Intelligence Hub

Economic Briefing February 2026

Introduction and Key Points

This first Regional economic briefing of 2026 focuses on the following series of topics relevant to GCR across the coming year:

The Latest UK and Scottish Economic Data

- Analysis of the latest national economic data, which highlights the continuation of sluggish performance across the UK economy.

- Comparison of recent labour force trends across Scotland and the UK, which show Scotland improving relative to the UK in September-November 2025.

New Year Economic Outlook

- A look at economic forecasts for 2026, including the impact of the continuation of sluggish growth on unemployment, the continuation of geopolitical and trade tensions, and, more positively, increasing ‘creative destruction’.

- Exploration of key demographic changes, with focus on the impacts of the forecast transition towards deaths outnumbering births.

Glasgow City Region Priorities

- Analysis of the consequences of these and other economic trends for GCR, with weak national growth risking the exacerbation of long-standing structural weaknesses in productivity and economic participation.

- Identification of priority areas for GCR to focus on in mitigating against these risks and strengthening the area’s economic resilience.

The Scottish Budget

- Early analysis of headlines from the Scottish Budget.

- Analysis of challenges the Budget presents for local government, and for the achievement of Scottish Government and Regional goals.

Latest Scottish and UK Economic Data

The latest economic data show relatively low levels of growth across Scotland and the UK, with Scotland’s labour market improving relative to the UK’s in Sep-Nov 2025.

- GDP: UK GDP grew by 0.1% in Q3 (Jul-Sept) 2025. Growth was driven by services and construction (each +0.2%), while the production sector fell (-0.3%). Real GDP per head showed no growth in Q3 2025 but is up 0.9% compared with Q3 2024. Real Household Disposable Income per head fell by 0.8% in Q3 2025.

- Productivity: Labour Force Survey (LFS) estimates suggest that UK output per hour worked was 3.1% higher in Q3 2025 than pre-COVID (2019 average), with output per worker 2.1% higher across the same period.

- Inflation & Interest Rates: Consumer Price Index (CPI) inflation rose by 3.6% in the 12 months to Dec 2025, up from 3.5% in the 12 months to Nov 2025. Alcohol & tobacco and transport made the largest contributions.

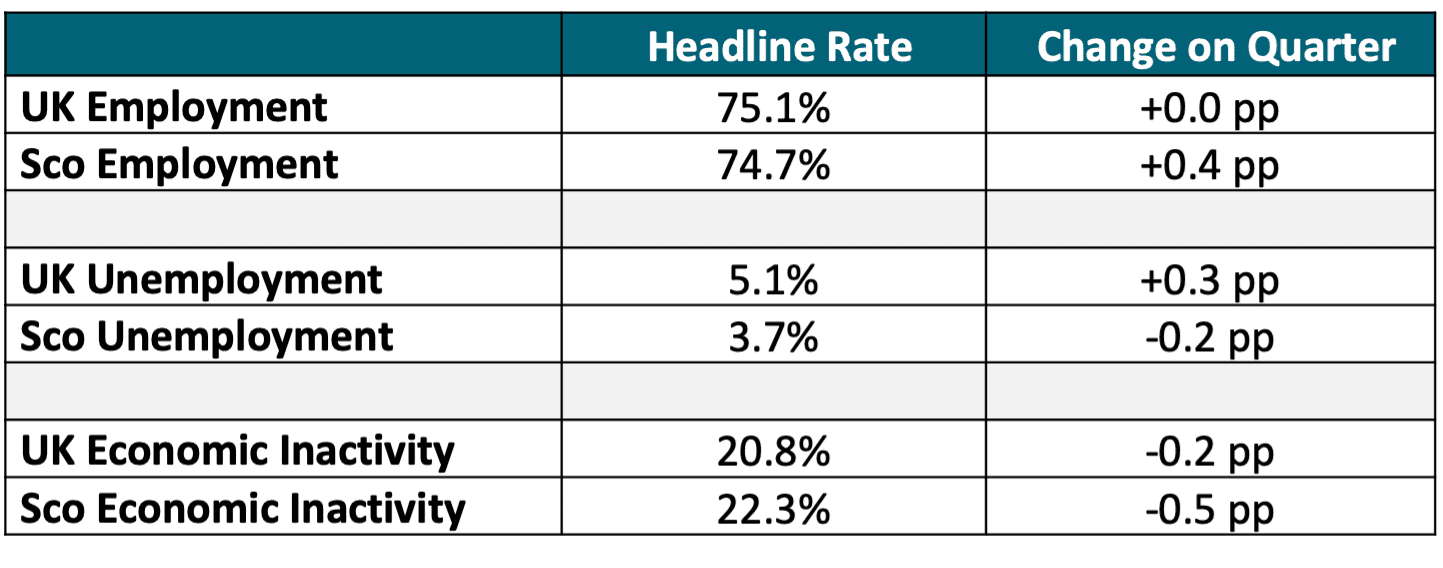

- Labour Market: Labour Force Survey (LFS) estimate, as noted in chart 1, show Scotland’s labour market improving relative to the UK over the last observed quarter (Sep-Nov 2025). Increased volatility of LFS estimates mean that quarterly changes should be treated with caution.

Chart 1: Labour market rates, Scotland and UK, Sep to Nov 2025

New Year Economic Outlook

Global Economic Outlook

Geopolitical and trade tensions will be a defining feature of 2026.

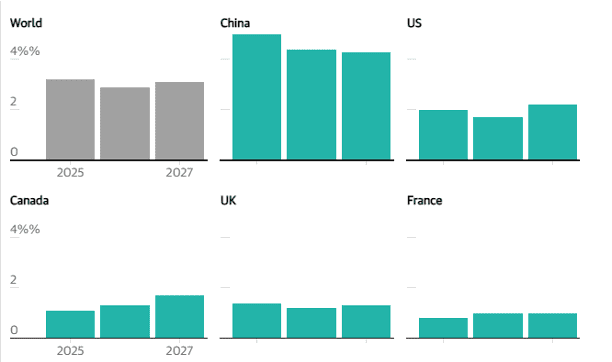

- Growth: OECD forecasts a slowdown in global GDP growth, driven by geopolitical uncertainty and trade disruptions, including US tariffs. Fragility in the global economy is also reflected in soaring AI company valuations versus actual returns.

- Inflation trends: Inflation is expected to normalise across advanced economies, enabling central banks to end their cycle of interest rate hikes and ease the burden of higher borrowing costs on growth.

- Fiscal Priorities: Rising debt servicing costs are pressuring governments, particularly those with high debt and weak growth. In the UK, elevated interest payments, alongside defence commitments, are likely to constrain future budgets.

Sources: Guardian, Financial Times

Chart 2: Real GDP Forecasts and Projections

Source: Guardian from OECD analysis

UK Economic Outlook

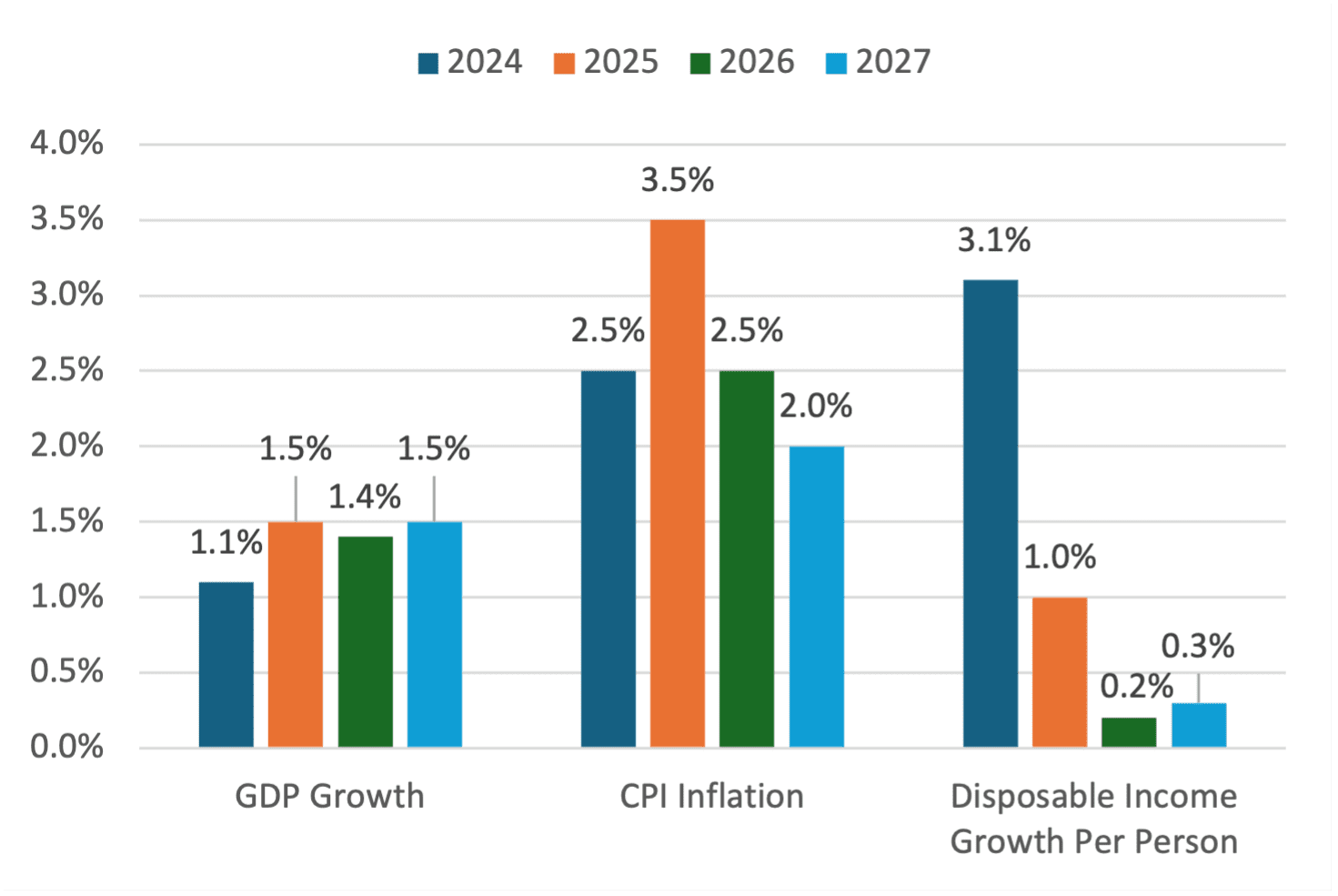

Macroeconomic forecasts show signs of a stabilising economy, but declining incomes.

- Growth: While GDP growth forecasts indicate a stabilising economy, they also imply an absence of meaningful growth. By 2027, the UK economy is expected to be no larger than it was at the beginning of 2025.

- Inflation: Inflation shows signs of deceleration, mainly driven by major cut in the energy price cap by Ofgem, easing food prices and weak consumer demand.

- Incomes: Disposable income growth is expected to be weak this year and next year mainly due to tax increases announced in the autumn budget and lack of sustained productivity growth.

- Public opinion research indicates that the cost-of-living crisis and the perception that work does not pay continue to be the public’s foremost concerns, as highlighted by the UK Director of More in Common in the Resolution Foundation’s living standards January event.

Chart 3: Outturn and forecasts of GDP, CPI and real household disposable income per capita

Source: Resolution Foundation, Growing pains? What’s in store UK politics, economics and living standards in 2026

Note: Forecasts are from the Office of Budgetary Responsibility and RF calculations

This year, the Bank of England is expecting to see unemployment rising and stabilising at about 5%.

- Sluggish growth and rising uncertainty are driving the recent increases in UK unemployment, reflecting weak economic growth alongside higher taxes according to the Resolution Foundation. Its Labour Market Outlook highlights that young people are likely to be most affected, as hiring typically slows during downturns, making entry into the labour market more difficult. This challenge has been intensified by the April 2025 increases in employer National Insurance contributions and the minimum wage, which raise the relative cost of employing younger workers.

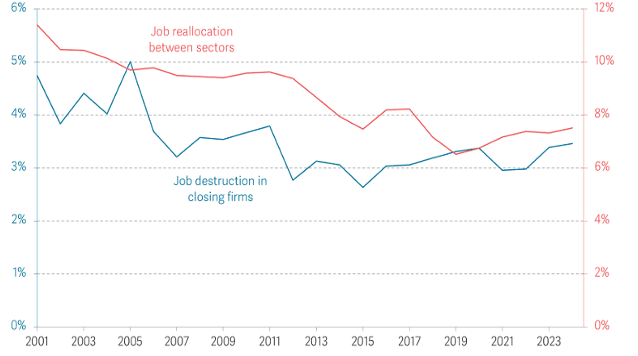

- A more positive factor is an uptick in economic churn, or “creative destruction,”* as inefficient firms exit the market. While this process has slowed over recent decades, the recent increase in churn is potentially beneficial for productivity. However, job destruction has not yet been matched by job creation, which the Resolution Foundation attributes to global economic uncertainty and the effects of the Budget.

*A term coined by the economist Joseph Schumpeter in the 1940s, to describe the continuous replacement of inefficient firms with more productive ones.

Chart 4: Job reallocation between sectors and job destruction in closing firms, UK

Source: Resolution Foundation, New Year Outlook 2026

Major Demographic Changes

2026 may mark the beginning of a new demographic phase in the UK, in which deaths outnumber births.

The UK is entering a new era in which deaths are expected to exceed births from 2026 onwards, ending a pattern that has prevailed for over a century. Future population growth will depend on net migration, which has already fallen sharply to around 200,000 a year.

These trends have particularly significant implications for Scotland and Glasgow City Region, where economic participation is already declining due to ill-health related economic inactivity.

A shrinking working-age population will place growing pressure on local government finances, constrain economic growth ambitions, and intensify workforce shortages for expanding businesses.

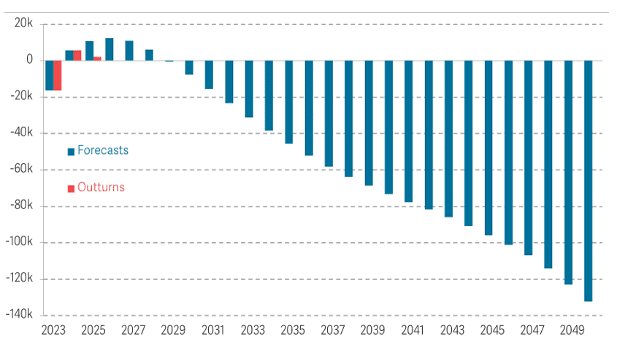

Chart 5: Outturns and forecasts of births minus deaths: UK

Source: Resolution Foundation, New Year Outlook 2026

GCR Priorities

What does the Economic Outlook mean for GCR

GCR’s long-standing structural weaknesses, especially around productivity and low economic participation, could be amplified by weak national growth and rising unemployment. Here, we propose five priorities for the Region in 2026.

First, GCR must continue to scale its innovation districts into clear job-creation engines. GCR has a unique opportunity to harness the growth of innovation hubs, the Investment Zone Programme and the Local Innovation Partnership Fund by implementing a coordinated strategy that explicitly links innovation activity to employment outcomes. This includes developing clear cluster growth programmes backed by partners and funding.

Second, supporting SMEs to adopt productivity-enhancing technologies is critical. Small-and-medium-sized enterprises are the backbone of employment, yet many are locked in low-productivity. Incentivising the adoption of new technologies can improve products and services and create higher-value jobs.

Third, policymakers must rethink support for “zombie” firms – businesses that survive on subsidies or debt but fail to grow. In a climate of constrained resources and high unemployment, propping up unproductive firms diverts capital and talent away from enterprises that could genuinely expand, and create sustainable employment opportunities.

Fourth, GCR should continue supporting the growth of sectors where it has unique competitive advantage, underpinned by clear and actionable sector strategies. This means developing targeted action plans that coordinate investment, skills development, infrastructure, and innovation support, ensuring these sectors can scale, create jobs, and strengthen the Region’s economic resilience.

Finally, partners across the Region need to have a clear focus on stopping the onflow of young people becoming economically inactive. Inverclyde Council is developing a pilot programme, with support from GCR team, to tackle the issue locally. A lot of learnings are being identified and will be shared, but this needs a wider partnership approach so it can be tackled across the Region.

The Scottish Budget

The 2026-27 Scottish Budget, published on 13th Jan 2026, highlighted further fiscal challenges ahead nationally and locally; considerably greater than had been forecast in June.

Tax: The primary tax announcement was a tax-rise, with freezes to the top three income tax thresholds until April 2029 bringing more people into these bands through fiscal drag. While two new council tax bands were introduced for properties over £1m (mirroring UK Government policy), a variety of commentators have highlighted there remains no sign of a much-needed revaluation of council tax.

Spend: Despite additional borrowing and attempts to plug gaps with one-off funding pots, still having to make substantial cuts, owing to weaker underlying tax forecasts from the Scottish Fiscal Commission (with forecast Income Tax down by £274m for 2026-27 compared with 2024).

- Revenue Spending: Relative to plans laid out in June, day-to-day spending has been cut by £480m. Planned increases in day-to-day spending are very small – 0.6% over inflation in 2026-27 and 0.2% above inflation on average over the following two years. Local Government and Finance is set to see a 2.1% real terms reduction per year.

- Capital Spending: Plans for capital spending have also been curtailed by 10% (£860m) for next year relative to June’s outlined plans.

Source: IPPR Scotland, IFS, FAI

The Scottish Budget: Challenges for Local Government

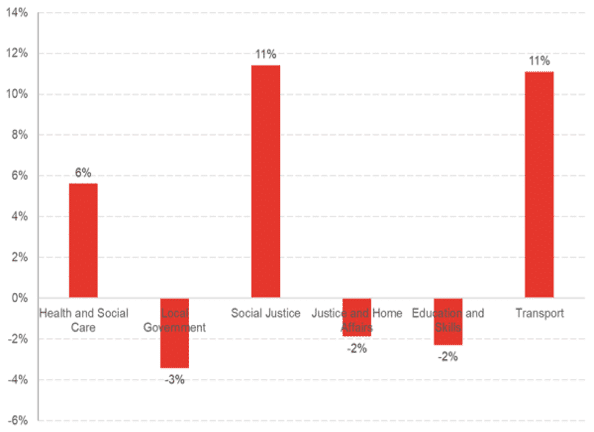

The Spending Review highlights that maintaining current service levels for local government will be very challenging.

- Health & Social Care spending is projected to grow by around 6% in real terms over three years (effectively health-only, as regular transfers to local government are excluded).This is below the Scottish Government’s May Medium-Term Financial Strategy assumption of 3.3% real-terms annual growth to meet demand.

- The local government settlement is highly constrained over the three years, particularly given rising social care demand.

- The budget assumes significant, but unspecified, efficiency savings based on local government reform, with limited detail provided on how these savings will be delivered.

Source: FAI

Chart 6: Spending Review- Change in Spending (Real terms) between 2025-2026 and 2028-2029

Source: Scottish Fiscal Commission

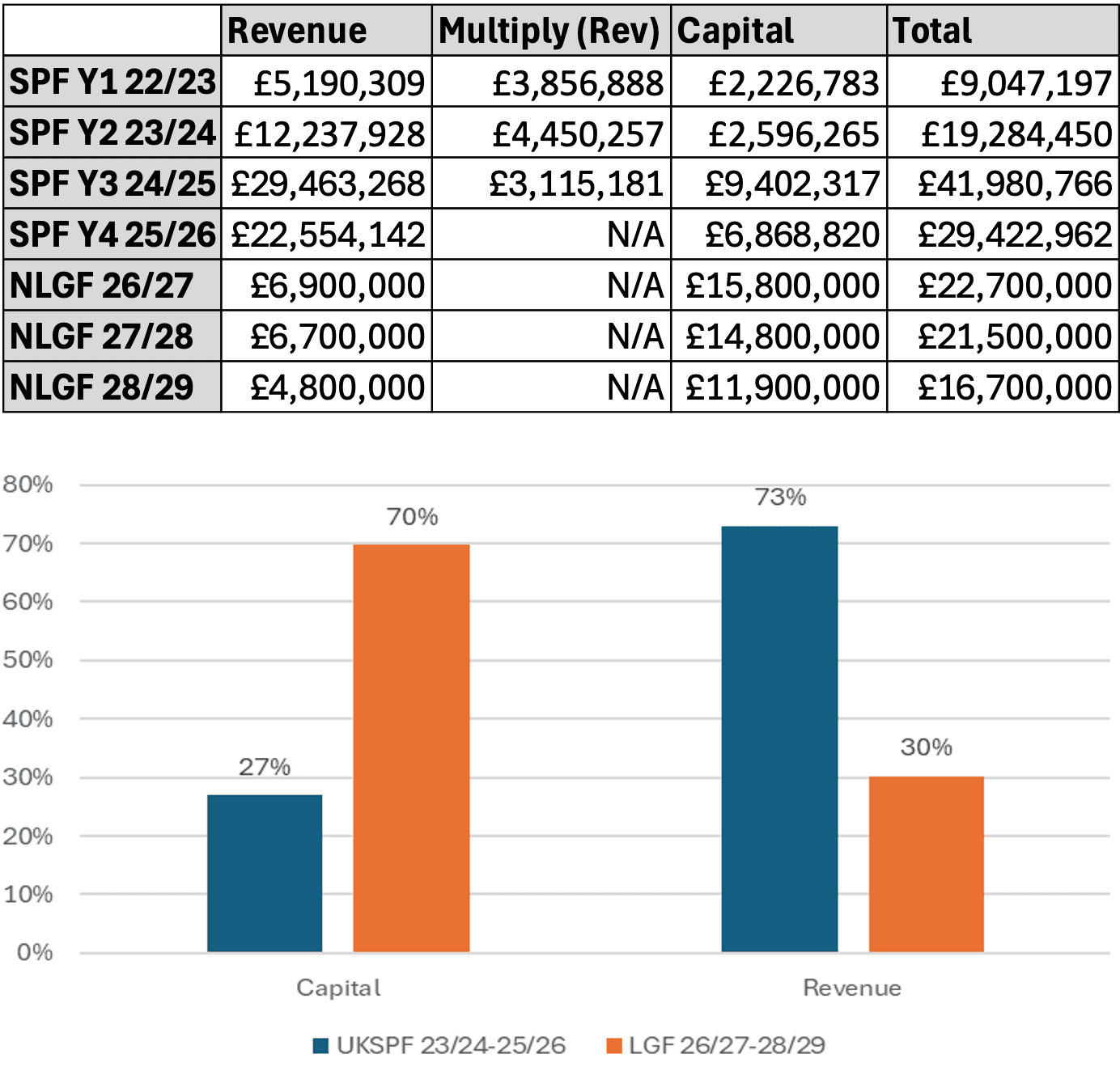

The budgetary challenges facing Local Government have also been compounded by a reduction in revenue funding as UK Government migrates from the UK Shared Prosperity Fund into the New Local Growth Fund.

- The UK Shared Prosperity Fund (SPF) was introduced by the UK Government in 2022 as a post-Brexit successor programme to EU Structural Funds, with a commitment to match the level of funding received from Europe.

- Over the last three years GCR received approx. £91m of funding from SPF. Through the UK Gov’s transition into the New Local Growth Fund (NLGF) the amount awarded to the Region decreased by 33%.

- This cut will have a significant impact on how the Region’s member authorities (MAs) deliver employability and business support services.

- The challenge for MAs is exacerbated by the proportions flipping within NLGF to be dominated by Capital spending.

Chart 7: UKSPF and NLGF Capital and Revenue Splits

Source: UK Government

The Scottish Budget: Misalignment with Goals

IPPS highlight a credibility gap caused by the poor alignment between the Budget and shared national and regional goals of reducing child poverty, improving public services, growing the economy, and addressing the climate emergency.

- Child poverty: The UK Government’s removal of the 2-child limit saved SG around £125m, but the Budget revealed little detail around whether this would be spent on child poverty reduction measures, or how much additional spending is included in measures such as the £50m Whole Family Support package or £49m boost to the Tackling Child Poverty fund.

- Addressing the Climate Emergency: Much of the £5bn identified as ‘climate positive spend’ includes items requiring investment regardless, including rail (£1bn) and affordable housing (£0.9bn). It is business-as-usual for spending on areas with negative climate impact, increasing by £110m, including extending the capacity of the A9 and A96. Clean heat spending proposals have been scaled down considerably, from a committed £1.8bn to £1.3bn over the next four years.

- Improving public services: There is consensus that it is very challenging to maintain, let alone improve, the quality of public services in light of extremely tight settlements, as outlined in the previous slide. Local government faces funding cuts of 2.1.% per annum in real-terms. This would require increases in council tax of 8% to hold budgets constant. The Christie Commission’s recommended shift towards preventative spending seems increasingly remote.

- Economic Growth: While cuts to business rates for retail, hospitality and leisure are welcome, economic growth is challenged too by announced cuts from the Scottish National Investment Bank and Scottish Enterprise.

Source: IPPR Scotland, IFS

Further Information

For queries and further information, please contact Christina Kopanou: