Intelligence Hub

Economic Briefing July 2024

Summary

Post-Election Special: Understanding the Incoming Government’s Challenges

Fiscal and Economic: After recovering from a technical recession in late 2023, the UK economy in May showed stronger the expected growth of 0.4% and inflation has remained at 2%. Despite this, prices remain elevated for essential goods and services such as housing and food, disproportionately impacting lower-income families. The new government will need to balance wage growth whilst preventing growth in inflation, all while managing historically high public spending levels and growing productivity.

Labour Market: The labour market presents critical challenges, with rising unemployment and economic inactivity rates. In Scotland, unemployment has increased, as well as economic inactivity due to ill-health, especially mental health issues among young people. This has led to a higher health-related benefits claims. This trend underscores the importance of addressing mental health support for young people as a priority. Long-term unemployment is also a growing issue, driven by factors such as skills mismatches, technological changes, and regional economic disparities.

Devolution: The devolution agenda will be crucial for addressing regional disparities and empowering local governments. Labour’s manifesto argues for increased devolution within England, granting metropolitan mayors more control over key economic areas such as transport, housing, planning, skills, and employment. However, the plans for Scotland are not yet fully detailed.

Economic Outlook

The UK Economy has returned to growth. The ONS said that growth was widespread across all sectors.

Growth Outlook: The latest figures from the ONS demonstrated double the expected growth in GDP. The Chancellor has promised to make sustained growth the new government’s national mission.

Inflation: has returned to the Bank of England’s target, after a prolonged period of soaring prices. As inflation comes down, the Bank is expected to start cutting interest rates.

Pay: The latest ONS figures show that UK wage growth slowed in May to the lowest level in two years amid a cooling jobs market.

Latest figures suggest monthly real GDP demonstrated growth in May 2024 by 0.4%, double the figure forecasted, after recording zero growth in April.

UK inflations stays at 2%, after nearly three years of above-target inflation which has squeezed household finances.

Annual growth in regular earnings (excl. bonuses) was 5.7%, growth was last lower than this in June to August 2022.

Sources: ONS GDP, ONS Inflation, ONS Pay, Guardian

Labour Market

Headline Labour Market Statistics

The latest data shows an increasingly weak labour market across the UK.

Table 1: Summary of the latest headline estimates and quarterly changes, seasonally adjusted, March-May 2024.

| Unemployment (%) | Unemployment (ppts) Quarter Change | Employment (%) | Employment (ppts) Quarter Change | Economic Inactivity (%) | Economic Inactivity (ppts) Quarter Change | |

|---|---|---|---|---|---|---|

| Scotland | 4.9 | -0.8 | 72.9 | -1.3 | 22.3 | 0.6 |

| UK | 4.4 | 0.2 | 74.4 | -0.1 | 22.1 | -0.1 |

Source: ONS

Employment, unemployment, and economic inactivity (in Scotland) have worsened.

Despite a decrease in employment rates across the UK, the total number of vacancies remain 11.6% higher than pre- COVID-19 levels. The two industry sectors that have increased the most are human health and social work activities as well as professional, scientific and technical activities.

The Institute for Employment Studies (IES) attributes the UK’s rising unemployment levels to long-term unemployment.

There is high unemployment among young people not in full-time education, and a rise in long-term unemployment. These trends highlight difficulties in matching job seekers with suitable positions and the disadvantages they face in the labour market.

Source: Institute for Employment Studies, FT

Worklessness Remains an Issue for Regional productivity

Significant challenges face the UK and Regional labour market, and critics have highlighted that Labour’s manifesto lacks concrete plans to tackle economic inactivity.

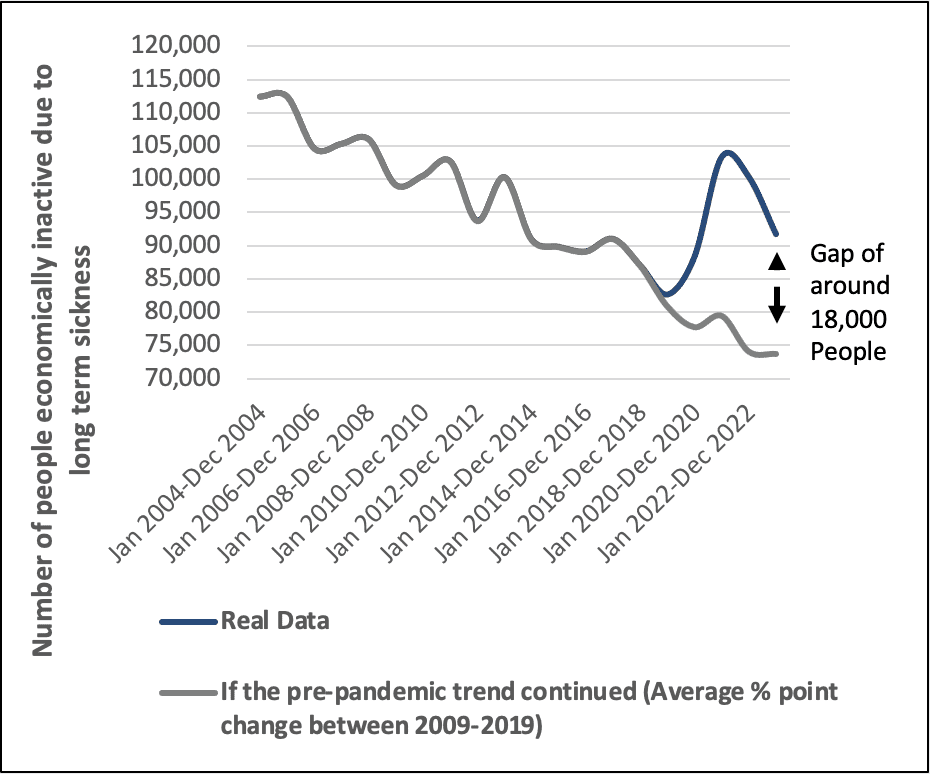

The pandemic caused a surge in economic inactivity.

If Glasgow City Region experienced the average trend seen before the pandemic, there would be currently be around 18,000 less people economically inactive due to long term sickness.

Across the UK, around 10.2% of the working-age population receiving at least one health-related benefit, up from 7.9% in 2019. This means 1 million more people receiving health related benefits than seen before the pandemic.

Labour’s manifesto proposes reviewing Universal Credit and reforming incapacity benefit assessments but does not give a clear indication if they accept the rising health benefit bill or will seek to tighten rules.

The International Public Policy Observatory (IPPO) has argued that interventions are best suited as holistic.

This means drawing on health as part of a range of factors including education, skills and childcare.

Chart 2: Number of people economically inactive in GCR due to long term sickness: Real Data Against If Pre-Pandemic Trend (2009-19) Was Followed

Sources: ONS, IFS, APS

Low Pay in the Foundational Economy Remains an Issue

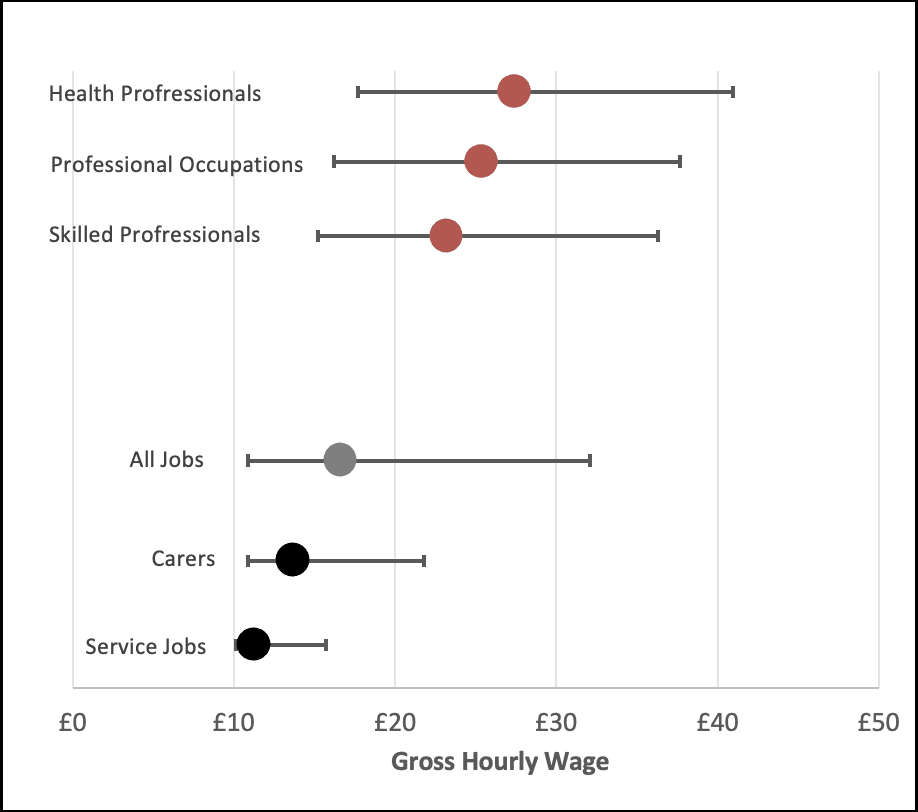

Despite the successes of the National Minimum Wage, critically important sectors like Social Care remain among the lowest paid in the country.

Labour has outlined plans for a ‘fair pay agreement’ in Social Care, between staff unions, care providers and the government. This agreement would look to improve conditions, pay and training standards in social care.

Evidence suggests that social care is in crisis, with demand set to grow as our population ages; despite this, the care sector is one of the lowest paid in Scotland.

Research in England shows that the Social Care sector had vacancy rate of almost 10% in 2022/23, suggesting the sector has high rates of staff turnover and poor retention.

Low wages often lead to poor retention and poor quality of employee work across the sector.

The Health Foundation argues that implementing a fair pay agreement could significantly improve retention rates. This, in turn, would lead to better outcomes for those relying on social care services within the Region.

Chart 3: Median gross hourly pay, by occupation: Scotland, 2023

Sources: ONS, Care Quality Commission. The Health Foundation

Fiscal Challenges

The Fiscal Challenges for the Incoming Government

According to the Institute for Government, most public services are performing worse than before the 2019 election – and far worse than in 2010 – while public spend has also increased.

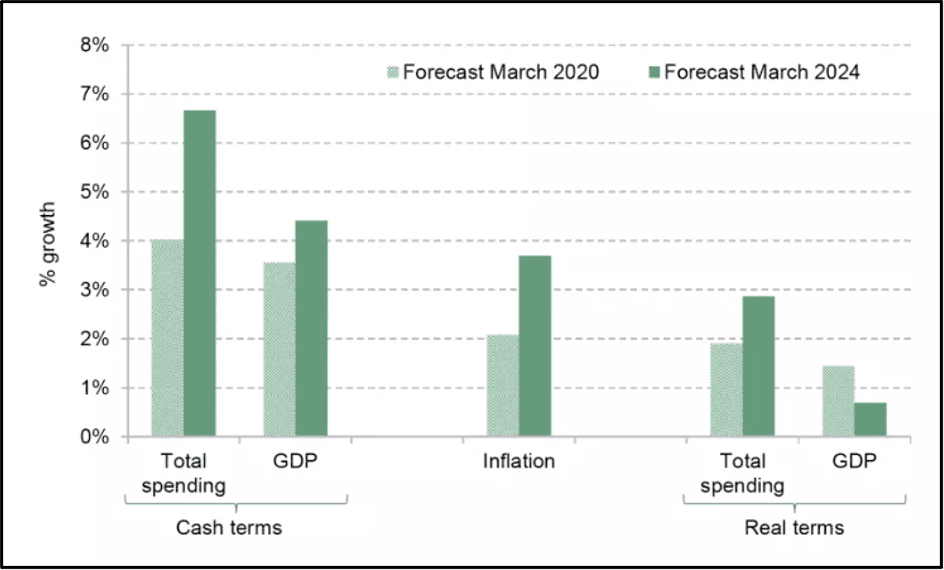

The size of public spending has considerably increased over the last 20 years.

At the height of the pandemic, public spend spiked to 53.1 % of GDP.

This was not anticipated in 2020, as shown in the graph.

Total spending in cash terms grew 1.7 times faster than was forecast in March 2020, while national income only grew 1.2 times faster.

Crucially, this means that real terms GDP growth has been lower than forecast. According to the OBR this has meant a rise in spend approximately 5 times higher than expected in March 2020.

A solution argued by the Resolution Foundation and the IFS has been to drive economic growth.

Chart 4: Average annual change in spending, GDP and inflation between 2019–20 and 2024– 25, as forecast in March 2020 and March 2024.

Sources: IFS

Productivity Growth

Productivity Growth and Future Government Plans

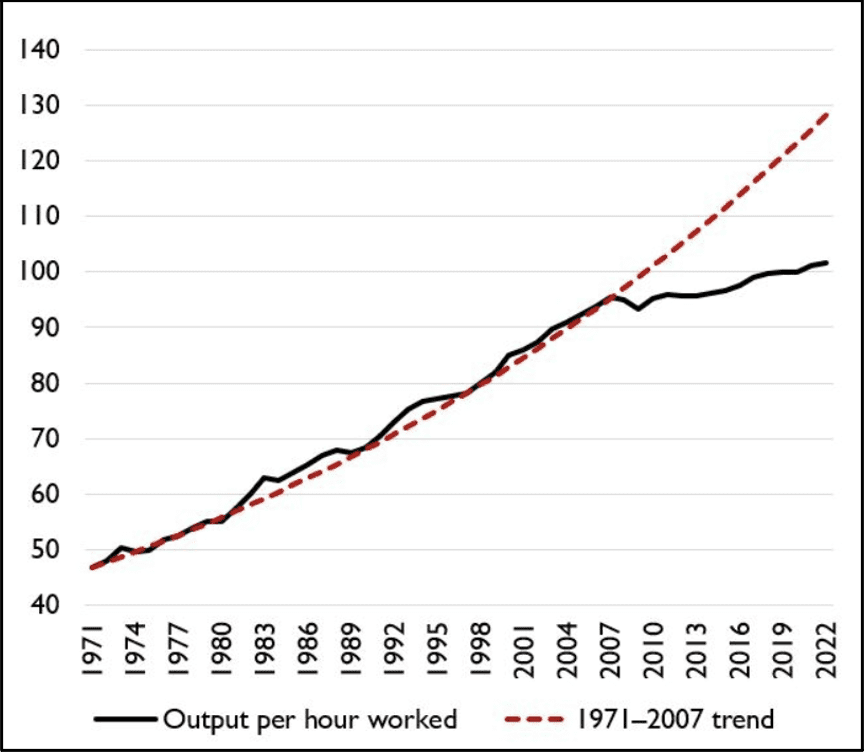

Crucial to an incoming government’s fiscal plans will be productivity growth, which has stagnated since the financial crash.

Since the 2007-08 financial crisis, the UK’s productivity growth has been notably weaker.

According to the Office for National Statistics (ONS), productivity has significantly diverged from its pre-crisis trend rate of approximately 2% per year. If the pre-2008 trend had persisted, productivity levels in 2022 would have been about 26% higher than they were.

Economic growth is crucial for increased employment and higher incomes.

Productivity growth, a key mechanism of economic growth, enables businesses to produce more with the same labour input, leading to higher wages and better living standards.

Boosting productivity will be a crucial challenge for the incoming government.

Devolution

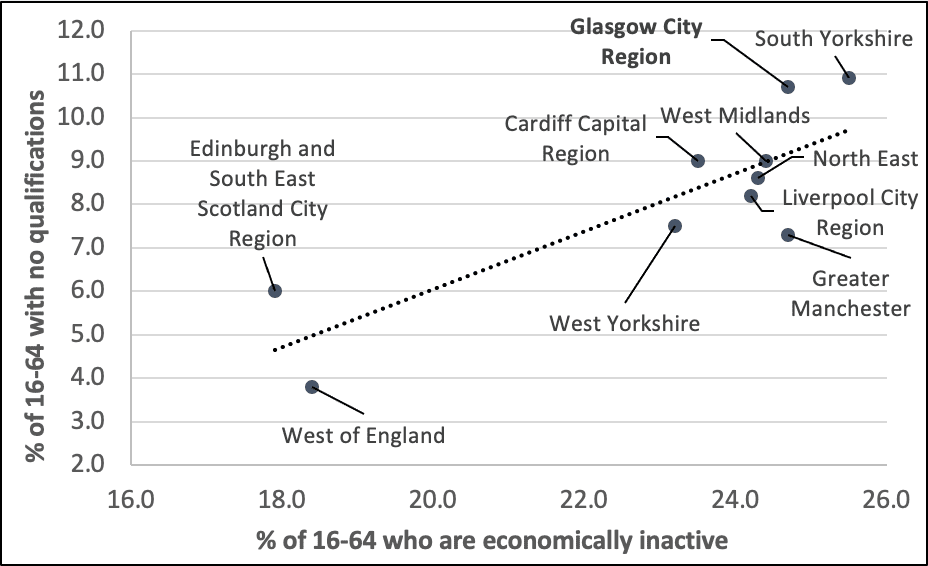

The Uneven Skill Distribution in Glasgow City Region

Devolution of skill planning to a regional level would allow Glasgow City Region to align policy to Regional business needs.

The most recent APS Regulated Qualifications Framework (RQF) data shows that Glasgow City Region has the highest percentage of individuals aged 16-64 with an RQF4 qualification or higher (53.9%). But it also shows the Region continuing to have the second highest percentage of individuals aged 16-64 with no qualifications (10.2%).

The Independent Review of Skills Delivery Landscape, published by James Withers in 2023 argues there is a need to devolve more decision-making regarding skills to a regional level.

The Labour manifesto details their commitment to regions being given power over adult education and skills and devolving funding for this, but the manifesto does not give precise detail on plans for Scotland.

Chart 6: Economic Inactivity Against No Qualifications across UK Core City Regions.

| % with RQF4+ | % with no qualifications (RQF) | |

|---|---|---|

| Glasgow City Region | 53.9 (Best Performing) | 10.7 (2nd Worst Performing) |

Sources: Intelligence Hub analysis of Annual Population Survey

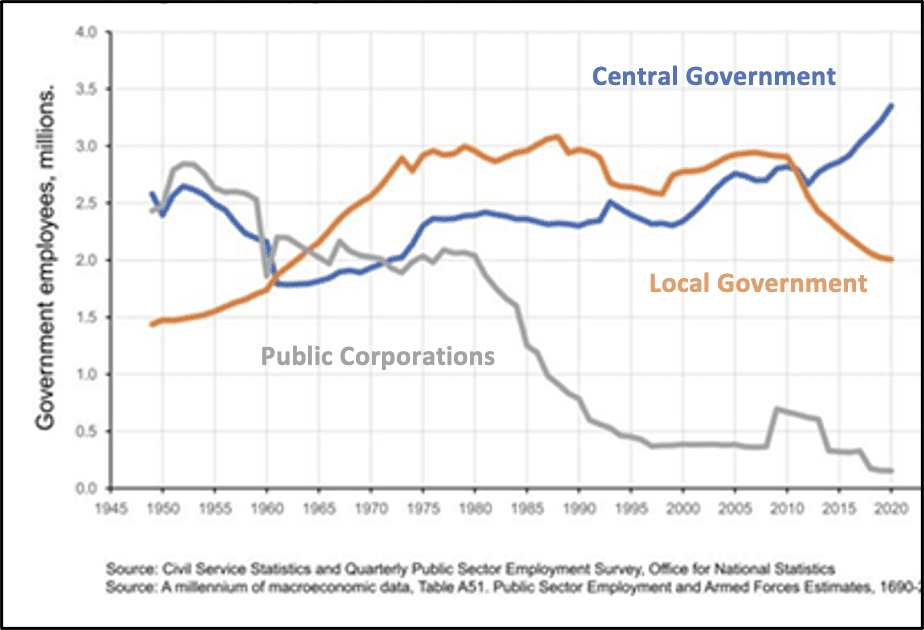

The new government will need to address centralisation of policy development

Labour has committed to deepening devolution for combined authorities but lacks detail on what this might mean for Glasgow City Region.

The Institute for Government and Centre for Cities have both argued for greater devolution.

The centralisation of power has been shown by the number of central civil servants increasing dramatically, while the number of council employees has dropped by the same amount.

Labour’s manifesto maintains their commitment to devolution within England as a central pillar to the party’s growth strategy.

In practice, this means giving more powers to metropolitan mayors, including key economic powers such as transport, skills and employment. Crucially, this also means giving multi-year funding settlements, and spreading the model of ‘integrated settlements’ as tested in Greater Manchester and the West Midlands.

Scottish Labour have called for devolution of powers to Scottish City Mayors but beyond England the devolution commitments are currently less detailed.

Chart 7: Civil Service Employment 1945-2020

Glossary

Gross Domestic Product (GDP): The total monetary value of final good and services produced in a country in a given time period.

Consumer Price Index (CPI): Is a weighted-average of a basket of consumer goods and services purchased by households. Changes in measured CPI tracks changes in prices overtime.

Unemployment rate: Unemployed people are out of work but actively looking for a job and available to start work in the next two weeks. It is measured as the number of unemployed people divided by the number of economically active population (those in employment and those unemployed).

Real Household Disposable Income: Real disposable income is a measure of the purchasing power of a household or individual, considering the effect of inflation. It is calculated by subtracting taxes and other mandatory payments from a household’s disposable income, and then adjusting for inflation.

Economic Inactivity: People who are not in the workforce are classified as economically inactive and have not been seeking work for the last four weeks and cannot start in the next two weeks.

Regular Earnings: Regular earnings refer to the consistent, periodic compensation that an employee receives, typically on a weekly, biweekly, or monthly basis. This includes base salary or wages and excludes irregular or non-recurring payments such as bonuses, overtime pay, and other special allowances.

Total Earnings: Total earnings encompass all forms of compensation received by an employee over a specific period, including regular earnings, overtime pay, bonuses, commissions, and any other additional payments.

Further Information

For queries and further information, please contact Will Harkiss: