Intelligence Hub

Economic Briefing April 2025

Executive Summary

The new Trump administration’s economic protectionism and shift in foreign policies are reshaping a global order that has been forged over the last century.

The full economic impacts will take months and years to be fully understood. However, they undoubtedly present risks and challenges for Glasgow City Region.

The 10% US tariffs on all UK goods on top of the previously implemented tariffs on steel, aluminium and derived products of 25% could challenge GCR’s post-Brexit moves towards non-EU exports. GCR recorded a significant trade surplus in 2022, driven by services. But manufacturing exports, a key contributor to the Region’s economy, are more vulnerable to the tariffs. This may mean Regional businesses need to look more closer to home for customers.

The new US administration’s foreign policy is leading to increased defence spending in countries including the UK. This presents an opportunity for economic growth in GCR where the defence sector is a major contributor to the economy with firms such as BAE Systems and Rolls Royce expanding operations in the Region. Simultaneously, the GCR Investment Zone has pointed to a local convergence of specialisms around space, maritime and semi-conductors, and highlighted GCR’s highly integrated defence supply chain. GCR is well positioned to benefit, with strong productivity in the sector, and MOD spending already trending towards the areas that GCR specialises in.

Encouraging the diversification of export markets, strengthening supply chains, and leveraging defence sector growth can help GCR mitigate some of the geopolitical risks.

Note: A Glossary of all the terms used in this report can be found at the end.

Introduction

The new US administration is fundamentally reshaping geopolitics with a realignment of the decades old global order, and President Trump has dramatically sped up the shift away from multilateralism towards a more fragmented, (global) regional world. This is particularly visible in recent announcements on:

- The new US tariffs on almost 180 countries.

- Changes in US foreign policy – leading to increased government defence spending across Europe and beyond.

The impacts of this are still to be fully seen, and the administration’s policies continue to evolve, but this briefing outlines the latest research from the Intelligence Hub into what the impacts could be for Glasgow City Region.

Note: A Glossary of all the terms used in this report can be found at the end.

The Recent US Tariffs

Changes in US trade policy will harm everyone, but will hit the poorest hardest

- Even with the pause and blanket 10%, bar China, the new US tariffs (taxes on goods imported into the country), are at the highest level for approximately 75 years.

- The original idea for the rates was based on need for a balanced trade relationship with countries. The economic coherence of such a policy has been described as “lunacy” and “preposterous” by commentators from the likes of the Fraser of Allander and FT.

- Even with a flat rate, the economic rationale for tariffs is weak, especially for the world’s richest economy. Evidence suggests that higher tariffs reduce productivity and real GDP in the long run as they restrict a country’s ability to capitalise on the sectors where it has comparative advantages over other countries.

- Tariffs make imports more expensive which can affect inflation, while the uncertainty surrounding changes in trade policy and the potential responses can cause businesses to delay or cancel investment and hiring plans.

- Ultimately, it is a regressive tax hike. Should the tariffs continue to focus on manufactured goods such as leather, apparel and electronics, costs will be passed on to consumers. So, perhaps most remarkably, the poorest in the US will be the hardest hit – as they spend a larger portion of their incomes on goods than wealthier residents.

- Some products, such as pharmaceuticals, semiconductors, and some minerals, are exempt. So, the effective rate for countries that export these products to the US will be lower than the published rate. But due to the interconnectedness of global trade, it is inevitable that the world economic growth will slow.

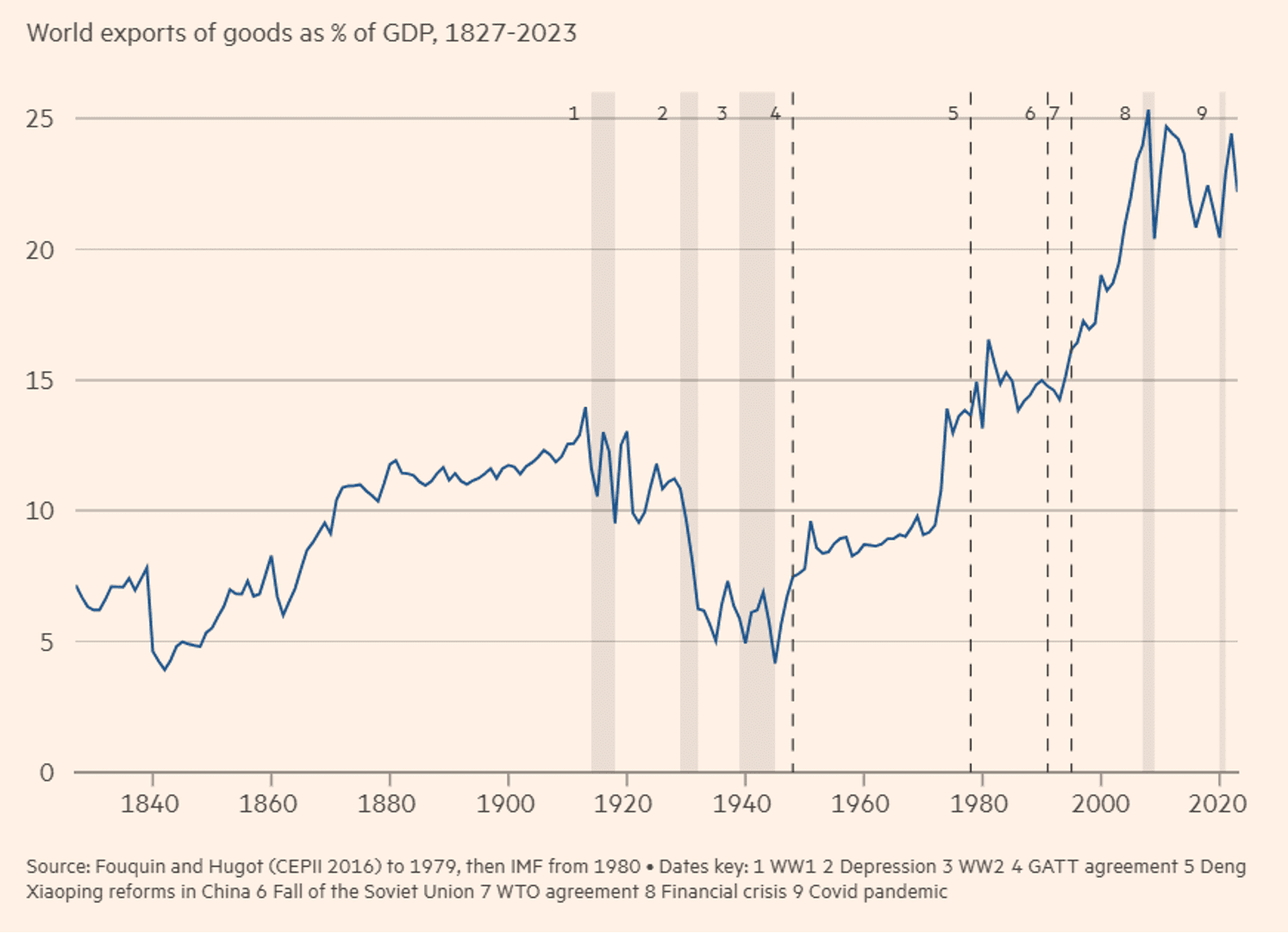

Since the 1940’s global exports have played a major role in GDP

Source: UK Business Count, 2023

The Impact of the Tariffs on the UK

The Tariffs will invariably squeeze an already flatlined UK economy

- The exposure of the UK economy to the 10% tariffs which are being levied (assuming they remain in place) is bad news for the economy and treasury officials.

- For the Chancellor to keep to her fiscal rules, the spring statement projected there was limited spare money available (£9.9bn). At the time of the statement, the OBR was projecting growth to be 1% in 2025, 1.9% next year and an average for 1.8% from 2027 to 2030.

- Research from the NIESR finds that a 10% tariff on the UK could mean 0.2 percentage points lower GDP growth next year and 0.25 percentage points higher inflation. This aligns with research by the Financial Times and Consensus Economics, which suggests that UK GDP will grow by 0.8% this year. And so, it is very likely there will further tough choices in the Autumn Budget.

- However, there could be a short-term boost to the economy as some trade may be diverted from the US to the UK.

British Business Response

- “62% of UK firms with trade exposure to the USA say they will be negatively impacted by US tariffs, compared to 41% with no exposure.

- “32% of firms with trade exposure to the USA say they will increase prices in response to the tariff.

- “44% of firms with exposure to the USA say the UK should seek to negotiate a closer trade relationship with the USA, and 43% want closer trade with other markets.

- “Just under a quarter (21%) think the UK should impose retaliatory tariffs.”

Sources:

- Office for Budget Responsibility – Economic and fiscal outlook, March 2025

- Implications of Higher US Tariffs for the UK Economy – National Institute of Economic and Social Research

- Rachel Reeves: Why she may have to raise UK taxes in October – BBC News

- UK growth forecasts hit by Trump’s tariffs

- Extent Of US Tariff Impact Revealed – British Chambers of Commerce

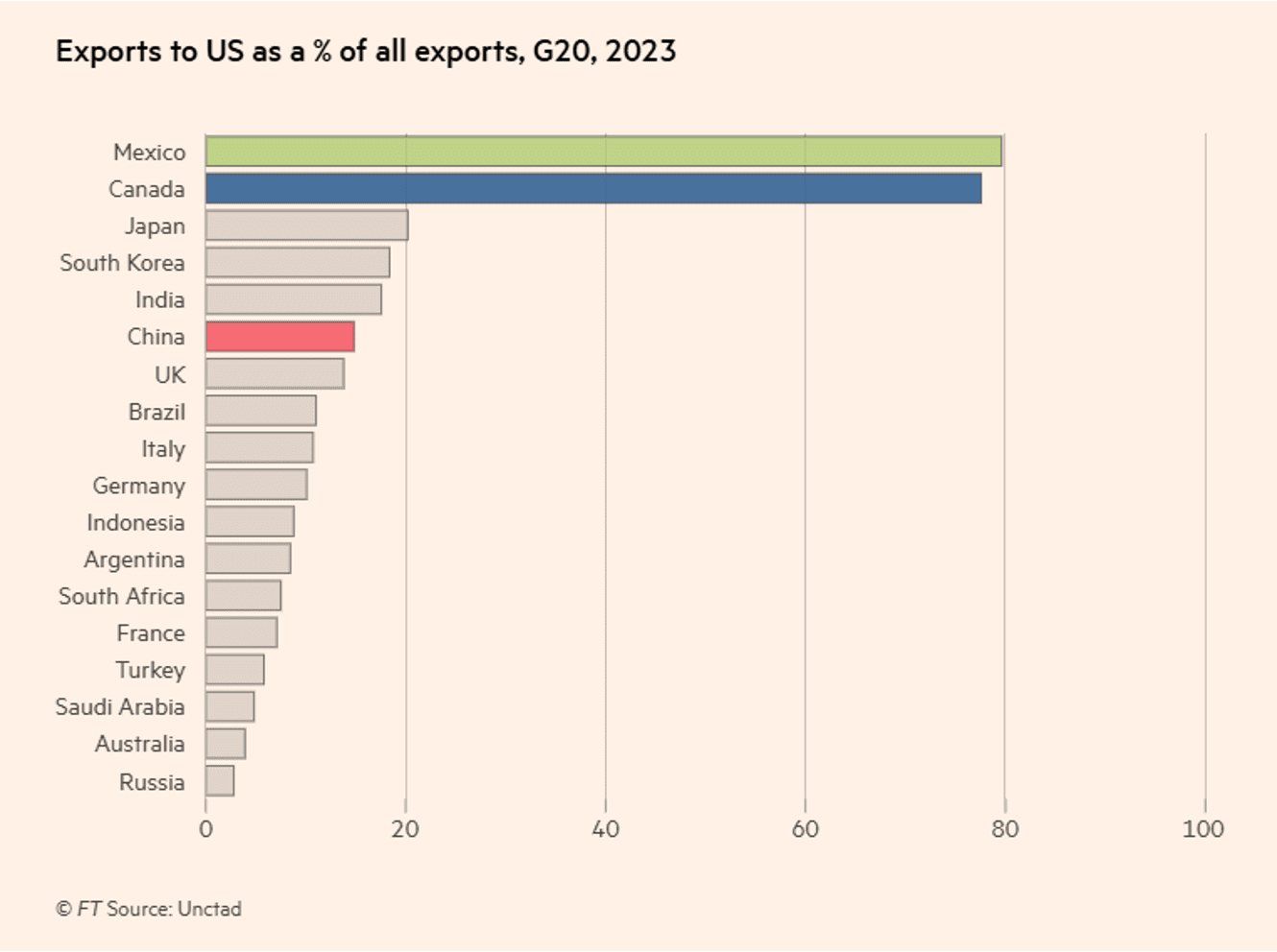

Whilst the UK’s export exposure to the US is significantly smaller than Mexico and Canada, it is higher than several of its European counterparts

Source: Trump tracker: US markets and economy

Glasgow City Region’s Trade Surplus

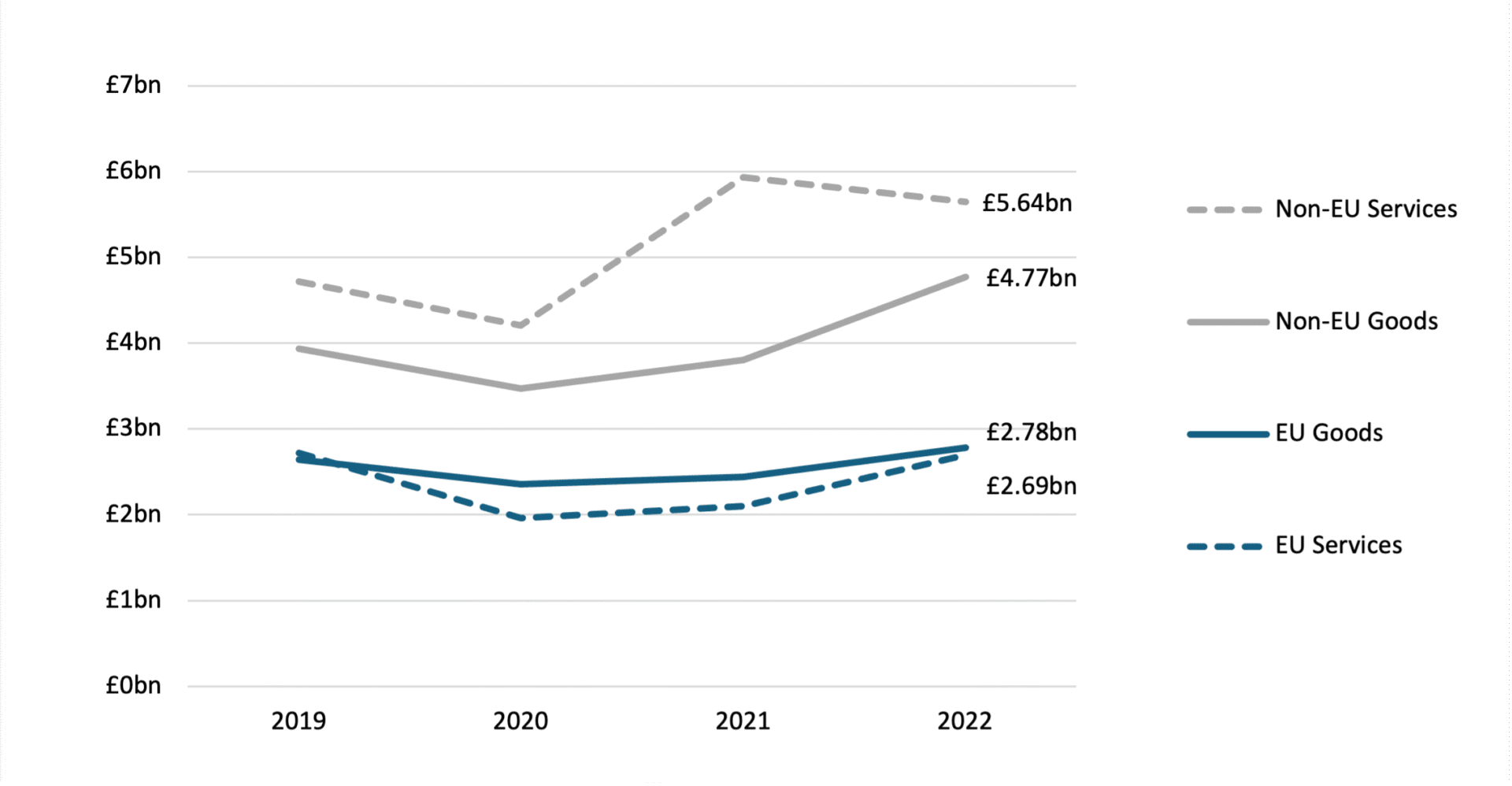

GCR’s exports, amid a shift away from EU markets, face growing exposure to tariffs

- In 2022, GCR recorded a significant trade surplus, driven largely by services, but goods exports were substantial with manufacturing being the largest component with a £4.25bn surplus.

- GCR has been shifting towards non-EU exports post-Brexit as shown in chart 2.

- However, the EU still accounted for 36% of all exports from West Central Scotland* in 2022 while the US accounted for 17% and China accounted for 5.4%.

- So, the overall exposure is similar to that of the rest of the UK.

(* GCR minus South Lanarkshire but including Helensburgh and Lomond)

Chart 1: GCR’s exports and imports in goods and services, 2022

Chart 2: GCR‘s goods and services exports by EU and non-EU, 2019-22

Source: ONS Subregional Trade Statistics

US tariffs pose a direct threat to GCR’s manufacturing-led export strength

- In 2022, GCR exported £1.129 billion in exports goods to the US. That accounted for 18.24% of all good exports across the globe.

- Like the rest of the UK, the export relationship with US is service dominated. And goods only accounts for 37.2% of all exports to the US.

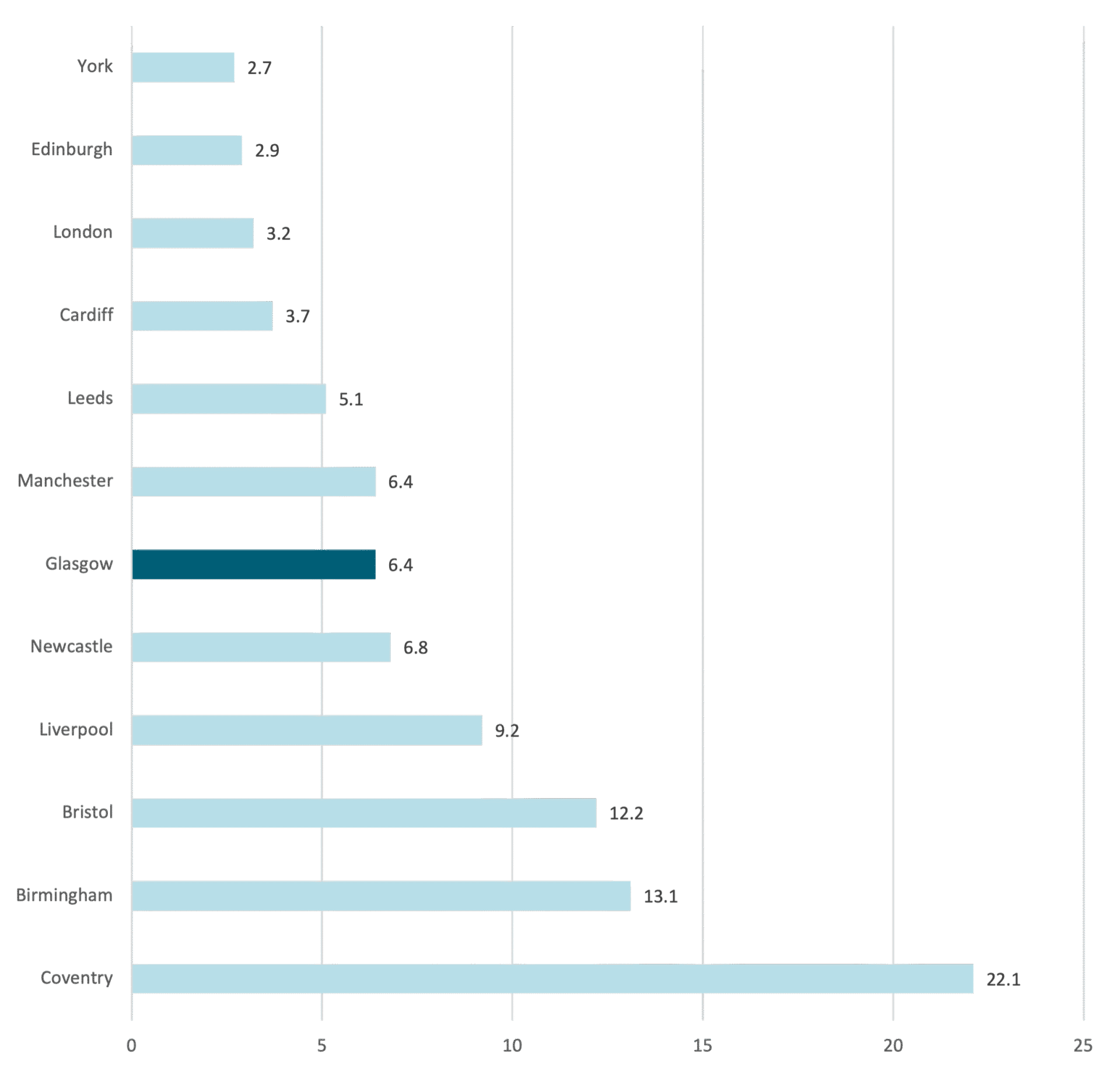

- The Centre for Cities recently published a review of how the exports of different areas across the UK are exposed to US tariffs. Note that this uses Glasgow Primary Urban Area and not Glasgow City Region for the geography. But as shown in the table, the review highlights that the Region’s exposure is significantly less than many other places in the UK. The longer list shows Glasgow has the 44th lowest exposure out of 62 cities.

Chart 3: Share of U.S. goods exports in total exports by PUA

Sources:

- ONS Subregional Trade Statistics

- The uneven storm: the impacts of U.S. tariffs on British cities | Centre for Cities

Defence and the Economy

Newly announced spend in defence could open up opportunities for the GCR economy

- The new US administration’s foreign policy is leading to increased defence spending in countries including the UK. UK Defence spending will be increased to 2.5% of GDP by 2027 (an increase of £6.4bn). The Chancellor announced an additional £2.2bn will be provided for the Ministry of Defence (MOD) in the next financial year and a minimum of 10% of the MOD’s equipment budget will be spent on novel technologies such as drones and AI, driving forward “advanced manufacturing production in places like Glasgow”.

- £400m will be allocated to UK defence innovation and there will be reforms to the defence procurement systems including giving small businesses better access to MOD contracts.

- £2bn is also being provided in loans for international buyers of UK defence products to help drive demand.

Source: Spring Statement 2025 – GOV.UK

Defence Sector in Glasgow City Region

The defence sector is an important part of the local economy

- In the short term, increased defence spending will increase demand and economic activity. In the longer term it will contribute to infrastructure and resources making the economy more productive.

- Across the GCR economy, sectors related to defence employ approximately 23,000 people across 1,725 businesses and contribute £9.2bn. GCR ranks 4th among UK Core City Regions in defence exports and has the second highest concentration of defence businesses behind the West of England.

- Companies are attracted by GCR’s high skilled labour pool. It had the 3rd highest number of enrolments in defence related subjects outside London in 2022-23 with high concentrations in subjects like aerospace engineering, mechanical engineering and physics.

Key Companies

BAE Systems continues to build cutting-edge warships for the Royal Navy at their Glasgow site after securing a £4.2 billion contract. It is investing £300m into its Glasgow shipbuilding facilities including a £12 million state-of-the-art training facility to develop its entire workforce.

Babcock is the MOD’s commercial partner at HMNB Clyde providing highly specialist engineering support services, including the management of critical infrastructure and nuclear facilities, operational maintenance, upgrades and repairs to support Royal Navy vessels. It supports over 6,500 jobs at the site and contributes £370m to the Scottish economy.

Rolls Royce Submarines opened a new submarines site in Glasgow in 2024 creating 120 specialist roles that will support the Dreadnought programme and other growth in demand from the Royal Navy, including work in support of the AUKUS agreement.

Thales employs over 750 people across its Glasgow and Rosyth sites and invested £130m in 2023. With expertise in optical-electronic systems in support of land, sea and air forces it is the sole supplier of submarine periscopes and optronic masts to the Royal Navy.

Sources:

- NIESR – Response to the 2025 Spring Statement

- Intelligence Hub analysis of Business Register & Employment survey, UK business counts, and Regional gross value added (balanced) by industry: city and enterprise regions

GCR’s defence sector could benefit from increased spending. The chancellor announced that 10% of the MOD budget will be spent on novel technologies, “driving forward advanced manufacturing production in places like Glasgow”

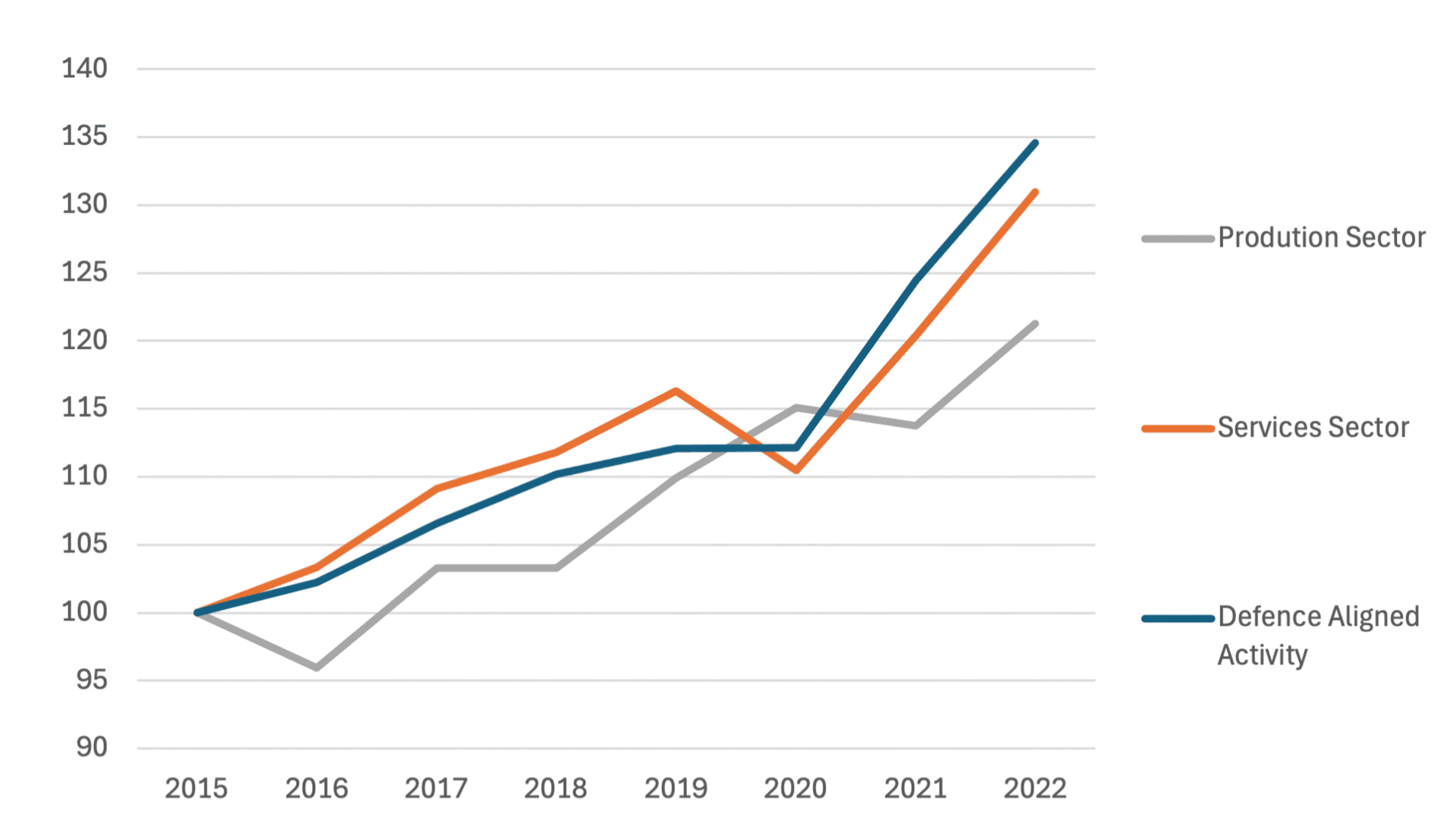

- GVA in GCR’s defence sector has grown faster than both the services and production sectors post-pandemic, and the sector played a key role in driving this recovery, outperforming the trend among UK Core City Regions.

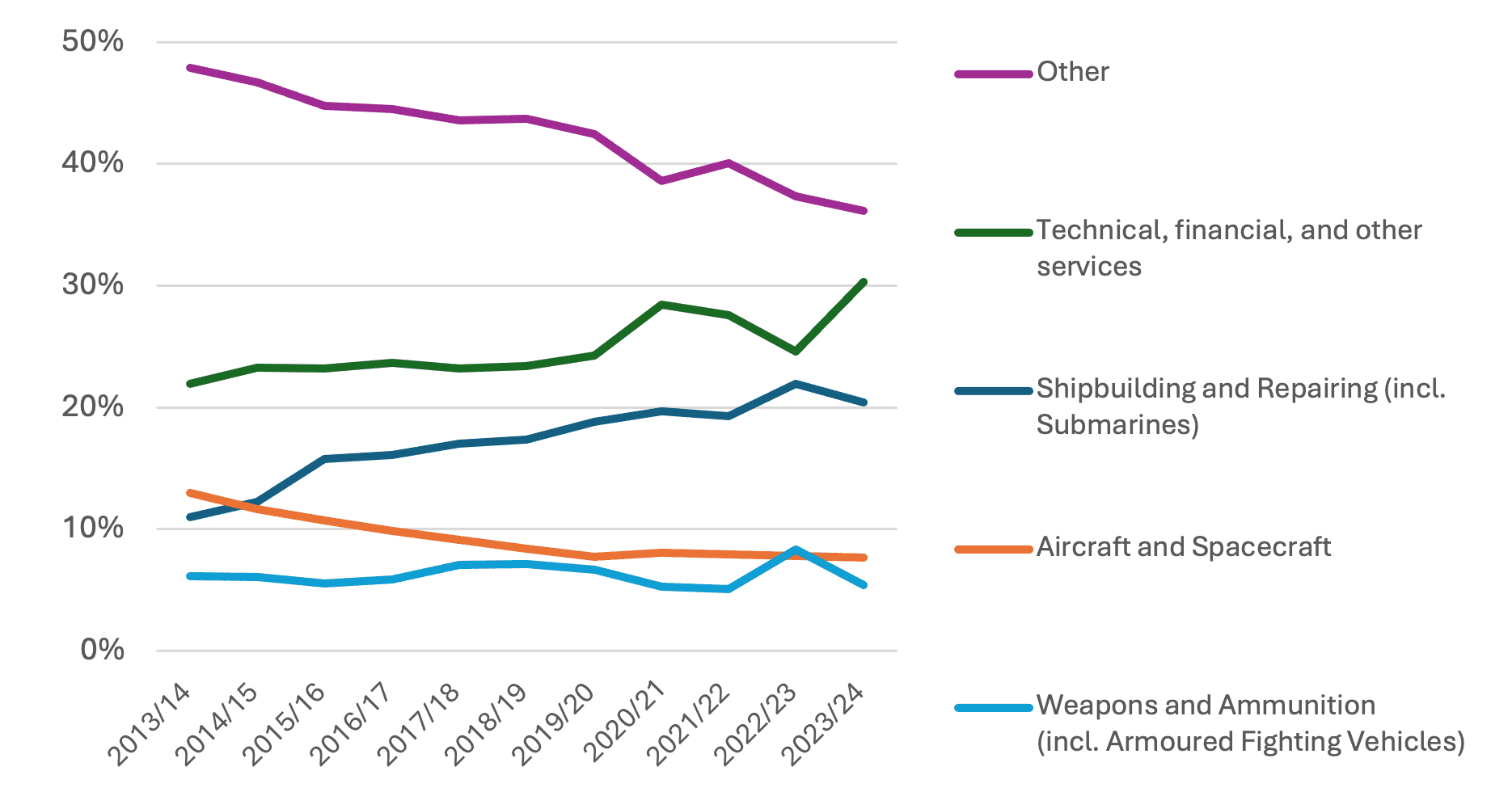

- One of GCRs defence sector’s strengths, shipbuilding & repairing (incl. submarines), has been consistently increasing as a share of the MODs spending in the last decade (11% to 20%).

- Scotland is the UK region with the second highest MOD expenditure (£1.2bn) and supported jobs (7,500) in this sector, behind the North West.

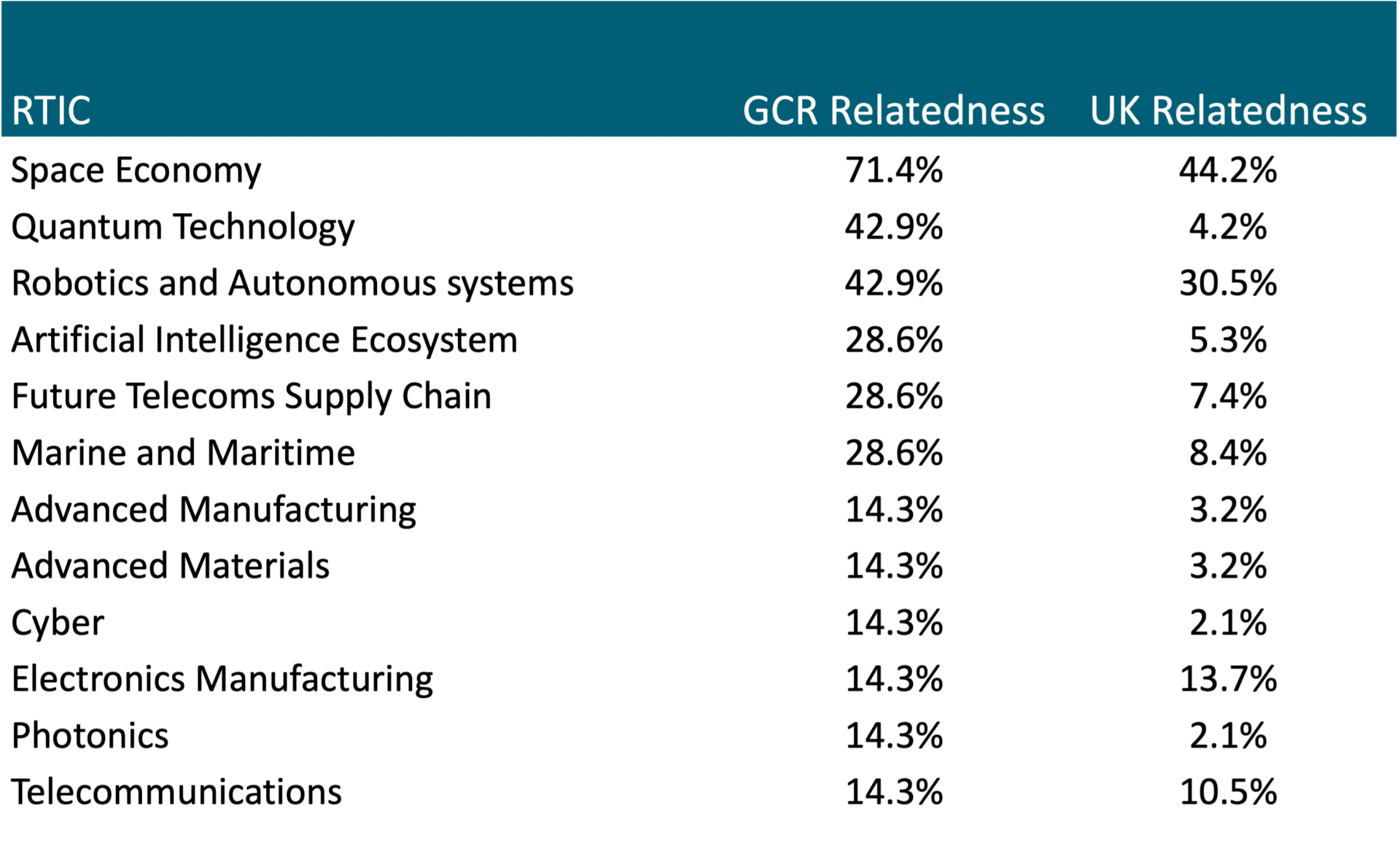

- GCRs defence companies are also linked to highly innovative sectors such as space, robotics & autonomous systems, and quantum technology.

Chart 4: GVA by sector 2015-22 (100 = 2015)

Source: IH analysis of ONS Subregional Trade Statistics

Chart 5: MOD expenditure by sector 13/14 – 23/24

Source: IH analysis of MOD regional expenditure with industry 2023/24

Defence and Wider Tech Diffusion

The strength of the private sector bids for GCR Investment Zone highlighted the underlying strength of the defence sector but also the multiple applications of tech which support it

- The Glasgow City Region Investment Zone (worth £160m of public sector investment) is focusing on Advanced Manufacturing and Precision Engineering.

- Within that, it is focused on three sub sectors – Space, Maritime and Semi-conductors – all of which can support the defence industry.

- Research from the Hub, as shown in the adjacent table, highlights the robust defence supply chain ecosystem in GCR with strong linkages across sectors which make it ideal for investment and innovation.

- A significant portion of the investment will be in open access facilities which will support wider supply chain growth, technology diffusion and resilience.

- By embedding some of the advanced digital tools, automation, and AI used by these firms into all sectors the Region has an opportunity to demonstrate that innovation isn’t just for tech firms — it can be a catalyst for productivity and prosperity across every industry.

Relatedness Between Sub Sectors and Defence

Research on relatedness, which analyses how firms operate across different sub-sectors, looked at firms in the defence sector and advanced manufacturing sub-sectors. It showcases how integrated the sectors are in the Region.

Policy Implications

There are several policy areas the Region can focus on to try and effectively manage the impacts of the evolving economic and geopolitical environment

- Encouraging the diversification of export markets and strengthening local supply chain linkages to help mitigate the impact of tariffs on GCR’s manufacturing and other exporting sectors.

- Targeted financial support, and trade promotion strategies to help businesses manage geopolitical uncertainty and maintain competitiveness.

- Positioning the Region so it can benefit from the increased defence spending by attracting investment, expanding skills training, and enhancing collaboration between firms and universities.

- Supporting smaller businesses to secure contracts, presenting an opportunity as the Chancellor announced better access to MOD contracts for small businesses. Scotland currently has the lowest percentage of MOD funding going to SMEs of the regions in the UK (1.5%).

Glossary

Geopolitical risk: The threat, realisation and escalation of adverse events such as wars, terrorism and political tensions that disrupt international relations

Protectionist policies: Government policies that restrict international trade

Trade surplus: An economic measure of a positive balance of trade, where a country’s exports exceed its imports

Real GDP: an inflation-adjusted measure that reflects the value of all goods and services produced by an economy in a year

Contact

For queries, please contact Finn Clasen:

Finn.clasen@glasgow.gov.uk

Further Information

For queries and further information, please contact Will Harkiss: