Intelligence Hub

Economic Briefing November 2023

Summary

Headline Inflation: inflation has fallen to 4.6%, down from 6.7% in September, but food inflation remains high at 10.1%.

Increased costs have reduced household disposable incomes: Resolution Foundation have projected an additional 300,000 people will be pushed into absolute poverty next year as a result.

The ONS’ Labour Force Survey release continues to be delayed: This has sparked concerns over the reliability of survey, as data during and after the pandemic saw response rates plummet among certain age groups.

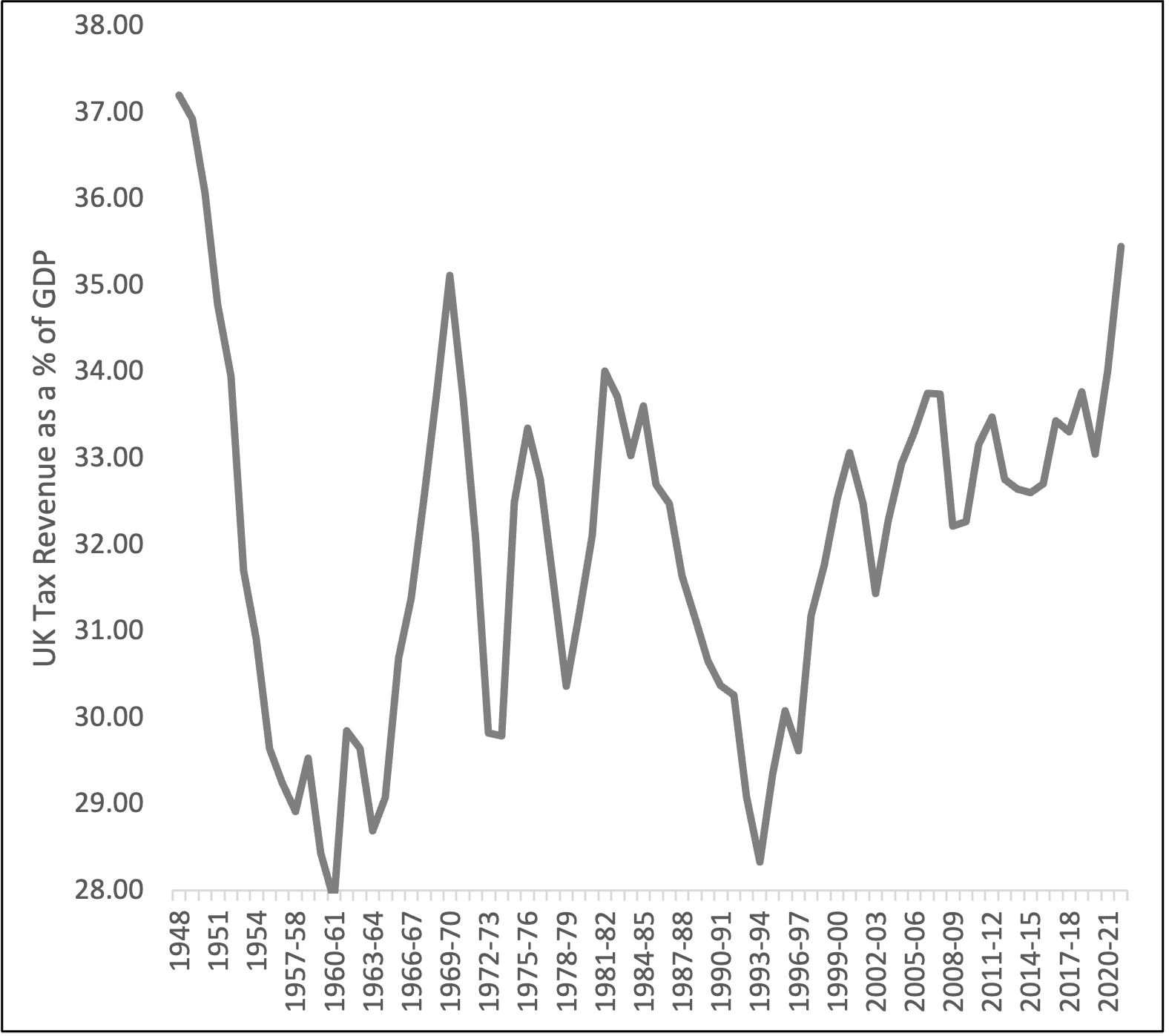

Tax Burden: Despite the Autumn Statement’s announcement of tax cuts, the UK’s tax burden remains at a 70 year high. The process of fiscal drag is predicted to raise £45bn by 2029, compared to the cost of the cuts to National Insurance predicted to cost the treasury £10bn.

SPOTLIGHT ON:

This month’s spotlight is on the Inclusive Growth Agenda:

A high tax burden, alongside the UK’s poor outlook for economic growth seen in the UK creates a difficult fiscal policy environment.

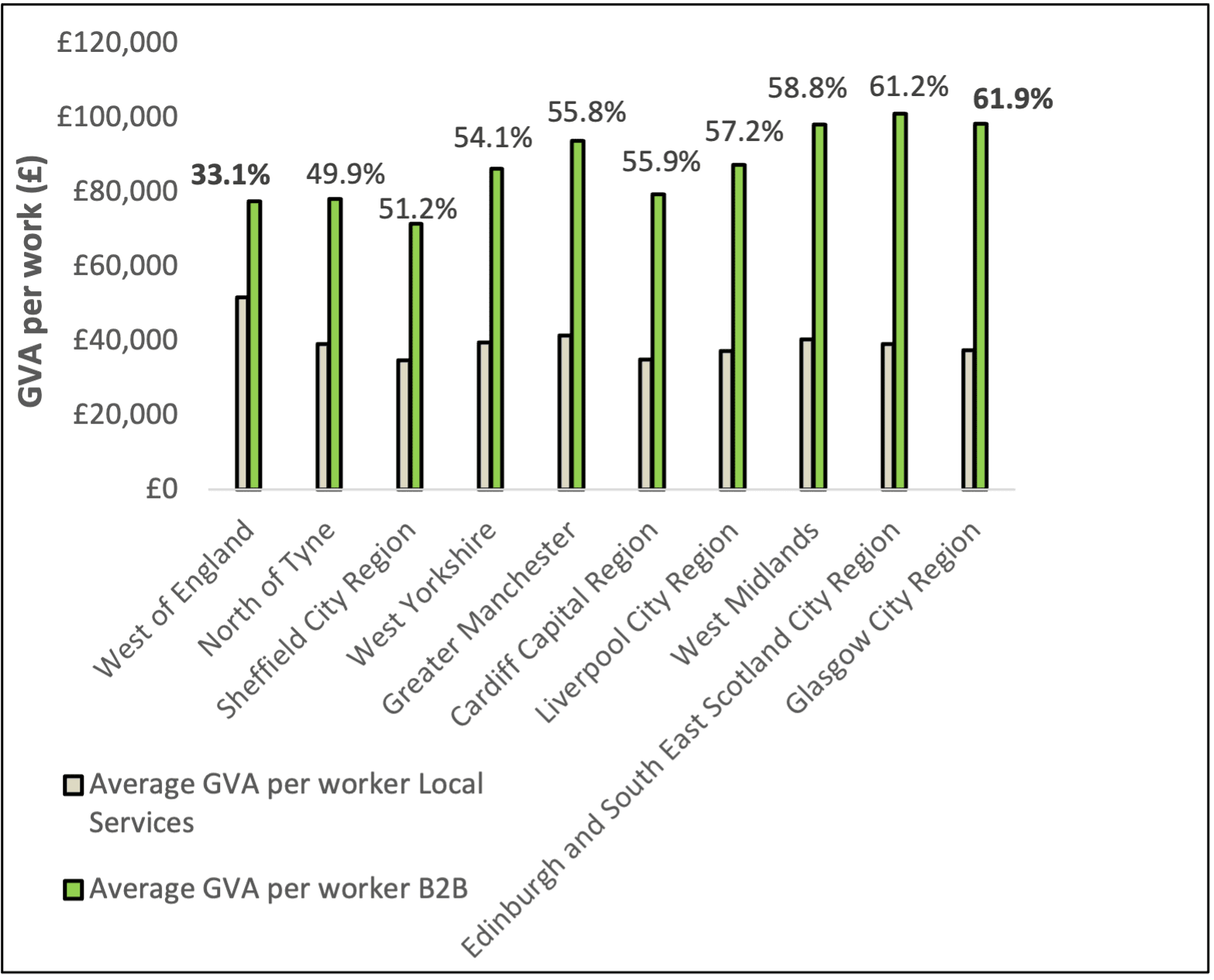

Our analysis suggests shows that the productivity gap between tradable sectors, and the foundational economy differs across the UK, and that polices aimed at increasing the productivity of the Foundational Economy could drive inclusive economic growth in GCR.

For instance, in West of England, tradable sectors are 33.1% more productive than Local Services, compared to GCR which has almost 2x the gap of 61.9%.

Improving productivity in GCR’s foundational economy to levels seen in West of England could increase total GVA generated by the Foundational economy by £9,500 million, or an increase of 20% to the value of goods and services produced by the entire Regional economy.

The Outlook for the UK Economy

According to the Office of Budgetary Responsibility (OBR), the UK economy is now expected to grow by 0.6% in 2023, up from a contraction of 0.2% predicted in March 2023.

Economic Output: The UK’s total economic output looks unlikely to return to its pre-pandemic trend in the short / medium term.

- According to PwC analysis, by 2026 the UK’s economic activity will be around 10% lower than where it would be if there the pandemic did not happen. The IMF has suggested the UK’s poor economic outlook are in part caused by Brexit and the underperformance of UK Core City Regions.

Inflation Impacts: According to OBR forecasts, the UK economy proved more resilient to the shocks of the pandemic than anticipated. But, high inflation is increasing the costs of services and government debt.

- The OBR forecasts that inflation will remain higher for longer, not easing to the Bank of England’s target of 2% until 2025 – a year later than forecast in March 2023.

- The Bank of England has warned that interest rates will need to remain high in order to bring inflation down.

Monthly real gross domestic product (GDP) is estimated to have grown by 0.2% in September 2023, following growth of 0.1% in August 2023.

The Consumer Prices Index (CPI) rose by 4.6% in 12 months to October 2023, dothewn from 6.7% in September.

Annual growth in regular pay was 7.7% in July to September 2023, this is slightly down on the previous periods but is among the highest annual growth rates since 2021.

Sources: ONS GDP, ONS Inflation, ONS Pay, PwC

Inflation and the Cost-of-living

Although inflation (CPI) has fallen to 4.6% over the last 12 months, food inflation is still high at 10.1%.

Beyond the widely covered narrative of easing inflation, estimates indicate that food inflation will likely end the year below 10%, almost 7x the rate seen before the pandemic.

Food inflation: has nearly halved from its peak of 19.2% in March 2023, which was the highest annual rate seen for over 45 years.

Household Spending: But, according to the ONS, more than 4 out of 10 adults surveyed are spending more than usual to buy food shopping. Other surveys ran by the ONS suggest that nearly half of the respondents were buying less food.

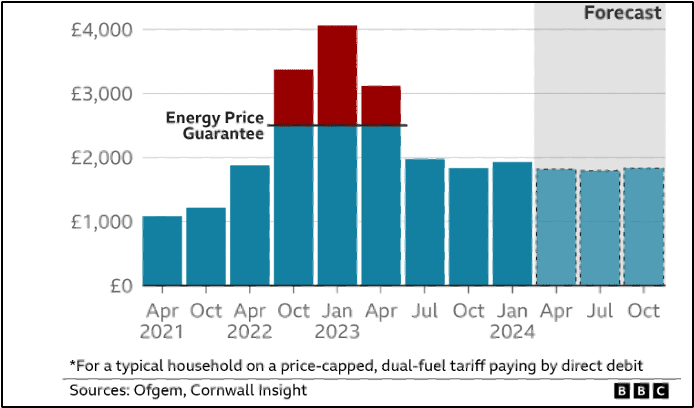

Living Standards are Falling: Despite record breaking real wage growth, the squeeze on families’ food and energy costs are causing a stagnation of disposable incomes, as suggested by the Resolution Foundation.

- The RF projects zero real growth for the median non-pensioner household income over the next 3 years. For the households with the lowest income, this stagnation is projected to force an extra 300,000 people into absolute poverty next year across the UK, an overall rise of 3%.

- Concerningly this analysis shows, that the proportion of children living in absolute poverty is projected to rise the highest.

Graph 1: Proportion of people living in absolute poverty, after housing costs

Sources: ONS, Resolution Foundation

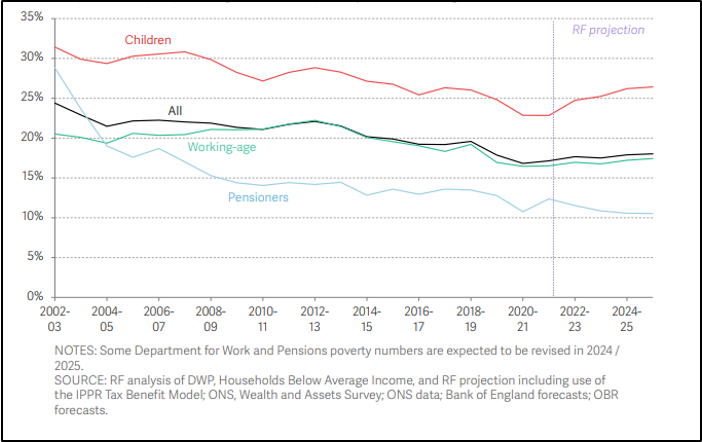

Energy Prices

Energy price cap will rise in January, adding additional pressure on households

Ofgem’s UK energy price cap has been set to rise by 5% in January 2024, meaning that the typical annual household bill is projected to increase from £1,834 to £1,928, an increase of £94.

Price Cap: The £1,928 price cap set by Ofgem for January 2024 is substantially lower than £4,059 which was triggered by the initial invasion of Ukraine by Russia.

But, the price cap remains far higher than caps seen pre-pandemic caps, which were on average below £1,200.

- Last winter, overall energy prices were limited by the Energy Price Guarantee, which limited annual bills to £2,500, but because this has been withdrawn many more might be exposed to higher costs.

- But the Energy and Climate Intelligence Unit has suggested that unseasonal and extreme weather has, and will continue to account for one-third of all the UK’s food price inflation this year.

Household impacts: The rise in energy costs comes at the same as recent research undertaken by the Resolution Foundation shows that average households will be around £1,900 poorer by January 2025 than they were in December 2019.

Labour Market

Headline Labour Market Statistics

The Labour Force Survey release continues to be delayed due to concerns about its reliability from low response rates, but the latest data shows a similar trend of a weakened labour market.

Table 1: ONS Experimental Labour Market estimates from July to September 2023* Source: ONS

| Unemployment (%) | Unemployment (ppts) Quarter Change | Employment (%) | Employment (ppts) Quarter Change | Economic Inactivity (%) | Economic Inactivity (ppts) Quarter Change |

|---|---|---|---|---|---|

| 4.0 | 0 | 74.3 | +0.1 | 22.7 | 0 |

| 4.2 | 0 | 75.7 | 0 | 20.9 | 0 |

Labour Market: The latest experimental data shows little difference to last month, with the impression being that the labour market remains stagnant. However, positive signs comes from nominal wage growth, which remains very high and growing, with falling inflation giving a to boost real pay growth slightly.

According to the IFS, vacancies continues to ease, but remain far above pre-pandemic levels, suggesting that the labour market is improving compared to the last few months: This also suggests that rather than there being a slowdown of demand, there is less people moving jobs or leaving the labour market.

New Data Gathering Methods: UK and global indicators, like GDP, are beset with similar issues, with revisions to the post-pandemic UK GDP, but new methods are helping validity. Measuring the economy is an inexact science, but the ONS are responding by exploiting VAT data to calculate GDP, web scrapping data to measure inflation and using payroll data from HMRC to interpret employment rates to inform upcoming releases.

Source: Institute for Employment Studies *These estimates use an experimental dataset

Autumn Statement

Fiscal Background to the Autumn Statement

The Autumn Statement arrives at a time when the UK tax burden remains at a 70 year high, whilst the UK potential for growth looks poor compared to others like the US and the Eurozone.

Fiscal Impacts: The high tax burden, alongside the poor economic growth seen in the UK, creates a difficult fiscal policy environment. Cutting taxes would impact already restrained and in demand public services, whilst increasing public services would require raising taxes

Deep-rooted Productivity Problem: But as reported widely, the UK’s productivity problem appears to be deep rooted and long standing, as suggested by the head of the Productivity Institute, Bart van Ark:

“Especially since the early 2010s, we have seen the UK economy increasingly firing on only one or two cylinders, notably productivity in IT manufacturing and services…”

Business Investment: UK business investment has stagnated since 2016, growing by only 4.6% compared to 32% in the US, and evidence suggests that the period of high interest rates has further deterred business investment.

- This illustrates the unique challenges impacting the UK economy, like Brexit, adding to the uncertainty and instability caused by the COVID-19 pandemic, or war in Ukraine and now the Middle East.

Closing the productivity gap in the Foundational Economy could drive inclusive growth

UK’s weak productivity outlook has been widely reported this month, and our analysis suggests that increasing productivity in the Foundational Economy could help drive inclusive economic growth

Productivity Gap: Glasgow City Region has a comparably high GVA per worker in tradable sectors, but local services are typically less productive than seen in other UK Core City Regions.

For instance, in West of England, tradable sectors are 33.1% more productive than Local Services, compared to GCR, which has almost 2x the gap of 61.9%.

Economic Importance: Increasing the productivity of the foundational economy proportional to the gap in West of England could boost GVA generated by the foundational by around £9,500m, or boosting the GVA generated across the entire economy by almost 20%.

Inclusive Growth: According to the OECD, the UK currently spends more than anywhere else in Europe subsiding inequalities of income. The Foundational Economy has among the lowest pay, in areas like Hospitality and Social Care. Economic policies that increase the productivity of the Foundational Economy can not only deliver substantial economic growth, but can also boost wages and living standards for people that deliver essential services to local areas.

Autumn Statement: Key announcements at a glance

In the autumn statement, Chancellor Jeremy Hunt announced cuts to National Insurance, changes to the benefits system and support for business to drive investment.

The £20bn tax relief

The main rate of employee national insurance contributions will but cut from 12% to 10% from 6 January 2024:

- It is currently 12% on earning between £12,571 and £50,271, meaning that for those earning the Scottish median wage will be £415 better off at the year end of this year.

The system of businesses being able to offset investments in IT equipment and machinery against tax will made permanent:

- According to the OBR, this will boost business investment by about 1% of UK’s GDP, but at a cost of £11bn to the public purse

- Business rate relief for small businesses in hospitality like pubs are also set to continue

Highlighted by many like the Resolution Foundation, despite the proposed tax cuts, many lower earners are still paying relatively high amounts of income and national insurance tax from thresholds being frozen:

- This means for the average worker, the 2% reduction is negligible.

- But for the treasury, fiscal drag is predicted to raise £45bn by 2029, compared to the cost of the NI predicted to cost the treasury £10bn.

Benefits rise, but rules tighen

National Living Wage (NLW) has increased

- From April 2024, the NLW will increase to £11.44 and will be extended to 21 year olds.

Universal Credit will uprate using September’s inflation

- Benefits will be increased by 6.7% from April, an average increase of £470 million for 5.5 million households.

Local housing allowance

- Housing benefit will be uprated after being frozen since 2020 to cover the lowest 30% of local market rents.

- This means that someone renting among the 30% lowest priced properties in their area could cover their entire rent with housing benefit.

State Pensions honour the triple lock

- State pensions will see an increase of 8.5% from April 2024, to grow in line with the recent growth in average earnings.

Mandatory work placements

- Those claiming benefits, will face compulsory work experience upon not successfully finding a job within 18 months. In addition, people who have had more than six months, their case may be closed and benefits stopped.

Glossary

Gross Domestic Product (GDP): The total monetary value of final good and services produced in a country in a given time period.

Consumer Price Index (CPI): Is a weighted-average of a basket of consumer goods and services purchased by households. Changes in measured CPI tracks changes in prices overtime.

Unemployment rate: Unemployed people are out of work but actively looking for a job and available to start work in the next two weeks. It is measured as the number of unemployed people divided by the number of economically active population (those in employment and those unemployed).

Economic Inactivity rate: Economically inactive people are out of work but are not actively looking for a job. The headline inactivity rate is calculated by dividing the inactivity level for those aged from 16 to 64 divided by the population for that age group.

Economic inactivity due to ill-health: Economically inactive people whose primary reason for being out of work is ill-health.

Enterprise Rate: Number of businesses per 10,000 of the working age population (16-64)

Inclusive Growth: The Scottish government defines it as, ‘growth that combines increased prosperity with greater equity; that creates opportunities for all; and distributes the dividends of increased prosperity fairly’

Further Information

For queries and further information, please contact Will Harkiss: