Intelligence Hub

Economic Briefing August 2025

Introduction and Key Points

The latest Regional economic briefing focuses on a series of topics:

The latest UK and Scottish Economic Data

- Analysis of the latest economic data highlighting the continuation of mixed economic performance in the UK.

- The latest population figures which show the changes in population over the last 40 years.

- An overview of the Resolution Foundation’s Low Pay Britain report – which focuses on the impact of the Employment Rights Bill on low-pay workers.

UK Industrial Strategy & AI

- The UK’s Modern Industrial Strategy was launched by the UK Government in late June – part of the wider mission to revitalise the UK economy.

- However, the labour market opportunities created through the strategy may be mitigated by the rise in AI and its potential disproportionate impact on graduate-role job creation.

High Street Performance

- A recent publication by the Centre for Cities that establishes the main drivers of success for High Streets throughout the UK. Glasgow’s performance across a variety of measure is notable, ranking amongst the best cities in the UK in terms of market pull and is a key regional asset.

Spotlight on the latest Graduate Destination Data

- New data from the Higher Education Statistics Authority (HESA) shows where the Region’s graduate workforce comes from, where they work, and how this can impact GCR’s innovation cluster’s supply of labour.

- The majority of graduates who study in the Region go on to work in the Region

- However, the Region has a lower-than-average retention rate for subject areas that are important to our innovation clusters.

- As part of a wider Labour Market study, the Intelligence Hub will look into whether the Region needs to do more keep these students, or if this is simply a reflection of university specialisms.

Latest Scottish and UK Economic Data

State of the UK Scottish Economy

The latest macroeconomic data continues to show a mixed picture.

- Inflation and Interest Rates: UK inflation rose by 3.6% in the 12 months to June 2025, which is the highest recorded rate since January 2024. This was primarily driven by increasing prices within the Transport industry – reflecting price increases for petrol, rail tickets, and airfares. Nevertheless, the Bank of England cut interest rates from 4.25% to 4% in August.

- GDP: The UK’s GDP grew by 0.3% from April to June. This was higher than expected but down from the 0.7% growth in the first quarter. The growth was led by the services, construction and manufacturing sectors. And “the UK was on track to record the quickest annualised growth rate in the G7 in the first half of the year according to Simon French, an economist at Panmure.”

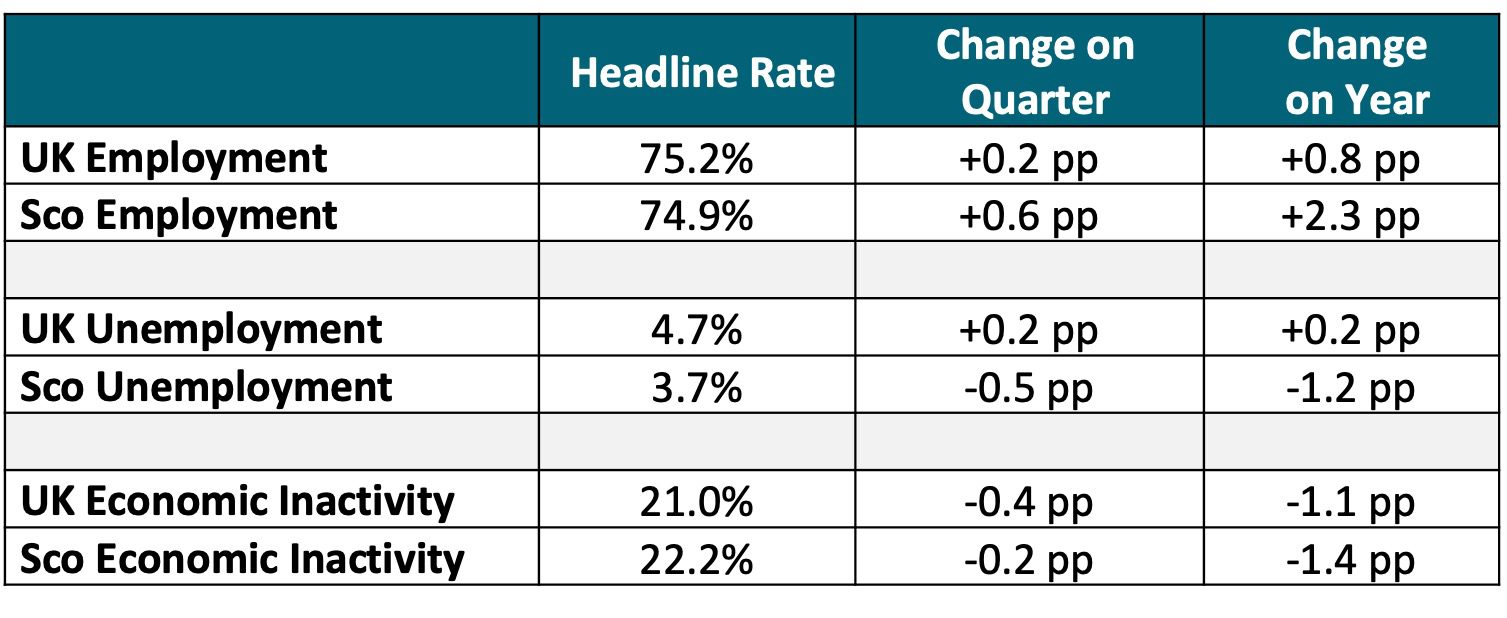

- Labour Market: Over the last quarter the Scottish labour market has experienced a positive shift as the rates of unemployment and economic inactivity fell whilst employment increased. This builds on the annual percentage point comparisons, but it is noted that annual changes should be treated with caution as sample-size issues remain present in 2024 data. Another note of caution can be seen as UK payroll employment fell for a sixth straight month in July

Figure 1: Labour market rates, Scotland and UK, March to May 2025

The Resolution Foundation recently published its 15th annual Low Pay Britain report which focuses on the impact of the proposed Employment Rights Bill on low-pay workers.

The Employment Rights Bill has been introduced as part of the UK Government’s plan to help more people stay in work, support worker’s productivity, and improve living standards.

Measures proposed in the Bill will address issues such as:

- Hours security

- Fair pay

- Family-friendly rights

- Wellbeing of workers

The proposed Employment Rights Bill supports the goals of the GCR Fair Work and Living Wage Campaign – which aims to tackle insecure work through measures including promoting fair pay, hours security, and improved working conditions.

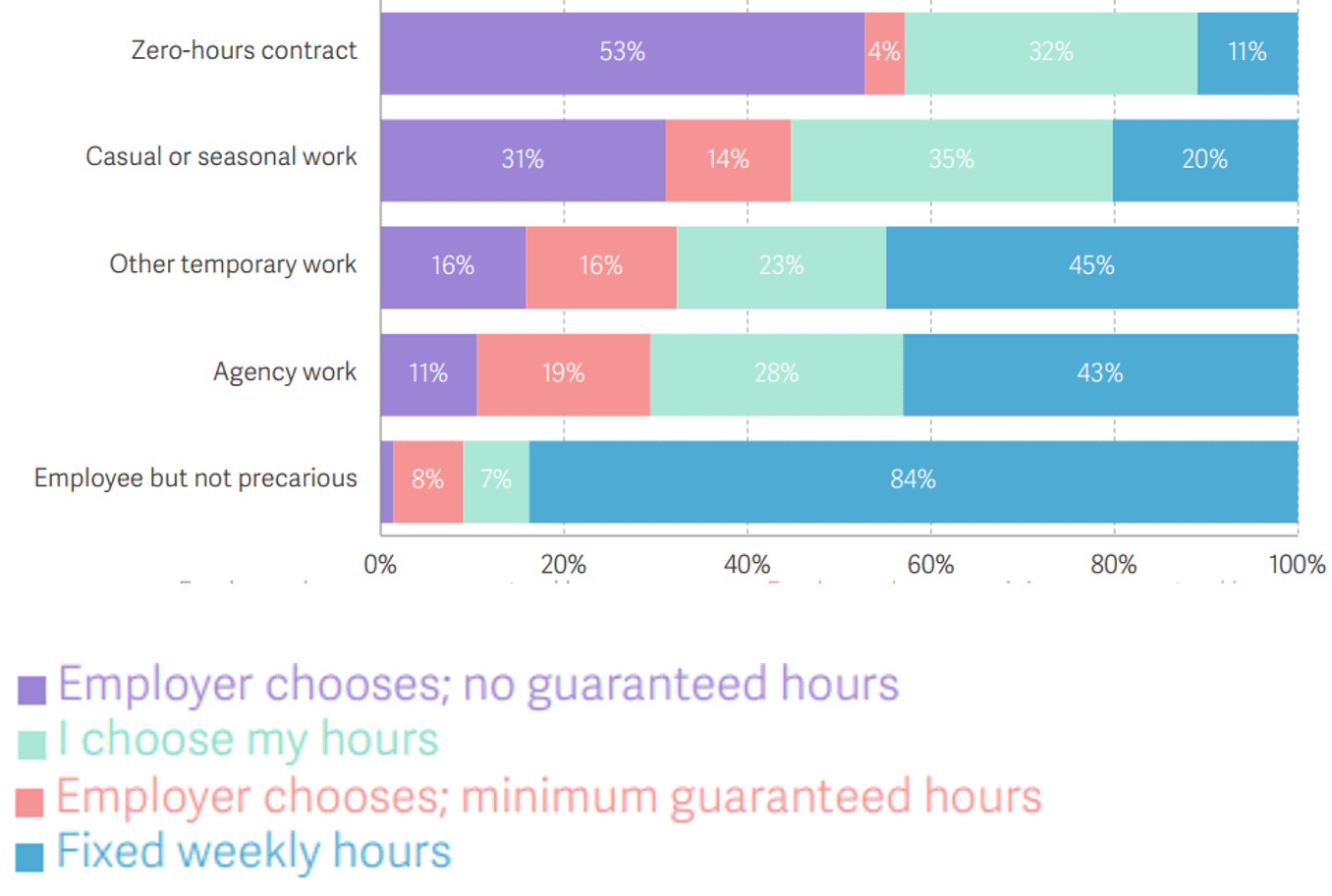

Specific focus was given to the impact of the proposed ending of exploitative zero-hour contracts – through the introduction of contracts that reflect regular working hours and a right to reasonable notice of changing shift patterns.

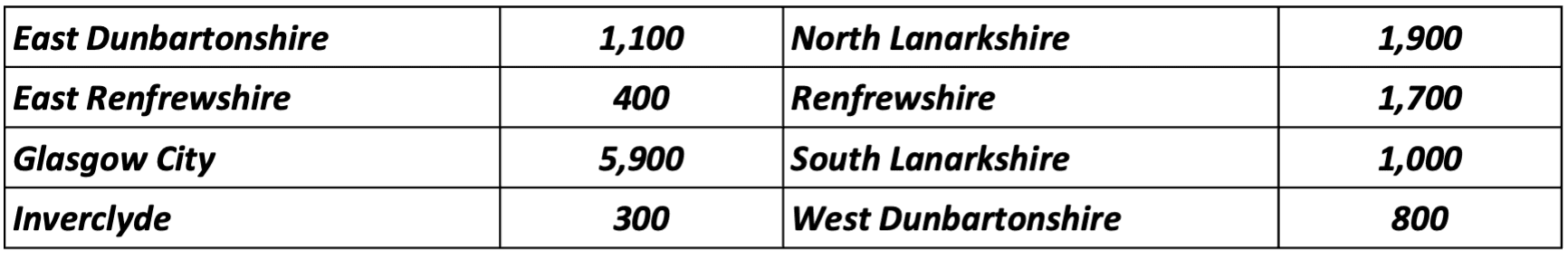

This could potentially impact the 13,100 zero-hour contract employees in GCR.

Figure 2: Proportion of UK variable contract workers’ hours determination, 22-23

Table 1: Zero-hour Contract workers in GCR (2021)

Sources: Resolution Foundation and ONS

Latest Population Data

The National Records of Scotland (NRS) recently released the latest population estimate time series data. This uses the 2022 Census to revise mid 2011 to mid 2021 data.

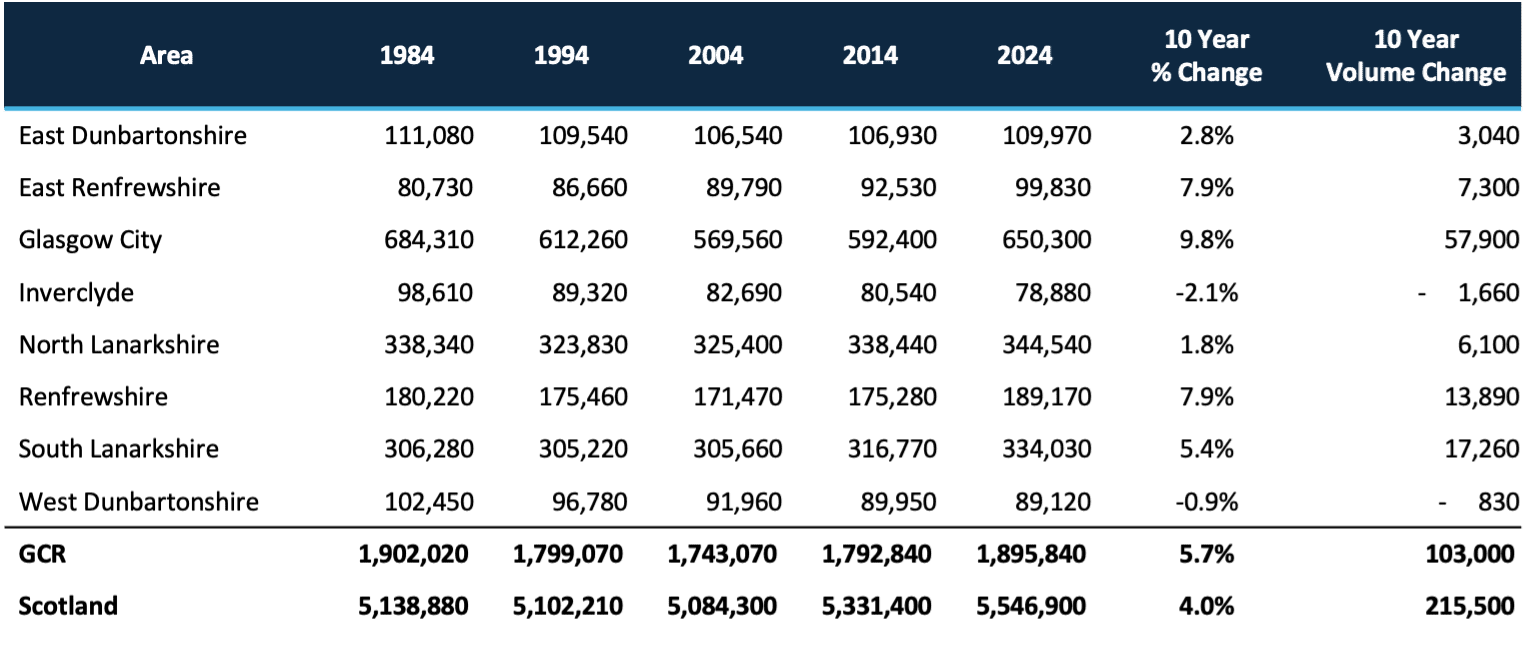

The latest NRS data allows for a review of population changes between 1981 and 2024. This data highlights the major population change that is occurring within the Region.

- Between 1981 and 2004, the Region lost over 200,000 residents. Nearly three-quarters of which came from Glasgow City.

- From 2014 and 2024, the Region’s population grew by 103,000 and is just about back to the levels of the early 1980s. This growth accounted for almost half the total population growth in Scotland.

- Over that decade, the populations of all local authorities in the Region grew, with the exception of Inverclyde and West Dunbartonshire. Glasgow City saw the highest growth within the Region. It was the third highest in Scotland and ahead of all the other Scottish cities.

Figure 3: Regional Population Time Series: 1984-2024

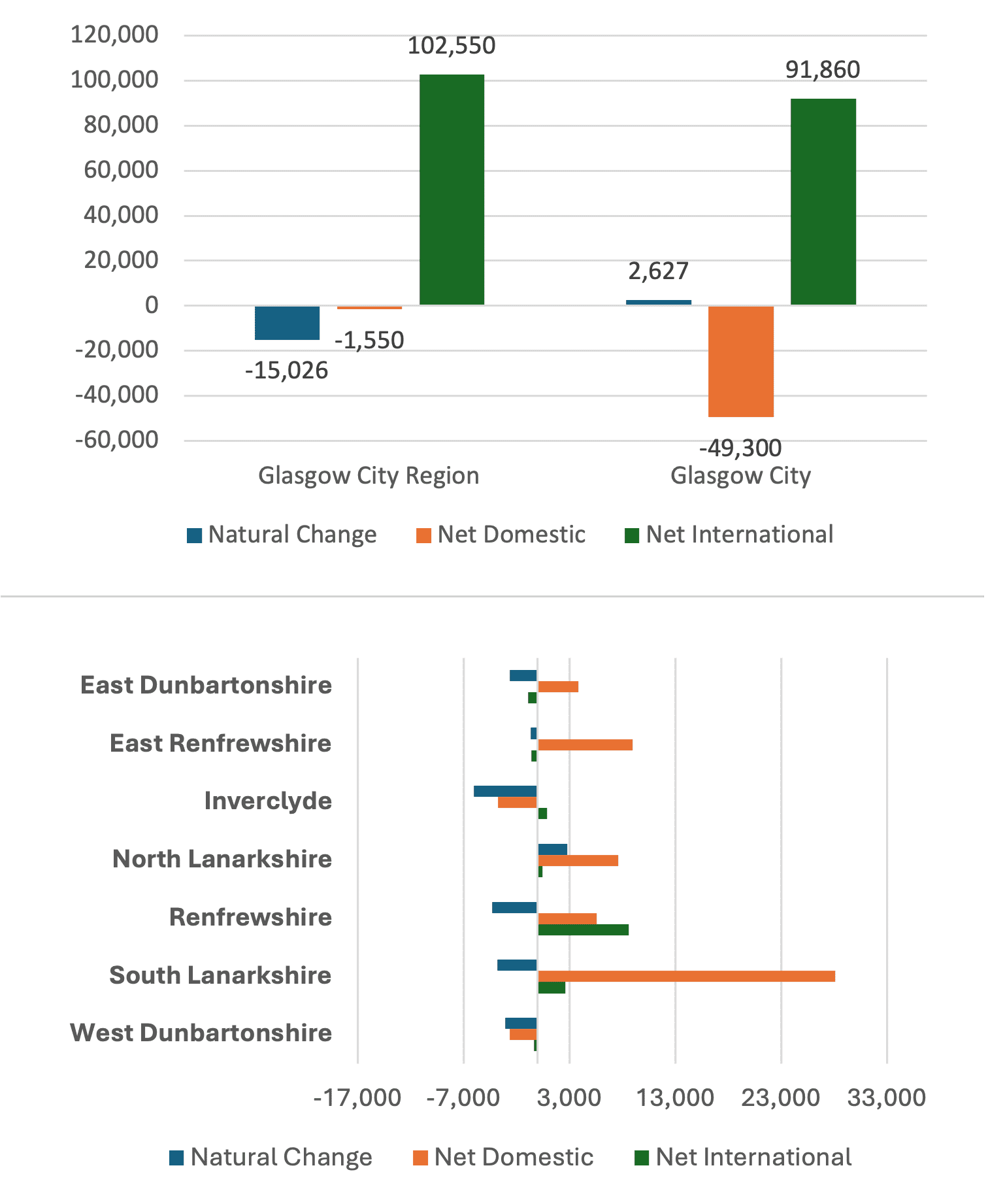

The population growth in Glasgow City Region is driven almost entirely by migration, offsetting natural decline across most council areas.

The composition of GCR’s population growth suggests that there has been a reliance of migration over the last two decades. Figures 4 and 5 show that natural change (births minus deaths) is negative in the majority of member authorities.

This means, without migration, the Region’s population would be shrinking.

Net international migration is the largest driver of growth in GCR, predominantly into the Glasgow City Council area. Whilst net domestic migration plays a key role in some councils, such as East Renfrewshire and South Lanarkshire. These inflows have compensated for natural decline, underlining the Region’s strong reliance on migration to sustain population levels.

Figures 4 & 5: Components of Population Change 2002-2022

Source: National Records of Scotland

Graduate Destination Analysis

Newly acquired data from the Higher Education Statistics Authority (HESA) has been analysed to ascertain where GCR’s graduates work, and where GCR’s graduate workforce come from.

Newly released HESA data analyses destinations of graduates across the UK between the academic years of 2017/18 and 2021/22. It includes their higher education institution, subject of study, whether they are employed, and the location and economic sector of their employment.

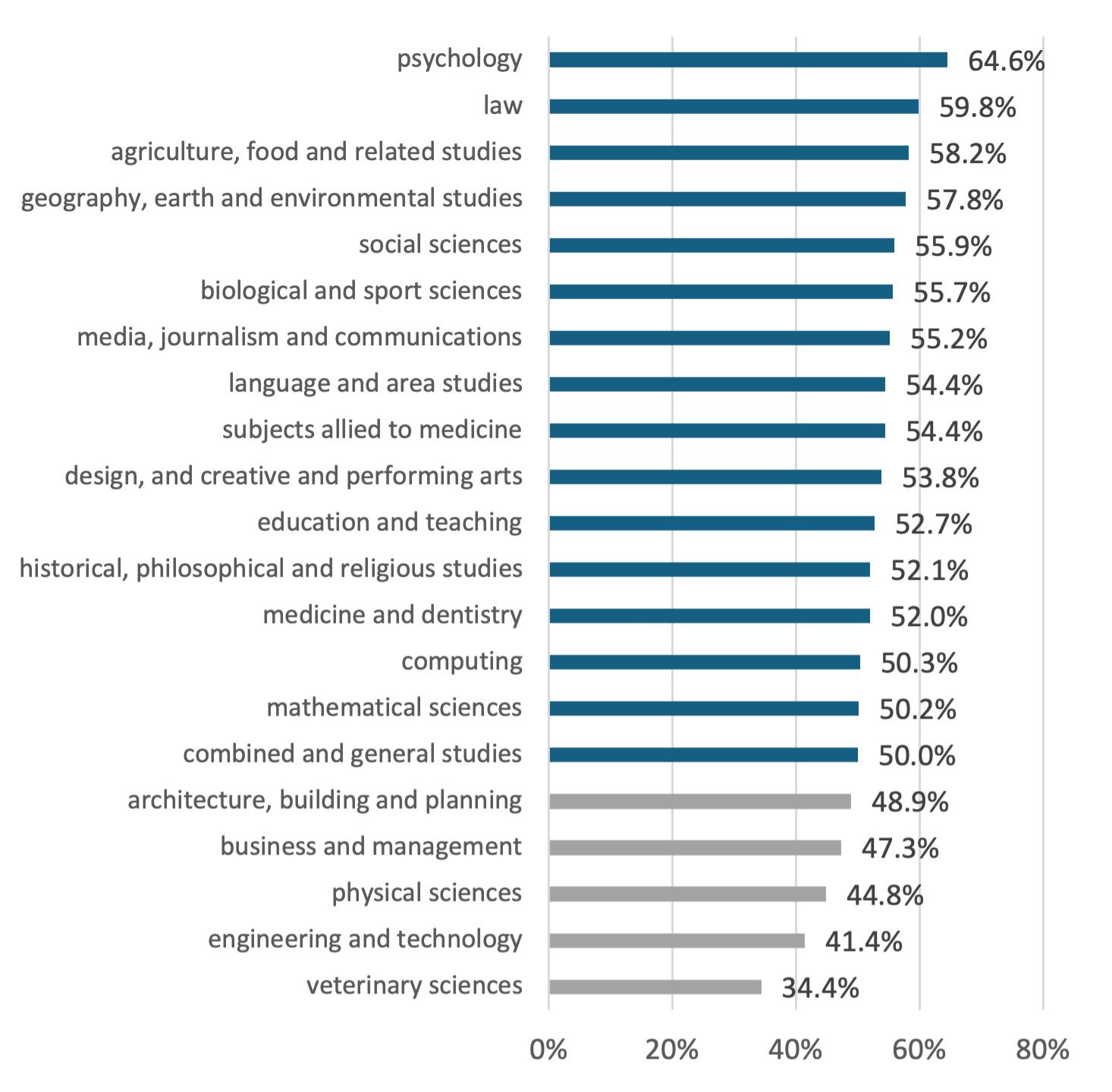

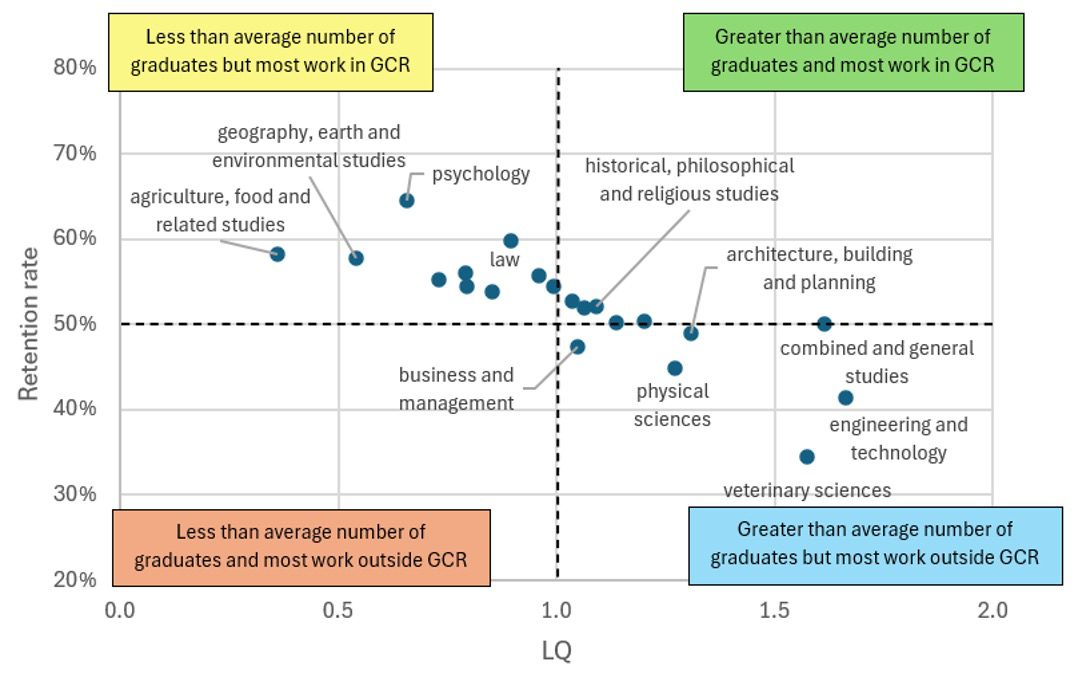

The first analysis looks at the proportion of graduates that remained in GCR to work. The overall retention rate was 51.2%, indicating that most graduates that attend institutions in GCR go on to work in the Region. 32% work elsewhere in the UK and 16.5% work outside the UK.

There were five subject groups where most graduates left the Region for work (<50% retention rate) including some that are pertinent in the supply of labour for the Region’s innovation clusters: Engineering and Technology; Business and Management; Physical Sciences; and Architecture, Building, and Planning.

To help establish whether there is a skills under-supply in the Region, the Hub has begun to look at skills demand. Some of this can be seen below.

Figure 6: GCR retention rate by subject group

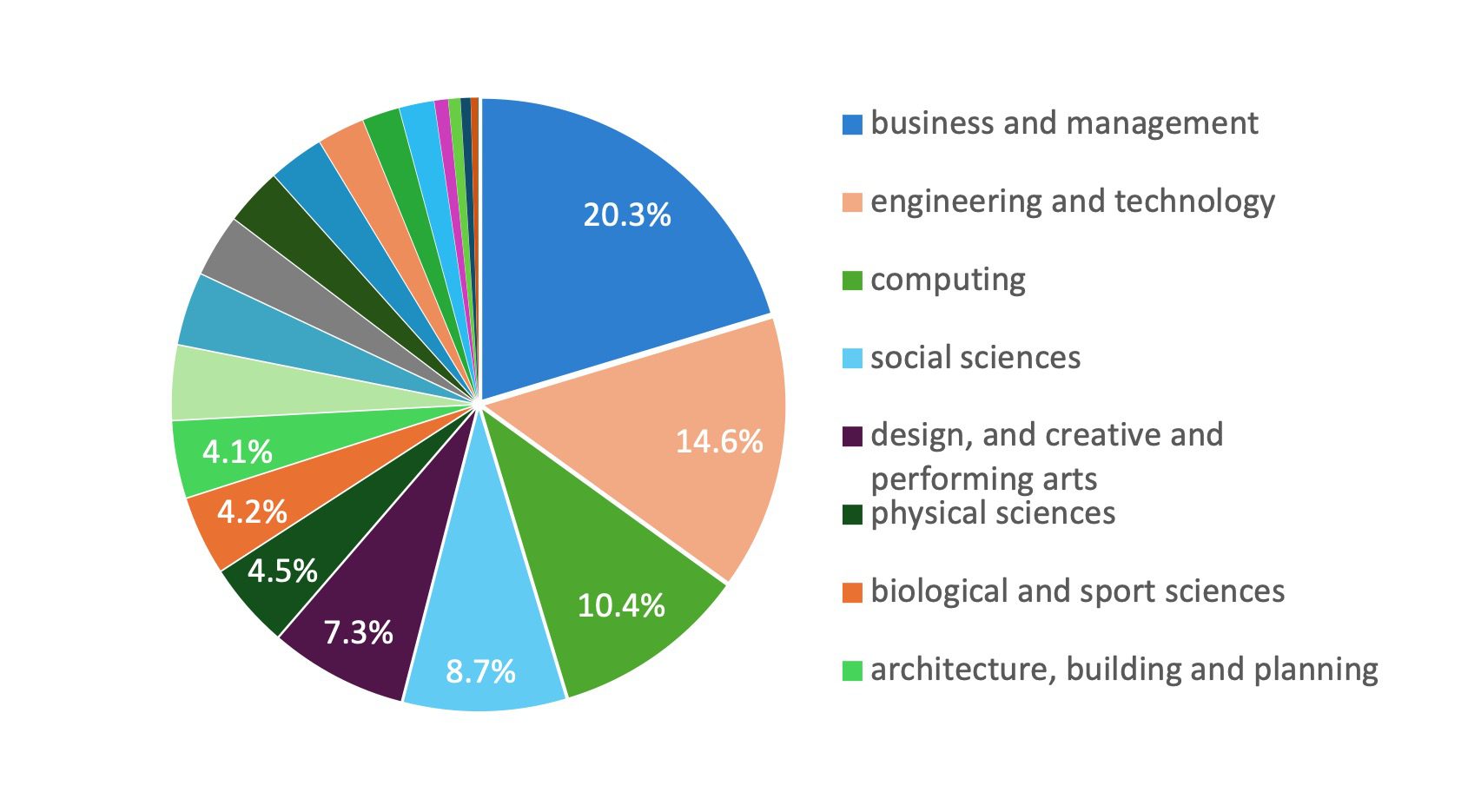

Analysing the relationships between subjects of study and industries of employment can help us understand the labour supply linkages for GCR’s innovation clusters.

Graduates working in sectors aligned with GCR’s innovation clusters across the UK is shown in Figure 7, split by the subject that they studied. This can be used to determine which subjects are important for supplying the workforce of GCR’s clusters and could be investigated further to ensure alignment between the qualifications taught at higher education and those needed by industry.

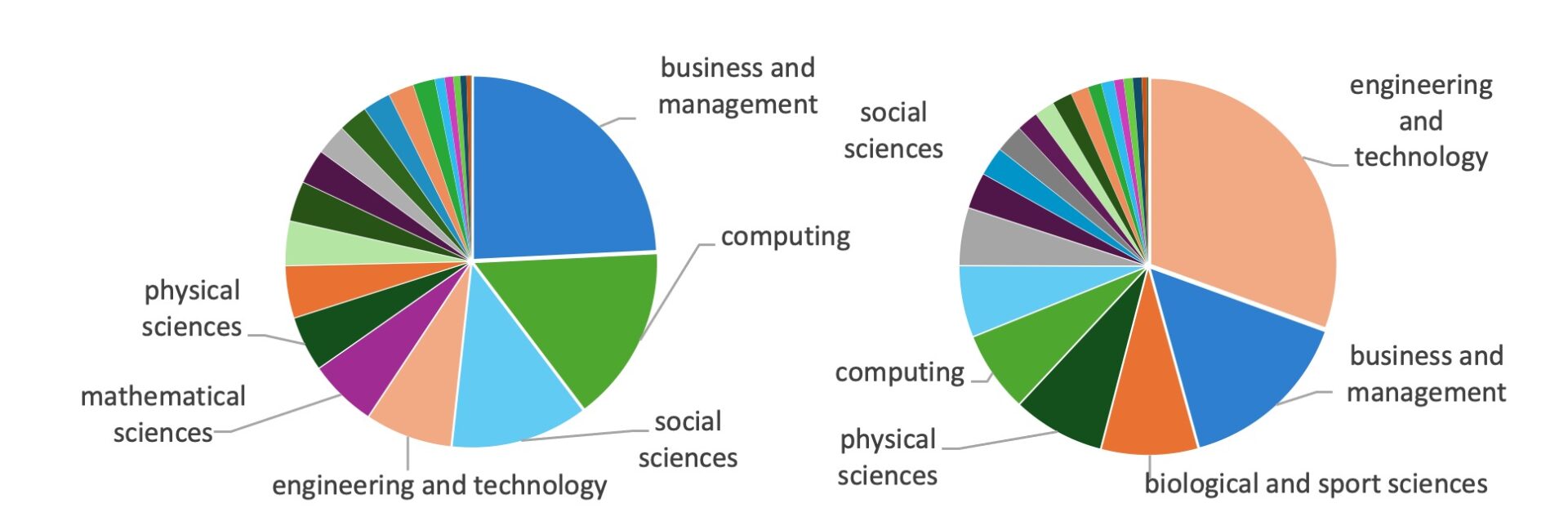

Figures 8 and 9 highlight the predominance of the Business & Management and Engineering & Technology subject graduates within some of GCR’s specific innovation clusters. Each of these subjects have a lower-than-average retention rate. So, further research is required to understand whether GCR needs to encourage graduate retention to provide a supply chain of qualified local labour supply or is this a reflection of university specialisms.

Figure 7: % of Graduates Working in GCR Innovation Cluster Sectors by subject of study

Figure 8: Digital & Enabling Technologies

Figure 9: Advanced Manufacturing & Precision Engineering

Source: HESA

Low graduate retention rates in subjects such as Engineering & Technology counteract the potential benefits of GCR’s above-average concentration of graduates.

Despite the low retention rates, comparative analysis across the UK has shown that GCR has an over-representation (Location Quotient) of graduates in Business & Management and Engineering & Technology. Future provision, and retention, of graduates from these sectors is critical in developing a local skilled supply of labour to GCR’s most innovative industries as supported through the Investment Zone and newly announced Local Innovation Partnership Fund.

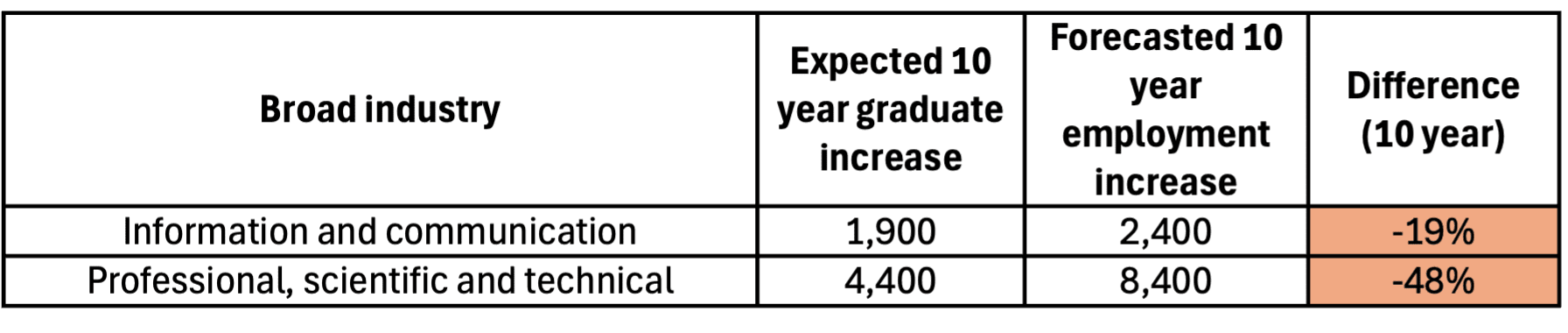

The latest employment projections from Oxford Economics, presented in Table 2, estimate that over the next 10 years there will be a sustained demand for labour in the broad-industries aligned to GCR’s most innovate industries.

Key Policy Question: Could this additional labour market demand encourage better retention rates for GCR’s graduate workforce?

Figure 10: Retention Rate vs Location Quotient of GCR Graduates by subject

Table 2: Anticipated GCR employment forecasts and graduates by subject

Source: HESA and Oxford Economics

UK Industrial Strategy & AI

The UK’s Modern Industrial Strategy was launched by the UK Government in late June – part of the wider mission to revitalise the UK economy.

The strategy outlines how the UK will seize upon significant opportunities and create the most favourable conditions in key sectors for the companies of the future to emerge.

Eight sectors (the IS-8) have been identified for support to increase national productivity, strengthen economic security and resilience, and support environmental goals and the net zero transition:

- Advanced Manufacturing

- Clean Energy Industries

- Creative Industries

- Defence

- Digital and Technologies

- Financial Services

- Life Sciences

- Professional and Business Services

The IS-8 broadly align with GCR’s innovation clusters, with GCR specifically identified within the strategy as having global competitiveness in Defence and Advanced Manufacturing.

This reiterates the importance of further developing a local skilled supply of labour to capitalise on these national sectoral priorities.

The interventions proposed, such as reduced electricity costs and greater cooperation with the EU, should be beneficial to GCR in the long-term. However, some commentators have noted that it will be challenging to design cross-cutting policies that effectively impact the frontier and foundational industries prioritised.

Sources: UK Government, National Institute of Economic and Social Research, and The Productivity Institute

The labour market opportunities created in GCR’s Innovation Clusters through the UK’s Industrial Strategy may be mitigated by the rise in AI – particularly for graduates.

Outlined within the UK’s Industrial Strategy was the need to seize AI opportunities through interventions including the expansion of the government’s AI Research Resource by 20x, establishing an up to £500m sovereign AI Unit, and investing in AI opportunities for science.

These interventions form part of the wider approach to stimulating the UK’s Digital and Technology industry. However, it can be argued that the enhancement of AI capabilities may have a disproportionate negative impact on the labour market opportunities for graduates in the Region who have studied subjects aligned to the GCR’s Innovation Clusters.

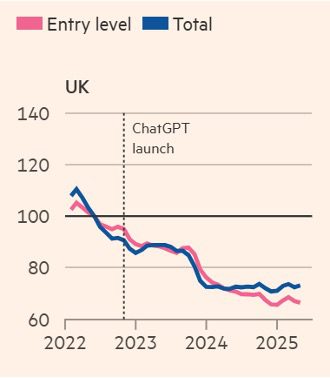

Research from Adzuna and Indeed estimated that job postings for entry-level roles requiring a degree have dropped by almost two-thirds in the UK since 2022. Software development (65%) and Banking & Finance (75%) have experienced similar declines in graduate roles since 2019.

McKinsey also highlighted that online job ads have decreased by 31% since 2022 – with low AI exposure roles down 21% and high exposure AI roles down 38%.

Figure 11: Advertised UK vacancies (June 2022 = 100)

Other factors, including economic uncertainty, post-Covid retrenchment and offshoring will simultaneously impact the fall of graduate hiring.

Sources: Financial Times and McKinsey & Company

Graduate Destination Analysis

The Intelligence Hub is commencing in-depth analyses into how GCR’s labour market operates.

Continued analyses of graduate outcome data, the implications of AI, and the labour market opportunities created through the UK’s Industrial Strategy will inform a long-term analysis by the GCR Intelligence Hub into how the Region’s labour market operates.

The analyses will investigate the nature of the Region’s labour supply and labour demand, with the aim to provide an evidence-base to allow more effective provision of skills/qualifications that align with future market demand. This will also be used to inform the Region’s aspirations around the devolution of skills activity.

Labour Supply:

- Participation barriers

- Migration of Labour

- Residential Availability

- Transport Infrastructure

Labour Demand:

- Industrial Composition

- Innovation Clusters

- Foundational Economy

- Evolution of Tech

Labour Pipeline:

- How can we influence skills provision?

- How do we evidence skill demand?

- Differentiation of skills and qualifications?

High Street Performance

Centre for Cities recently published a report which identified key reasons why some high streets may be suffering, and how to address these issues.

The Checking Out utilises detailed spending data from 63 UK primary cities to reveal the main driving factors of High Street success – which include:

Size of Catchment

- Larger Catchments mean more potential customers; influenced by city size and nearby competition.

Incomes in the Catchment

- Higher local incomes, driven by a stronger export economies, increase spending power.

Geography of economy

- Economies clustered in city centres benefit high streets more than spread-out and low-density areas.

Size of visitor Economy

- Cities attracting visitors effectively expand their catchment and spending.

% of Commercial/Food-based properties within the high street

- Successful high streets have more food and leisure amenities, meeting changing demand as retail declines.

Policy Context:

- Past and current policies have largely overlooked the city centre economy as a vital part of the macroeconomy.

- Earlier approaches focused mainly on retail challenges and competition from out-of-town and online shopping, missing broader economic influences.

- Despite some reports of regional high street decline, Centre for Cities highlight that many city centres are still performing well.

- Effective policy should focus on strengthening the wider economy with tailored strategies specific to city centre high streets.

Figure 12: A timeline of national policies directly or indirectly targeted at the high street since 2010 (excluding Covid-19 interventions)

Glasgow’s performance across a variety of measures is notable, ranking amongst the best cities in the UK in terms of market pull, and highlights its importance to the Region.

City Centre Vacancy Rate

- Glasgow’s Vacancy Rate is 11%, higher than Edinburgh’s 8%, but relatively low compared to regional averages

Market Pull

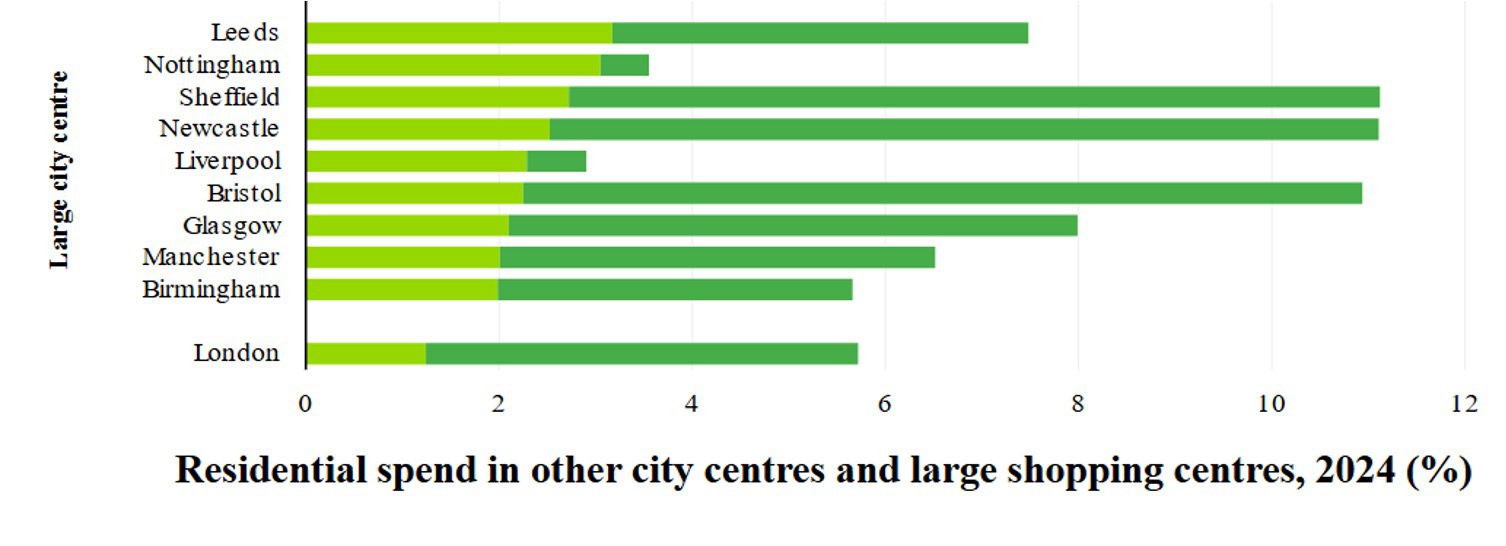

- Glasgow was estimated to have an average proportion of residential spend leakage to large shopping centres and other large cities. Sourced from a supplementary article from the Centre for Cities, Figure 13 illustrates that leakage to Braehead shopping centre made up the predominant proportion of leakage from Glasgow.

Population and Catchment

- Glasgow ranks 4th in population and 2nd in city centre catchment size regionally, showing its city centre attracts more visitors than expected for its size.

Diversity of Cuisines

- Glasgow ranks 2nd in the UK (after London) for the number of cuisines available within the city centre catchment.

Regional Spending

- Glasgow is among the top 10 UK cities for regional spending within its own high street.

Figure 13: Residential spend leakage, 2024

The report also notes that Glasgow is the most popular external centre for expenditure in both Aberdeen and Dundee. It also notes that London is the most popular external centre for expenditure in Glasgow.

Key Policy Questions: How can Glasgow build on its expenditure popularity? And how can it retain indigenous expenditure?

Source: Centre for Cities

Further Information

For queries and further information, please contact David Patrick Boyle: