Intelligence Hub

Economic Briefing May 2025

Introduction and Key Points

The latest Regional economic briefing focuses on four main areas:

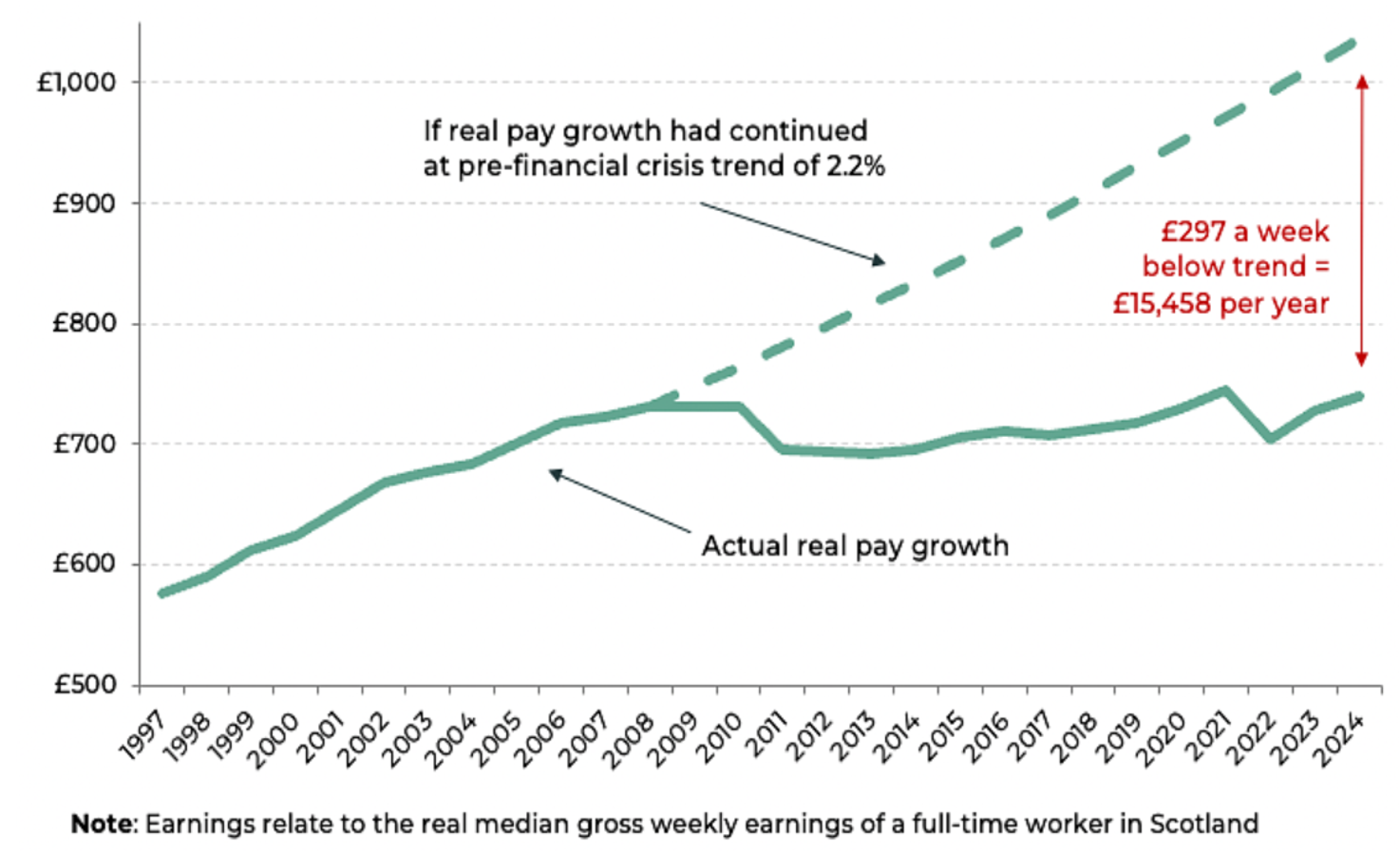

- The latest UK and Scottish economic data – which is a mixed bag and part of a continued trend of sluggish growth. A recent study estimates that average wages in Scotland are over £15,000 lower than they would have been if wages had remained on the same growth rate seen between 1997 and 2007.

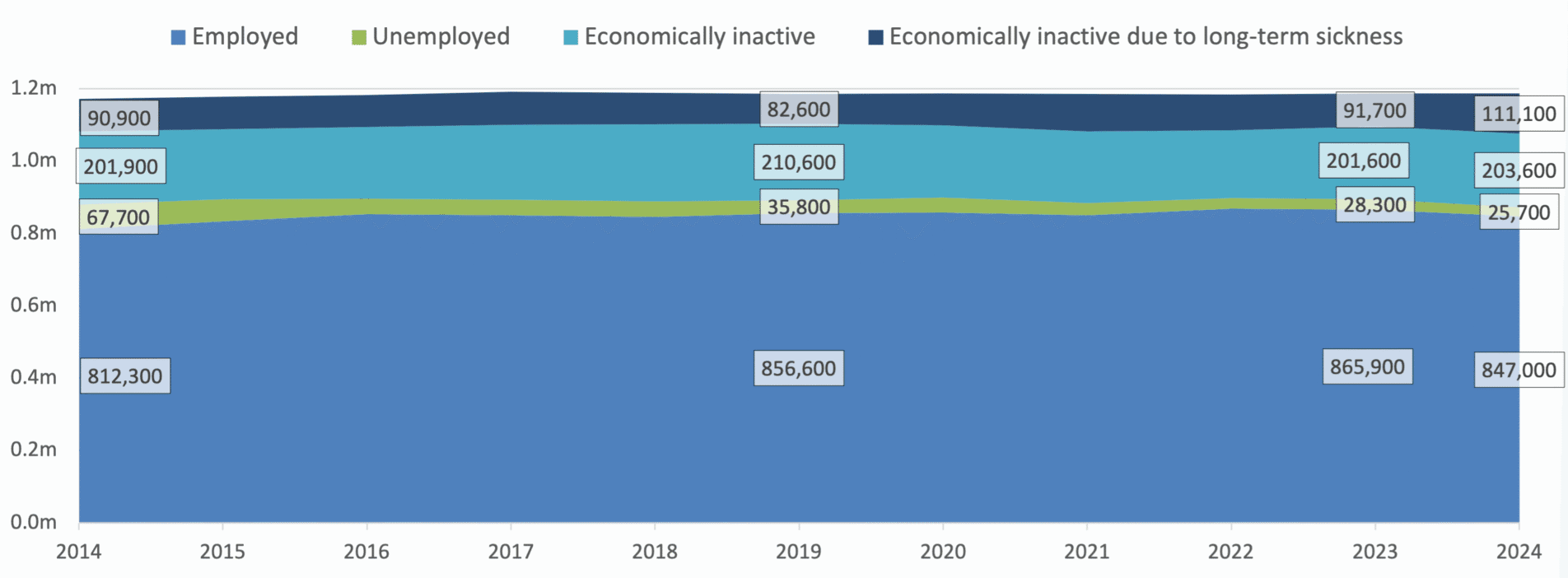

- The latest Annual Population Survey data for Glasgow City Region – the data shows some real challenges facing the Region with inactivity due to long term sickness at its highest rate since 2007.

- Immigration White Paper – the UK Government this week published a white paper aimed at reforming the immigration system. The Region has relied on migrants to ensure its working age population doesn’t decrease and dealing with this could generate challenges locally, at least in the short term.

- Policy Responses – the latest economic news only strengthens the case for further devolution in GCR to allow it to create place-based policies that respond to these challenges.

State of the UK and Scottish Economy

Signs of Growth Amid Inflationary Pressures and Labour Market Adjustments

- Inflation: UK inflation rose in April (3.8%), up from 2.6% in March.

- Whilst it is expected that the rises will be temporary, they have been driven by increases in energy, water and food prices.

- GDP: UK GDP grew by 0.7% in Q1 2025, the fastest rate in a year. Led by a surge in business investment and stronger export performance, this was likely in anticipation of the tariffs. However, underlying growth is expected to slow, with US tariffs putting a dampener on the global economy.

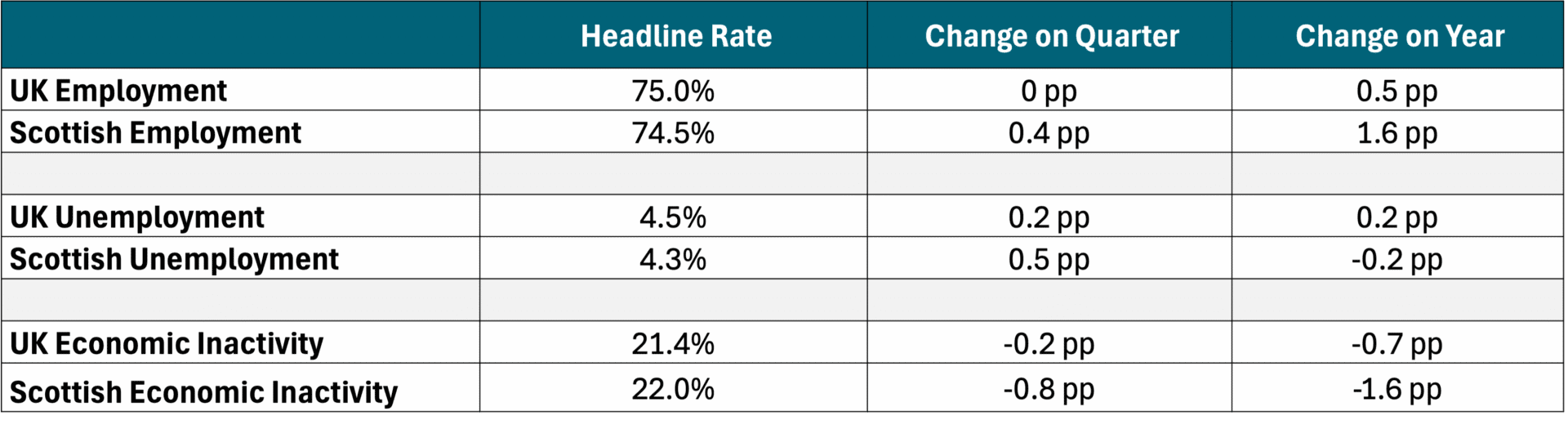

- Labour Market: This is the first labour market data release since the rise in National Insurance. But both the UK and Scottish labour market have remained resilient. In Scotland, the labour market shows stronger signs. Both employment rose to 74.5%, up 1.6 % points on the year, and unemployment fell to 4.3%. Economic inactivity also dropped to 22.0%, down 1.6 % points year-on-year.

Figure 1: Labour market rates, Scotland and UK, January to March 2025

Living Standards

Analysis from Future Economy Scotland shows that over the past 16 years real wages in Scotland have increased by just 1% , lower than the UK average of 1.7%.

- Before 2008, real weekly earnings in Scotland grew steadily at 2.2% per year, improving living standards. However, the 2008 financial crisis triggered a sharp decline in earnings.

- By 2024, real median weekly earnings were only £8 higher than in 2008—a mere 1% increase over 16 years—marking the weakest long-term earnings growth in modern Scottish economic history.

- Today, the average full-time worker in Scotland earns £38,464 a year. If pre-2008 earnings growth had continued, they would be earning £53,923—£15,000 more.

- This gap highlights how much living standards have fallen, with that difference often meaning the line between financial security and hardship for many households.

Figure 2: Real median gross weekly earnings, actual and pre-financial crisis trend (Scotland)

Latest GVA Data

Falling living standards are connected to sluggish productivity growth and a lack of investment in technology and skills.

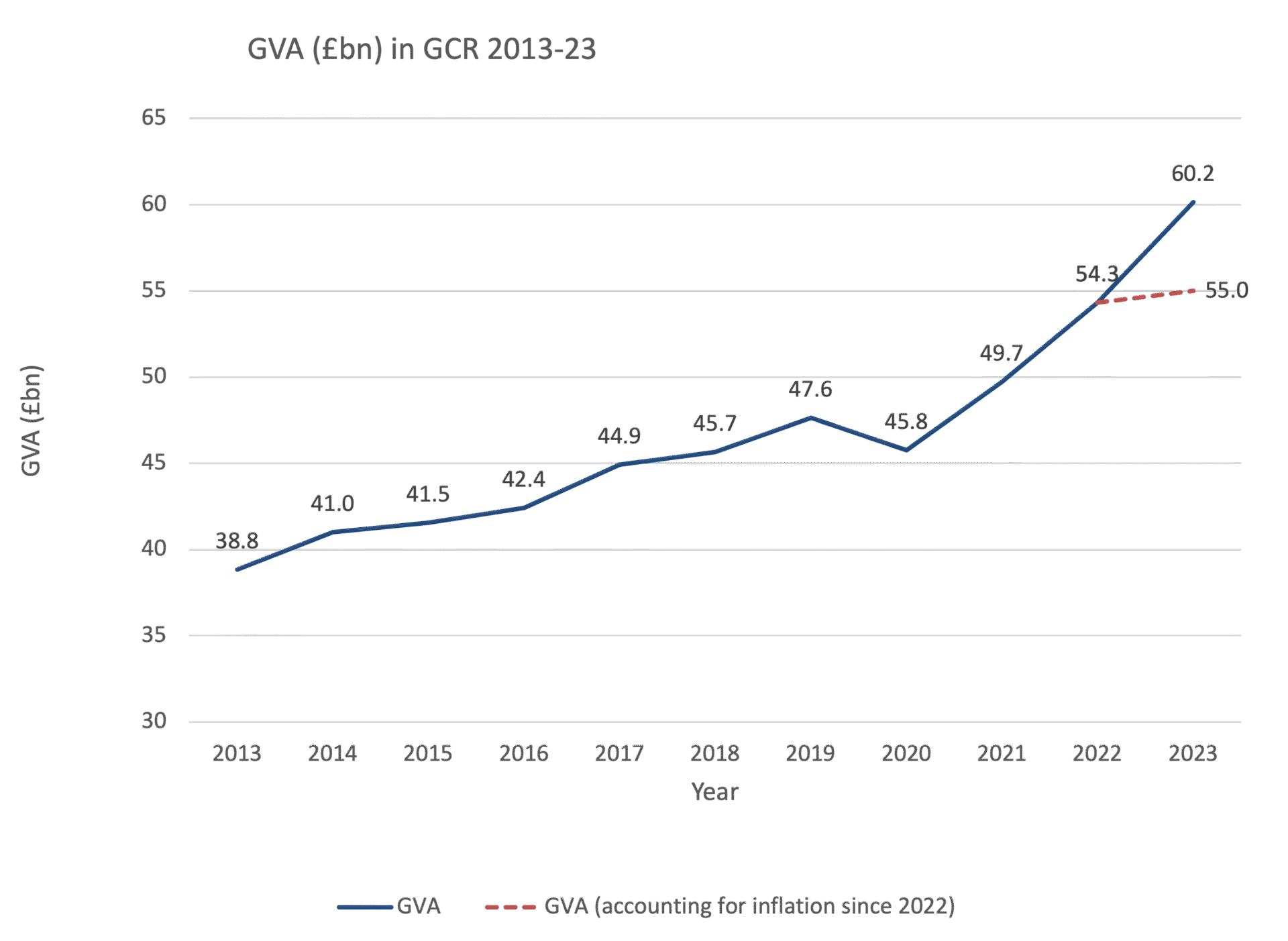

GCR’s GVA was £60.15bn in 2023, remaining the fourth highest of the nine UK Core City Regions.

The largest ever current price GVA increase was recorded between 2022 and 2023 at 10.8% (£5.84bn). However, when accounting for inflation this was a 1.3% increase (£0.68bn).

- This was greater than the increases in UK and Scotland and the third highest increase among the UK Core City Regions behind West of England and North East.

- Over the last decade GCR had the 5th highest GVA growth amongst the UK Core City Regions

All GCR Member Authorities recorded an increase in GVA but when accounting for inflation Renfrewshire and East Dunbartonshire had decreases. West Dunbartonshire performed the best with a 18.5% increase while most other member authorities had rates at or just above the GCR average of 10.8%. Renfrewshire’s increase of 6.8% and East Dunbartonshire’s increase of 6.2% were much lower and were net decreases of 0.3% and 2.4%, respectively, when accounting for inflation.

Figure 3: Latest GCR GVA Growth Figures

Source: ONS

Latest Annual Population Survey Data

Whilst the reliability of the data is an issue, if correct, the latest labour market is a concern for the Region

- 2023-2024 saw the largest annual increase in GCR’s rate of inactivity due to long term sickness since records began (+4%pts/19,400 people). It’s at its highest rate since 2007 (35.3% of inactive people, 9.4% of the working-age population). This affected GCR’s overall Economic Inactivity rate which increased to its highest rate since 2004 (26.5%) – meaning GCR had the highest rate of Economic Inactivity amongst UK Core City Regions.

- There was a sharp decline in the employment rate of 1.6 percentage points, equivalent to a decrease of 18,900 employees. GCR’s rate of 71.3% is its lowest since 2018.

- There was also a 9.2% decrease in the number of unemployed people meaning that overall, the size of the labour market decreased by 21,500 people (2.4%).

Figure 4: Latest Labour Market and Economic Inactivity Stats

Source: Annual Population Survey

Latest Annual Population Survey Data

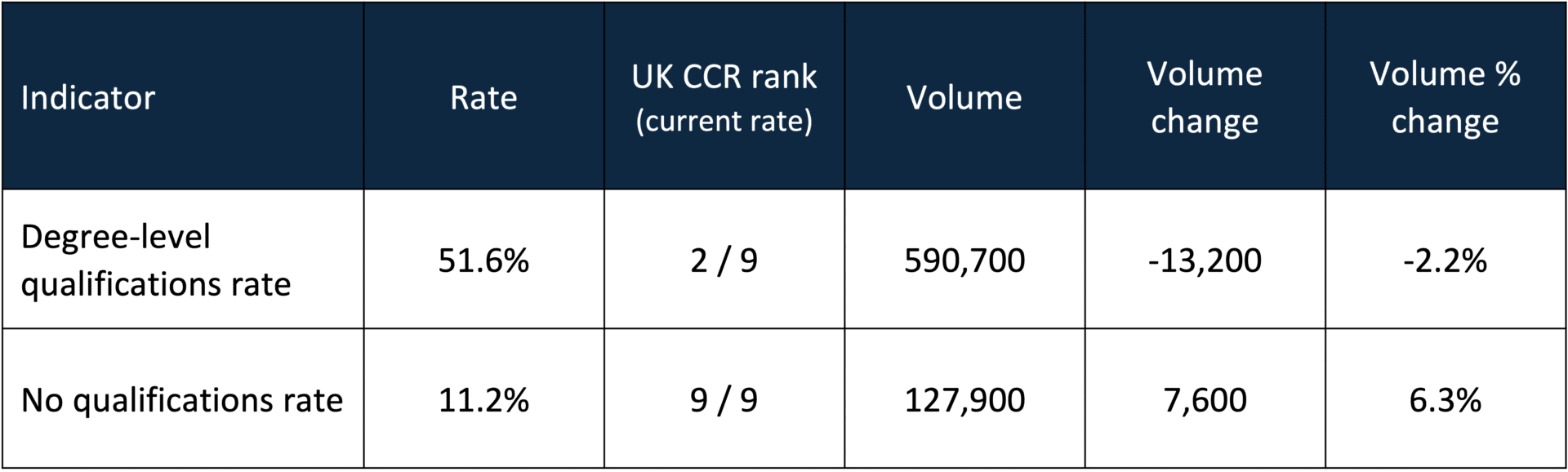

Despite Glasgow City Region’s highly educated population, inequalities are stark and widening

Glasgow City Region has one of the most highly qualified labour markets in the UK outside of London. Over half (51.6%) of working-age residents are educated to degree level, the second-highest rate among UK Core City Regions.

- This reflects the strength and scale of the Region’s universities, which underpin a globally recognised knowledge economy and generate a consistent pipeline of skilled talent.

At the same time, 11.2% of residents have no formal qualifications, which remains the highest rate among peer UK Core City Regions. Evidence shows this is closely linked to higher levels of economic inactivity and worklessness

- This dual challenge of strength at the top of the UK Core City Regions, alongside persistent inequality at the bottom, highlights the need for more place-sensitive policy levers to help tackle GCR’s sticky issues.

However, a key gap remains in fully understanding the demographics of both groups, not just in terms of age and background, but also subject choices and the extent to which graduates in the Region were born abroad – and if they stay within GCR to work. The Intelligence Hub is planning further work to understand this.

Figure 5: GCR’s Qualifications Stats in Annual Population Survey 2024

Source: Annual Population Survey

Immigration White Paper

On 12th May the UK Government published a White Paper on the UK’s immigration system.

The white paper outlined several proposed reforms to the legal migration system that aim to restore ‘order, control, and fairness’. These reforms include:

- Increased educational and salary thresholds for visas

- Extension of the residency period to obtain settled status

- Reduction in duration of graduate visas

- Strengthened requirements for universities to recruit international students

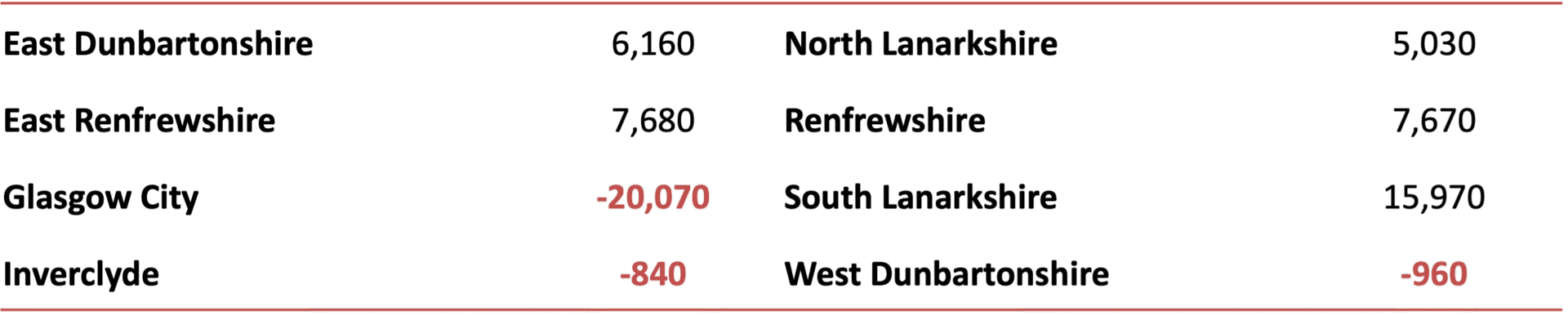

Over the last two decades GCR’s labour force reflects a level of reliance on international migration. The FAI highlight that international migration is projected to drive population growth in Scotland to 2047 – helping to balance an ageing domestic population.

Despite a positive rate in the mid-to-late 2010s, GCR’s net migration rate with international migration removed has been predominantly negative. The reduction of international migration could disproportionately impact Glasgow City.

Figure 6: Total Net Migration without Int’l Migration 11/12-21/22

Sources:

- What immigration restrictions might mean for Scotland | FAI

- National Records of Scotland

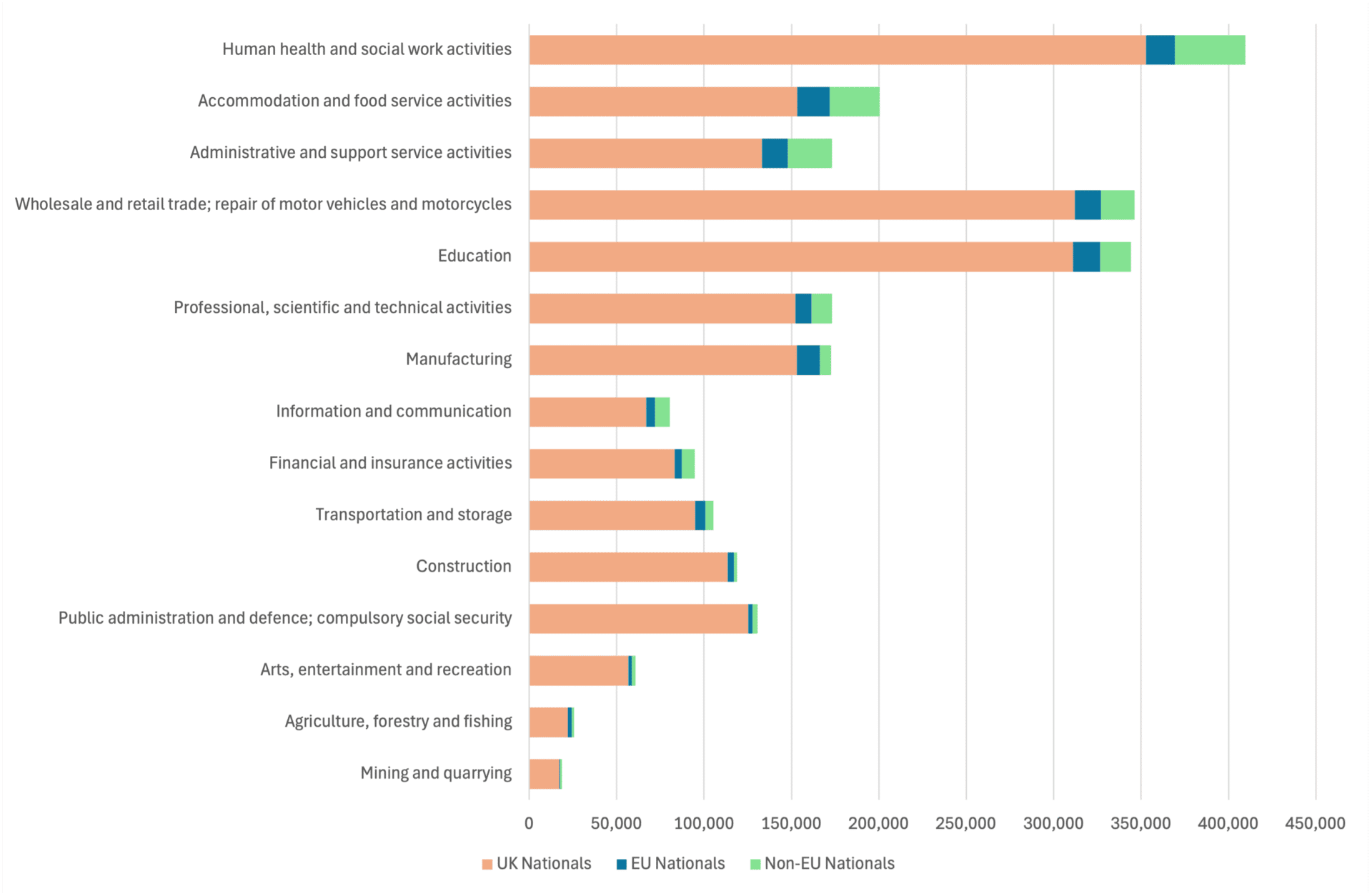

Reduced international migration may impact GCR’s Foundational Economy sectors.

The UK Government aims to create a system that links directly to domestic skills and training – preventing industry from relying on immigration to fill skills shortages.

As shown in Figure 8, this will have labour supply implications for industries aligned with the Foundational Economy (FE) in Scotland. This payroll data backs up findings published by the Resolution Foundation (RF) that EU migrants are overrepresented in underpaid work – which is prevalent in FE sectors.

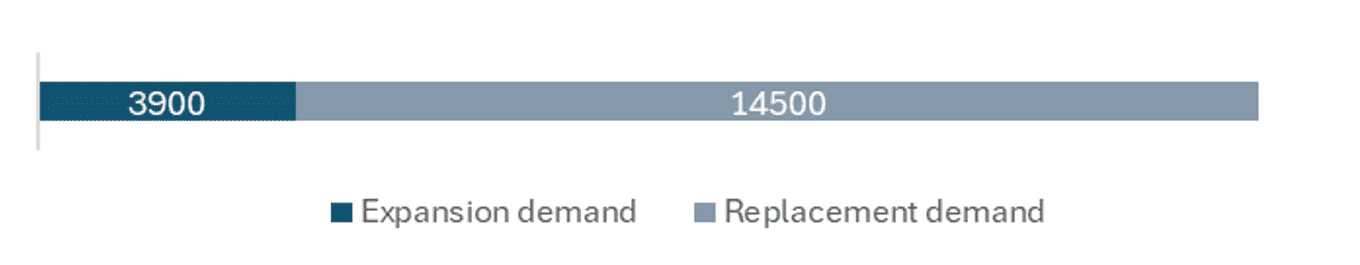

Arguably the most affected industry would be Health and Social Care – as one of the proposed reforms is to close social care visas to new migrant applications. This is the largest employing sector in GCR comprising of over 130,000 jobs – with a projected 14,500 replacement demand jobs required by 2027.

The IPPR have commented that the UK Gov needs to improve wages and work conditions to avoid exacerbating the staff crisis in social care.

Figure 7: Scotland’s Payrolled Employees by Nationality – Dec 2024

Figure 8: GCR Forecast Job Requirement in Human Health and Social Care 2024-2027

Sources: HMRC Payrolled Employees and Skills Development Scotland

Immigration and Higher Education

New rules on immigration might negatively impact of the Region’s Higher Education sector and associated Investment

Since 2018/19, the proportion of non-UK national students in UK and GCR’s higher education has steadily increased and has seen a rise from 26.4% to a peak of 36.0% in 2022/23.

However, the latest data shows a new trend. While international enrolments had been rising year-on-year, the rate of growth has now slowed considerably.

These shifts matter for GCR:

- International students bring a substantial amount of income to universities and support local economies through enhanced demand for services and labour.

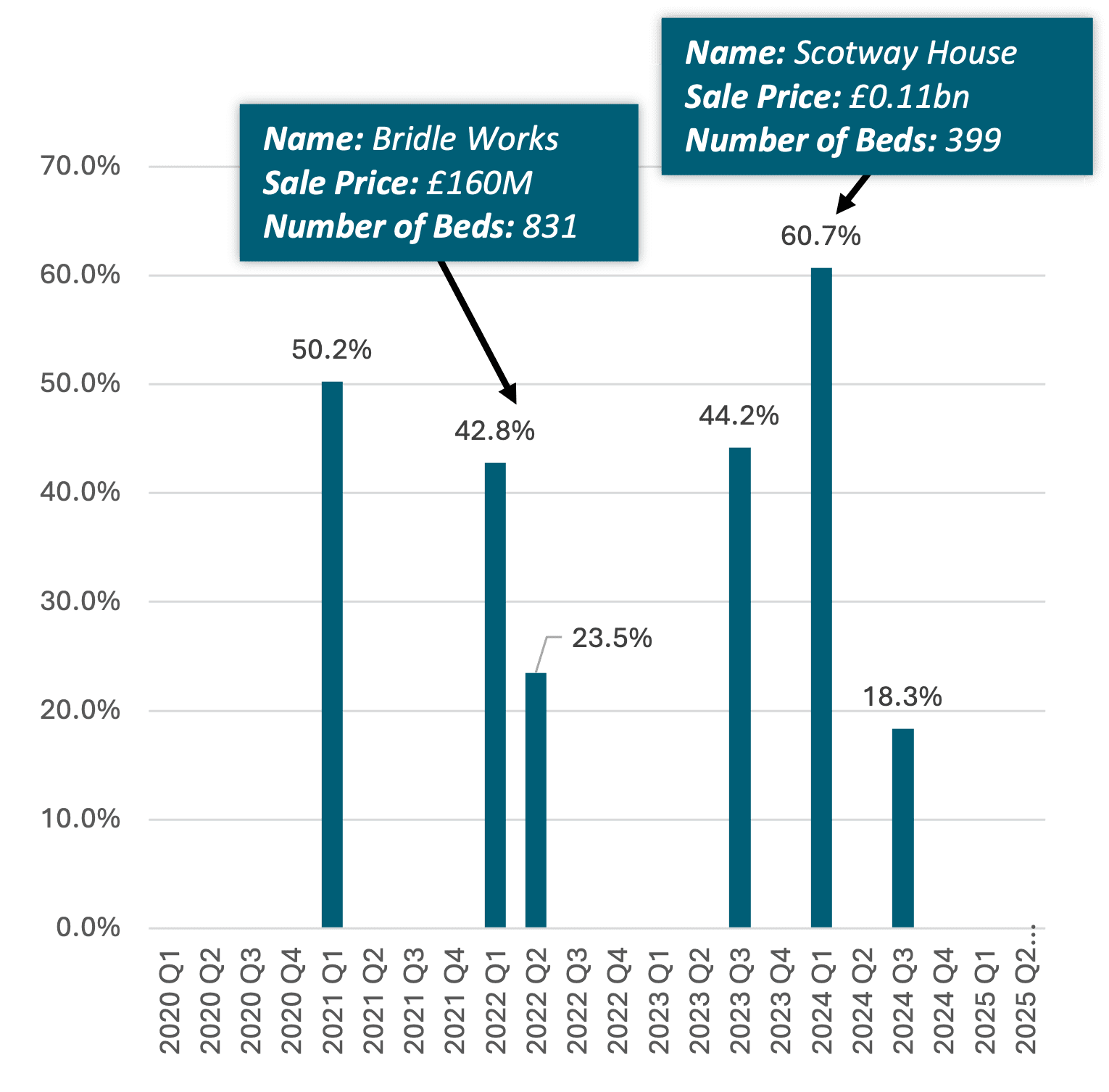

- Student accommodation is driving property investment into the Region – as much as 60.7% of total real estate sales in Q1 2024, as shown by Figure 9.

A tightening of visa rules risks disrupting labour supply further after Brexit, alongside the high amount of investment supporting the Region’s world class higher education sector.

Figure 9: Share of Student Accommodation in GCR Property Sales (by Quarter)

Source: CoStar

Policy Implications

The latest economic news highlights why we need more place based policies designed in Glasgow City Region

- The undoubted challenges facing the Region strengthens the case for a Glasgow City Region Devolution Deal

- Glasgow City Region needs the levers available in its English counterparts

- Having the ability to develop placed based – evidence backed programmes is crucial to address these long term ‘sticky’ problems.

- The Region could deliver more integrated, locally tailored support for those furthest from the labour market

- And, with greater devolved powers over skills, employment support, and business development, the Region could better harness its graduate workforce to attract and scale innovative firms.

- As a recent academic report by leading economists’ highlights:

“increasing numbers of commentators and policymakers worldwide, including those who previously eschewed place-based approaches, were moving away from assumptions that there is a neat ‘people versus place’ dichotomy or trade-off, and that ‘people-in-places’ reflected a more realistic understanding of the relationships between markets, and institutions and governance”

“Bartik (Citation2020) offers six key priorities for the design of place-based policies.

- Place-based policies should focus explicitly on depressed areas.

- Place-based policies should focus on high multiplier industries.

- Place-based policies should not disproportionately favour large firms.

- Place-based policies should focus on the enhanced provision of local business inputs, and local infrastructure and land provision.

- Place-based policies should be a coordinated package of policies tailored to the local context and aimed at building complementarities.

- Place-based policies should be better evaluated using quantifiable selection criteria, thereby permitting the use of techniques such as regression discontinuity design.”

Contact

For queries, please contact Finn Clasen:

Finn.clasen@glasgow.gov.uk

Further Information

For queries and further information, please contact Will Harkiss: