effects of reduced disposable income.

Another policy announcement important for GCR is the Get Britain Working White Paper which will be published later this autumn. Ahead of this, the Chancellor announced £240 million funding which will go into the rollout of local services to help bring down economic inactivity. Furthermore, according to the Work Foundation, the investment in the NHS will be particularly crucial to bringing down waiting lists and enabling people out of work to get the health support they need to return to work.[17] Given the persistent challenges that the Region faces with ill-health induced worklessness, the plans announced by the Government and associated investments will have important implications for the Region in the coming years.

[12] HM Treasury, Distributional analysis to accompany the Autumn Budget 2024

[13] Low Pay Commission summary of evidence 2024, 30 October 2024

[14] Disposable income is the amount of money that households have available for spending and saving after taxes and benefits.

[15] Office for Budgetary Responsibility, Economic and Fiscal Outlook 2024, pg. 11

[16] Resolution Foundation., ‘’More, More and More. Putting the Autumn Budget 2024 decisions on tax, spending and borrowing into context’’

[17] The Work Foundation., What impact will the Autumn Budget have on UK workers?

Local Government Finances and Investment Plans

The 2024 Autumn Budget provides Scotland with the most significant funding uplift since devolution in 1997, totalling at £47.7 billion in 2025/26, with an additional £3.4 billion through the Barnett formula and £1.5 billion earmarked for day-to-day spending.

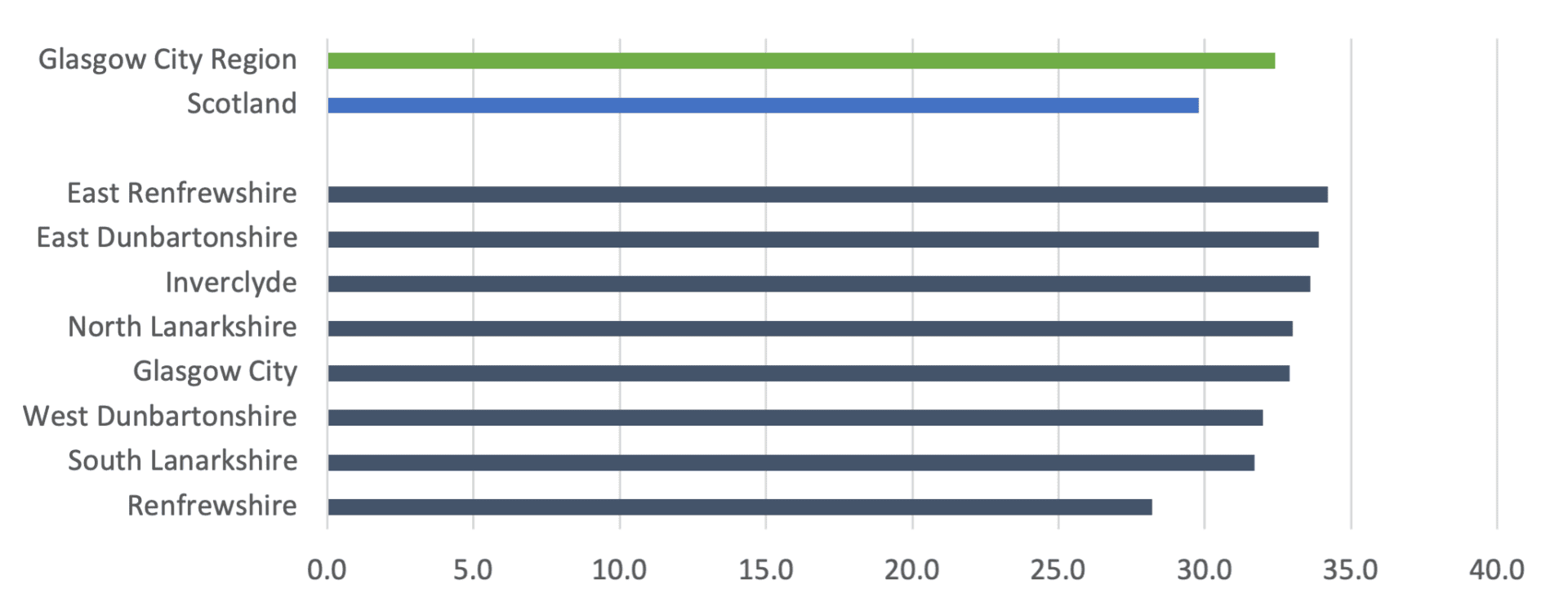

While this is a substantial funding boost for Scotland, the increased settlement is set against rising national insurance contributions for employers, including public sector bodies. This adjustment is particularly impactful for Glasgow City Region (GCR), where public sector employment accounts for 32.4% of the workforce, compared to Scotland’s average of 29.8%.[18]This can also be seen across the Region’s member authorities in the chart below.

Figure 9: Percentage of workforce in public sector (2023)

Source: Annual Population Survey 2023

As noted by the Fraser of Allander Institute[19], this higher proportion of public sector workers may reduce the size of the net benefit from the funding uplift. More information on Scottish Government’s plans for local government financing will be announced on the 4th December, when allocations from Scottish Income Tax will also be considered. It is essential that factors like this are considered for local government.

The Chancellor confirmed that UK Shared Prosperity Fund will continue for a fourth Year. However, the Budget has been reduced to £900 million for the twelve month-period. This is a reduction of around 40% for the Year 3 allocation of £1.5 billion. It is expected that this includes a removal of the Multiply budget. So, assuming the national approach is applied regionally, it is anticipated that the allocation across the Region will be 67% of the Year 3 budget (minus the Multiply grant).

Nearly £890 million of direct investment was also confirmed for Green Freeports, Investment Zones[20], the Argyll and Bute Growth Deal, and other local projects in Scotland. Although details were not provided on how this funding would be allocated, this represents a significant commitment from the UK Government for Scottish regional economic development and will likely enhance Scotland and GCR’s growth potential.

Another important policy announcement was the extension of the Innovation Accelerator programme beyond its original end date of March 2025. It was initially introduced to drive high-impact R&D and catalyse economic growth within UK City Regions outside of London. This extension is a positive development, with the programme already having helped to reinforce GCR’s strengths, further solidifying its role in advancing the Scotland and the UK’s frontier economy. However, the details of what the extension will look like are not yet clear.

The Budget also made further announcements on Great British Energy with its headquarters in Aberdeen, aiming to drive renewable energy and support job creation within Scotland’s clean energy sector. This has been given £125 million over the next year to support green hydrogen projects. In GCR, an electrolytic hydrogen project in Whitelee, East Renfrewshire has been identified for support, promoting low-carbon energy production and building on the Region’s strengths in Net Zero[21].

Another £0.75 million has been allocated to establish Brand Scotland, a programme run by the Scotland Office to enhance the international profile of Scottish investment opportunities and exports.[22] This aims to boost Scotland’s trade visibility, benefiting sectors like Food and Drink, and Tourism that contribute significantly to the Scottish economy and its reputation abroad.

Finally, there was the confirmation of the integrated settlements for mayoral combined authorities: ‘the integrated settlements will be implemented for Greater Manchester and West Midlands Combined Authorities at the start of the 2025-26 financial year, and for four further Mayoral Combined Authorities (MCAs) from 2026-27 – the North East, South Yorkshire, West Yorkshire and Liverpool City Region………… The government will also explore how the integrated settlement policy could be applied for the Greater London Authority from the 2026-27 financial year onwards, taking into account the capital’s unique devolution arrangements.’

The note confirmed that to be eligible for the settlement, the authorities must be able to prove a positive track-record of financial management and managing major programmes.

Whilst these arrangements may not impact funding for the Region, they may have medium-long term impacts. If these regions can tailor programmes to their local challenges and opportunities, Glasgow City Region may end up being left behind.

[1] Glasgow City Region’s Investment Zone (GCR IZ) is a programme of interlinked projects that will provide the best opportunity to boost the Region’s innovation economy – securing up to £160m in funding to create high skill jobs, deliver quality infrastructure, and provide specialist business support.

[18] Annual Population Survey 2023

[19] ‘Scotland to receive extra £3.4bn from UK Budget, says chancellor’, BBC

[20] Glasgow City Region’s Investment Zone (GCR IZ) is a programme of interlinked projects that will provide the best opportunity to boost the Region’s innovation economy – securing up to £160m in funding to create high skill jobs, deliver quality infrastructure, and provide specialist business support.

[21] Intelligence Hub’s Cluster Analysis

[22] ‘A Budget to fix the foundations and deliver change for Scotland’

Further Information

For queries and further information, please contact Will Harkiss: